What Is USOR? Can I Invest in USOR?

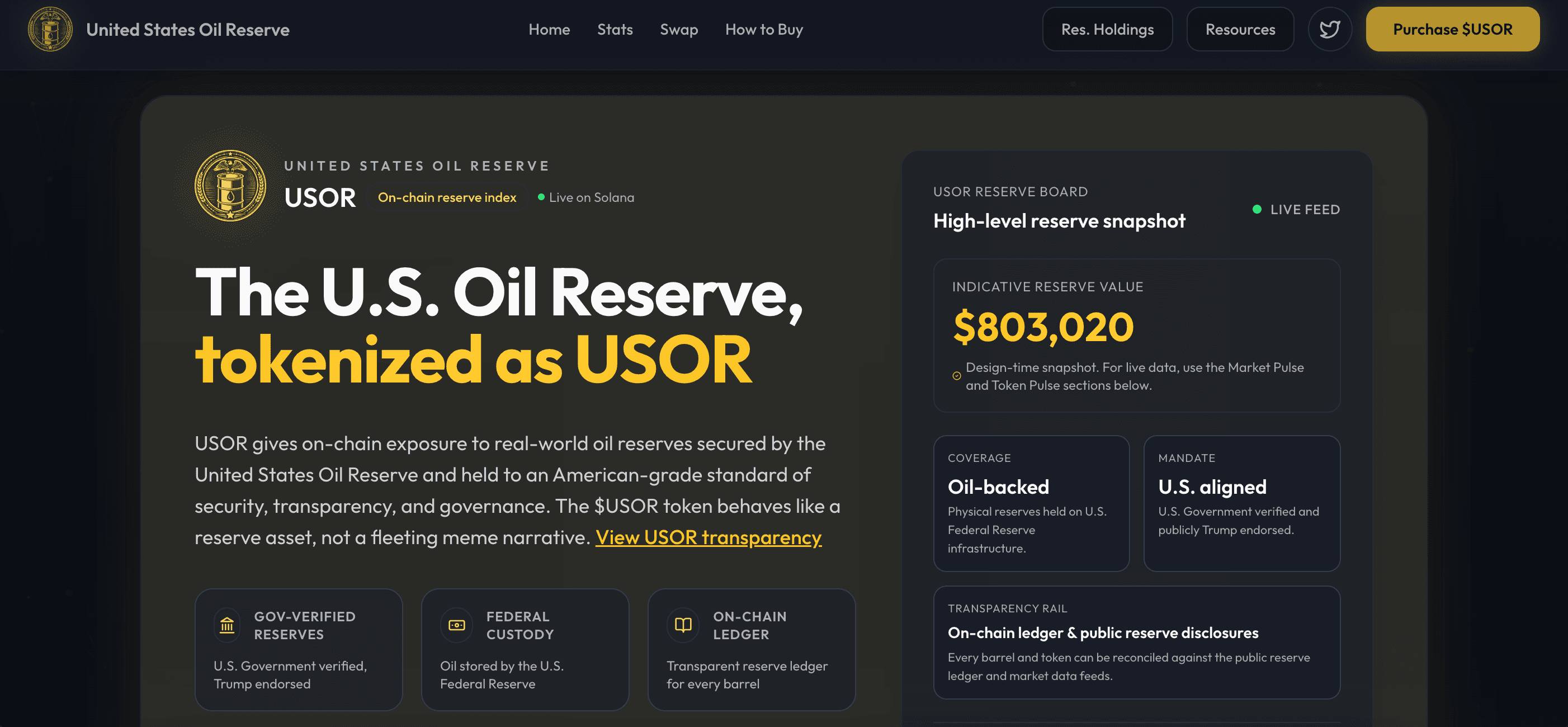

In the rapidly evolving world of cryptocurrency, a new narrative is gaining momentum—tokenized real-world assets. Among the latest projects capturing attention is USOR (United States Oil Reserve), a Solana-based token that merges blockchain transparency with energy market themes. If you've been searching for information about oil-backed crypto or tokenized commodities, this guide will explain what USOR is, how it works, and what you need to know before considering this emerging digital asset.

What Is USOR Crypto?

USOR (United States Oil Reserve) is a cryptocurrency built on the Solana blockchain that aims to bring transparency and narrative-driven exposure to U.S. oil reserves through decentralized technology. Unlike traditional oil ETFs or futures contracts, USOR represents a new category of tokenized oil assets—digital tokens that reference real-world commodities without requiring direct physical ownership.

Core Features of USOR Crypto

- Blockchain-Based Transparency: Built on Solana for fast, low-cost transactions with on-chain verification

- Fixed Supply Model: Total supply capped at 1 billion tokens, with no additional inflation

- Narrative-Driven Value: Tied to energy market themes rather than direct oil price correlation

- Decentralized Trading: Available primarily on Solana-based decentralized exchanges

How Does USOR (United States Oil Reserve) Work?

USOR operates as an SPL token (Solana Program Library token) with a straightforward economic model:

USOR (United States Oil Reserve) Tokenomics:

- Total Supply: 1,000,000,000 USOR tokens

- Circulating Supply: All 1 billion tokens are currently in circulation

- Market Capitalization: Approximately $7-8 million (as of early 2026)

- Trading Mechanism: Users can swap SOL or other Solana-based tokens for USOR on supported DEXs

Technical Approach:

Rather than holding physical oil reserves, USOR emphasizes on-chain transparency. The project publishes reserve data and token movements directly on the Solana blockchain, allowing anyone to verify transactions and holdings through blockchain explorers. This approach aligns with the growing Real World Asset (RWA) crypto movement that seeks to bridge traditional assets with blockchain technology.

Why Is USOR Gaining Attention?

Several factors contribute to USOR's growing visibility in crypto space:

1. RWA (Real World Asset) Tokenization Trend

As blockchain technology matures, there's increasing interest in tokenizing traditional assets like commodities, real estate, and treasuries. USOR represents one of the first attempts to create a crypto-native representation of oil reserves.

2. Energy Market Narratives

With global energy markets experiencing volatility due to geopolitical factors and energy transitions, crypto projects tied to energy themes have gained speculative interest.

3. Solana Ecosystem Growth

Solana's resurgence as a high-performance blockchain has created fertile ground for innovative token projects, with USOR benefiting from the network's low fees and fast transaction speeds.

4. Transparency Focus

In an industry sometimes criticized for opacity, USOR's emphasis on on-chain verification and fixed supply appeals to investors seeking clearer tokenomics.

Can I Invest in USOR Crypto?

Before engaging with USOR or any similar narrative-driven crypto asset, consider these important factors:

No Government or Institutional Backing

Despite its name, USOR is not affiliated with the U.S. government or the Strategic Petroleum Reserve. It's a community-driven crypto project without official commodity backing.

High Volatility

As a relatively small-cap, narrative-driven token, USOR experiences significant price volatility that may not correlate directly with oil market movements.

Regulatory Uncertainty

The regulatory status of commodity-linked tokens remains unclear in many jurisdictions, creating potential legal and compliance risks.

Speculative Nature

USOR's value is largely driven by community sentiment and narrative strength rather than fundamental valuation metrics.

Limited Liquidity

Compared to established cryptocurrencies, USOR has relatively limited trading volume and liquidity, which can impact execution prices and slippage.

USOR vs. Traditional Oil Investments

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

Aspect | USOR Crypto | Traditional Oil Investments |

Access | Global, 24/7 via crypto wallets | Typically through brokerage accounts during market hours |

Ownership | Digital token on blockchain | Shares in companies, futures contracts, or physical barrels |

Transparency | On-chain verification | Company reports and market data |

Correlation | Narrative-driven, indirect oil exposure | Direct exposure to oil prices or company performance |

Regulation | Emerging crypto regulations | Established financial regulations |

Future Outlook and Potential Developments

The future trajectory of USOR depends on several factors:

- Adoption within DeFi: Potential integration with lending protocols, yield farms, or other DeFi applications

- Broader RWA Adoption: Growth in tokenized real-world assets could benefit niche projects like USOR

- Regulatory Clarity: Clearer guidelines for commodity-linked tokens could impact legitimacy and adoption

- Market Sentiment: Continued interest in energy and commodity narratives within crypto communities

Conclusion: Is USOR Right for You?

USOR represents an experimental convergence of cryptocurrency and commodity narratives, offering a distinct entry point for traders focused on narrative-driven assets, RWA tokenization, energy-themed crypto, and the Solana ecosystem.

Investors should proceed with caution: allocate only risk capital, conduct independent research, recognize its speculative and unbacked nature, and monitor regulatory updates. Its future trajectory will depend on community adoption, technological developments, and broader market trends.

You may also like

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For investors searching "what is Boundless (ZKC)", it's essential to understand it's more than just a token. Boundless (ZKC) is a decentralized protocol that provides zero-knowledge (ZK) proof generation services to blockchain networks. Its core mission is to solve scalability and interoperability issues by offloading complex, computationally heavy verifications off-chain, allowing blockchains to operate faster and cheaper.

Unlike many speculative tokens, ZKC is built on tangible technology, specifically leveraging RISC Zero's zkVM. This positions it as a crucial piece of Web3 infrastructure, akin to a "utility company" for the blockchain world, where projects pay for verification services rather than relying on hype for value.

How Boundless (ZKC) WorksThe Core Protocol: On-Chain Proof VerificationBoundless distinguishes itself by operating an on-chain, trust-minimized marketplace for ZK proofs. Developers can request provable computations directly through smart contracts. Provers (network participants with computing power) then generate the proofs and are paid in ZKC tokens for their work. This model replaces slower, less secure methods like fraud-proof "challenge games" used by some rollups, reducing finality times from days to mere hours.

Key Utility & Use CasesThe ZKC token is the lifeblood of this ecosystem with clear utilities:

Payment for Services: Blockchains, rollups, and dApps use ZKC to pay for proof generation.Prover Incentives: Individuals contribute computational resources to earn ZKC rewards.Governance: Token holders will likely guide the future development of the protocol.Boundless (ZKC) Price Prediction 2026Given its technical foundation, a "Boundless (ZKC) price prediction" must balance utility potential with current market volatility. As of early 2026, ZKC trades around $0.16 with a market cap near $36 million, but exhibits extremely high trading volume, indicating strong speculative interest.

2026 Price Forecast Scenarios:

Bearish Scenario ($0.09 - $0.12): Triggered by broader crypto market downturns, delayed adoption, or significant token unlocks from early backers leading to sell pressure.Base / Consolidation Scenario ($0.15 - $0.25): The protocol sees steady but modest growth in partnerships and usage. Price stabilizes as utility begins to offset pure speculation.Bullish Scenario ($0.30 - $0.40+): Requires massive adoption catalysts, such as major Layer 2 rollups (e.g., Arbitrum, zkSync) integrating Boundless for their proof needs, validating its technology at scale.Analyst Note: ZKC's extremely high volume-to-market-cap ratio (often over 1000%) signals both high liquidity and high-risk speculative trading. Long-term price sustainability will depend almost entirely on real-world adoption and revenue generation, not just exchange activity.

Is Boundless (ZKC) a Good Investment?The question "Is ZKC a good investment" hinges entirely on your investment profile and belief in ZK technology.

Potential Upsides (The Bull Case):

Real Utility: Possesses a clear, revenue-generating business model in a high-growth sector (blockchain scalability).First-Mover Advantage: Early mover in the specialized field of decentralized ZK proof networks.Strong Backing: Built on respected technology (RISC Zero) and has attracted serious developer and investor attention.Significant Risks (The Cautionary Tale):

Extreme Volatility: Low market cap and high speculation lead to wild price swings.Execution Risk: The technology is complex; failure to secure major partnerships or scale effectively could stall growth.Competition: Faces competition from other ZK projects and established scaling solutions.Token Unlock Risk: A large portion of the total supply (1.02 billion tokens) is not yet in circulation; future unlocks could depress price.Verdict: ZKC is a high-risk, high-potential-reward investment. It is suitable for investors with a higher risk tolerance who are betting on the long-term adoption of ZK-proof technology and believe Boundless can capture a meaningful share of that market. It is not suitable for conservative investors or those seeking stable returns.

How to Buy Boundless (ZKC) on WEEX ExchangeFor those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

Guide Step-by-Step Guide: Buying Boundless (ZKC) on WEEX ExchangeStep 1: Create and Verify Your WEEX AccountVisit the official WEEX website or download the mobile app.Click “Sign Up” and register using your email or phone number.Verify your email through the confirmation link.Complete KYC verification to unlock higher limits and enhanced security.Step 2: Deposit FundsNavigate to “Assets” → “Deposit” and select your preferred method:

Fiat Deposit: Use bank transfer, card payment, or supported third-party providers.Crypto Deposit: Send BTC, USDT, or other supported cryptocurrencies to your WEEX address.Step 3: Execute Your PurchaseWEEX offers three primary methods to buy Bitcoin:

Method 1: Instant Buy (Recommended for Beginners)Go to “Buy Crypto” → “Quick Buy”.Select Boundless (ZKC) and your fiat currency.Enter the amount and choose the payment method.Review and confirm. Bitcoin will be delivered to your spot wallet instantly.Method 2: Spot Trading (For Advanced Control)Navigate to “Trade” → “Spot”.Search for ZKC/USDT.Choose order type: Market Order or Limit OrderEnter amount and execute trade.Final Thoughts: Is Boundless (ZKC Coin) a Good Investment?Boundless Network is establishing itself as a pivotal innovation within the zero-knowledge infrastructure landscape. Its core architectural approach of integrating verifiable proof markets natively on the blockchain eliminates intermediary dependencies, substantially enhances network scalability, and achieves dramatically faster transaction finality for rollups and smart contract platforms.

The ZKC token serves as the fundamental economic conduit within this ecosystem. It orchestrates the alignment of incentives among proof providers, application developers, and end-users, ensuring the network operates as a cohesive and efficient marketplace.

With the accelerating mainstream integration of zero-knowledge technology, Boundless and its native ZKC token are strategically positioned to be integral components in enabling the next generation of scalable, secure, and interoperable blockchain systems.

Ready to be part of the evolution?

[Sign up now and trade Boundless (ZKC) on WEEX Exchange], where advanced tools meet a secure trading environment.

FAQ:Q1: What is the main purpose of the Boundless Network?A: Boundless provides a decentralized marketplace for zero-knowledge proofs, helping blockchains and rollups scale by verifying computations off-chain quickly and cheaply.

Q2: Does ZKC Coin have real utility, or is it just speculative?A: It has clear utility: it's used as payment for proof services and to incentivize network participants. However, its current market price is heavily influenced by speculation alongside this utility.

Q3: What is the biggest risk for ZKC investors in 2026?A: The primary risk is adoption failure. If the protocol doesn't attract significant usage from major blockchain projects, its utility value will not support the price, leading to potential decline amidst high volatility.

Q4: What is ZKC Coin used for?A: ZKC is used for prover incentives, payments within the network, and participation in Boundless’ economic model.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

When investors search “what is PENGUIN crypto” or “what is Nietzschean Penguin,” they encounter a defining example of a modern, purebred memecoin. Nietzschean Penguin (PENGUIN) is a cryptocurrency launched on the Solana blockchain that intentionally forgoes any claims of traditional utility, a development roadmap, or intrinsic technological value.

Its identity is constructed entirely around a viral internet narrative—blending philosophical nihilism with the relatable “Penguin Trend” meme symbolizing burnout and rebellion. This narrative serves as its sole value proposition, making PENGUIN a quintessential sentiment-driven asset. Its price is almost exclusively dictated by social media hype, community momentum, and speculative trading volume within the fast-paced Solana ecosystem. Understanding that PENGUIN trades on attention, not utility, is the first critical step for any potential buyer.

What Is Nietzschean Penguin (PENGUIN)?PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

This stands in direct contrast to cryptocurrencies with underlying utility. PENGUIN derives its market worth almost exclusively from narrative and collective sentiment. Its price is predominantly a function of social media traction, shifts in trader psychology, and the momentum of speculative trading flows, completely detached from traditional valuation metrics like user adoption, network activity, or fundamental protocol usage.

Origin of the Nihilist Penguin MemeThe viral video that sparked the trend began as an unexceptional piece of wildlife documentation. Its transformation was entirely human-made. As social media users recontextualized the scene by adding captions expressing existential anxiety and themes of voluntary isolation, the footage underwent a complete semantic shift. It was no longer a simple biological observation; it was elevated into a broader, culturally resonant philosophical symbol.

A pivotal moment in its spread was its adoption on social media platform X. Influential accounts, such as that of user @adi_thatipalli, were instrumental in recasting the penguin's solitary trek as a poignant meditation on absurdity, autonomy, and the search for purpose. From this point, platform algorithms efficiently propagated the newly framed narrative to a global audience, cementing its status as a digital-age parable.

Nietzschean Penguin (PENGUIN) Market Analysis: Volatility, Liquidity & Key RisksAs of late January 2026, PENGUIN’s market data paints a classic picture of a high-risk memecoin in a volatile phase:

Price: Approximately $0.12, subject to intraday swings exceeding 20-30%.Market Capitalization: Fluctuating around $120 million, indicating significant speculative interest.24-Hour Trading Volume: Frequently surpasses $150 million, often exceeding its own market cap—a hallmark of extreme speculative churn.Available Liquidity: Relatively thin at ~$1.6 million in decentralized pools.The Critical Risk: The Liquidity-Volume MismatchThis environment creates PENGUIN’s paramount risk: a massive discrepancy between high trading volume and shallow liquidity. This means that large sell orders (from so-called “whale” wallets) cannot be easily absorbed by the market, inevitably causing precipitous price drops. For retail traders, this translates to potential slippage (receiving a worse price than expected) and the risk of being unable to exit a position during a downturn without sustaining severe losses. It is a market structure designed for high volatility and requires sophisticated risk management.

PENGUIN Price Prediction 2026Forecasting PENGUIN requires abandoning traditional financial models. Its value is not tied to cash flow or adoption, but to the unpredictable ebb and flow of online sentiment. Below is a structured look at potential 2026 trajectories based on market psychology and historical memecoin cycles.

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

ScenarioPrice RangeProbabilityKey Catalysts & Market ConditionsTrader ImplicationsBearish$0.007 – $0.015HighMeme fatigue sets in; broader crypto bear market; concentrated holders take profits.Likely the terminal phase for most “hype-cycle” memecoins. Risk of near-total capital loss.Neutral / Consolidation$0.02 – $0.03MediumSpeculative interest stabilizes; token finds a temporary range amid rotating hype.Characterized by sharp, brief pumps and dumps within a band. Demands active trading.Bullish (Speculative Surge)$0.03 – $0.05+LowListing on a major Tier-1 exchange (e.g., Binance); new viral narrative or celebrity endorsement.Any surge would be explosive but short-lived, creating a narrow exit window for profitable trades.Analyst Perspective: It is crucial to view these not as investment growth projections, but as potential volatility corridors. The “Bullish Scenario” represents a temporary speculative spike, not sustainable appreciation. The “Bearish Scenario” remains a statistically probable outcome for assets without fundamental backing.

How to Buy Nietzschean Penguin (PENGUIN) CryptoFor those proceeding after evaluating the risks, knowing how to buy PENGUIN crypto safely is essential. The primary route is through WEEX Exchange.

Step-by-Step Guide: Buying PENGUIN on WEEX ExchangeStep 1: Create and Verify Your WEEX AccountVisit the official WEEX website or download the mobile app.Click “Sign Up” and register using your email or phone number.Verify your email through the confirmation link.Complete KYC verification to unlock higher limits and enhanced security.Step 2: Deposit FundsNavigate to “Assets” → “Deposit” and select your preferred method:

Fiat Deposit: Use bank transfer, card payment, or supported third-party providers.Crypto Deposit: Send BTC, USDT, or other supported cryptocurrencies to your WEEX address.Step 3: Execute Your PurchaseWEEX offers three primary methods to buy Bitcoin:

Method 1: Instant Buy (Recommended for Beginners)Go to “Buy Crypto” → “Quick Buy”.Select Penguin (PENGUIN) and your fiat currency.Enter the amount and choose the payment method.Review and confirm. Bitcoin will be delivered to your spot wallet instantly.Method 2: Spot Trading (For Advanced Control)Navigate to “Trade” → “Spot”.Search for PENGUIN/USDT.Choose order type: Market Order or Limit OrderEnter amount and execute trade.Is Nietzschean Penguin (PENGUIN) a Good Investment?Potential (But Fleeting) Upsides:Asymmetric Returns: During peak hype, price can multiply rapidly in a short timeframe.Community Momentum: Strong, engaged communities can temporarily propel prices.Solana Memecoin Cycle: Benefits from being on the blockchain currently dominant for retail meme trading.Severe and Fundamental Risks:Zero Underlying Value: No product, service, revenue, or cash flow. The token is a digital token of sentiment.Extreme Volatility: Designed for high volatility, which can wipe out portfolios just as fast as it builds them.Concentration Risk (“Whales”): A small group of early holders often owns a large supply, giving them disproportionate power to move the market.Regulatory Target: Pure memecoins are increasingly under scrutiny by global regulators as potential unregistered securities or vehicles for market manipulation.Investment Verdict: Nietzschean Penguin (PENGUIN) does not qualify as a traditional “investment.” It is a high-stakes speculative instrument. It may be suitable only for a very small, risk-designated portion of a portfolio for traders with strict discipline, active management strategies, and the emotional fortitude to withstand total loss. It is emphatically not suitable for long-term “HODLing,” retirement savings, or risk-averse individuals.

Final Thoughts on Nietzschean Penguin (PENGUIN)The Nietzschean Penguin (PENGUIN) token serves as a perfect case study in the power and peril of narrative-driven crypto assets. While detailed PENGUIN price prediction models outline potential paths, they ultimately underscore that this is a game of musical chairs dictated by sentiment, not value.

For the disciplined trader, it represents a volatile instrument for short-term speculation. For the market observer, it is a fascinating lens into internet culture and behavioral finance. For everyone, it is a potent reminder that in the absence of fundamentals, extreme caution is the only prudent strategy.

Ready to trade with a platform that provides tools for volatile markets?

[Sign up now and Explore Nietzschean Penguin (PENGUIN) on WEEX], where you can access advanced trading features designed for managing high-risk environments.

Further ReadingWhat Is USOR? Can I Invest in USOR?Which Crypto Will Go 1000x in 2026?Is JGGL (JGGL) a Good Investment? JGGL (JGGL) Price PredictionDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Introduction to Fogo (FOGO) Coin: Is Fogo (FOGO) Coin a Good Investment?

If you've been searching for information on "What is Fogo (FOGO) Coin" and wondering "Is Fogo (FOGO) Coin a Good Investment?", you've found the right guide. In the dynamic world of cryptocurrency, new tokens like FOGO are emerging with unique value propositions. This comprehensive article will explore everything you need to know about Fogo Coin - from its fundamental technology and use cases to practical guidance on how to buy Fogo (FOGO) Coin.

What is Fogo (FOGO) Coin?Fogo (FOGO) Coin is a relatively new cryptocurrency that has been gaining attention in the digital asset space. While specific details may vary depending on the project's development stage, here's what we can typically understand about such emerging tokens:

Core CharacteristicsBlockchain Foundation: FOGO likely operates on a well-established blockchain network, possibly BNB Smart Chain (BSC) or Ethereum, providing security and interoperabilityToken Standard: As an ERC-20 or BEP-20 token, FOGO benefits from compatibility with existing wallets, exchanges, and decentralized applicationsSupply Structure: Most new tokens have defined supply mechanisms, with some implementing burning mechanisms or staking rewards to manage inflationUse Cases and Vision of FOGOBased on available information from crypto platforms, FOGO appears to position itself with specific utilities that may include:

Community-driven initiatives or social impact projectsNFT integration or digital collectibles ecosystemGaming or metaverse applicationsDecentralized finance (DeFi) componentsImportant Disclaimer: Always verify project details through FOGO's official website, whitepaper, and authenticated social media channels. The absence of clear, verifiable documentation represents a significant investment risk.

Is Fogo (FOGO) Coin a Good Investment? Risk-Reward AnalysisThe question of whether Fogo (FOGO) Coin is a good investment requires careful consideration of multiple factors. Let's break down the potential opportunities and risks:

Potential AdvantagesEarly Adoption Potential: As a newer token, FOGO may offer growth opportunities if the project gains traction and delivers on its roadmapNiche Positioning: Specialized use cases can create dedicated communities and sustainable demandExchange Listings: Inclusion on additional exchanges typically increases accessibility and liquiditySignificant Risks and ConsiderationsMarket Volatility: Like all cryptocurrencies, especially newer ones, FOGO is subject to extreme price fluctuationsLiquidity Concerns: Lower trading volumes can make entering and exiting positions challengingRegulatory Uncertainty: The evolving regulatory landscape affects all cryptocurrenciesProject Execution Risk: The team's ability to deliver on promises and maintain development momentumMarket Performance and Trading InformationAccording to data from cryptocurrency tracking platforms:

Current Trading Status: FOGO is actively trading on several exchangesPrice History: The token has demonstrated the volatility characteristic of emerging cryptocurrenciesTrading Pairs: Primarily traded against USDT and possibly other major cryptocurrenciesCommunity Activity: Social metrics and community engagement can provide insight into project momentumReal-Time Data Note: For current price, market cap, and trading volume information, consult reputable cryptocurrency data aggregators or the exchanges where FOGO is listed.

How to Buy Fogo (FOGO) Coin on WEEX Exchange: A Step-by-Step GuideIf your research leads you to acquire FOGO, here's a comprehensive guide on how to buy Fogo (FOGO) Coin safely and efficiently:

Steps to Buy Fogo (FOGO) on WEEX Exchange:

Create Your Account: Sign up on WEEX Exchange. Complete identity verification (KYC) to unlock full features and security.Deposit Funds: Deposit a USDT into your WEEX account.Find the Correct Market: Navigate to the Spot Trading section. Search for the official trading pair, which is FOGO/USDT.Execute a Trade Carefully:Limit Order (Recommended): Specify the exact price you are willing to pay for JGGL. This prevents you from overpaying in a volatile market.Market Order: Buys JGGL instantly at the best available current price. Use with caution due to potential slippage.Safety Considerations When Buying Fogo (FOGO)Verify Contract Addresses: Always confirm you're interacting with the official FOGO token contractBeware of Scams: Avoid unsolicited offers and too-good-to-be-true promisesStart Small: Make an initial test transaction before larger purchasesMonitor Market Conditions: Be aware of overall crypto market trends that might affect FOGO's priceWhy Trade Fogo (FOGO) on WEEX Exchange?For traders seeking a reliable platform, WEEX Exchange offers a secure trading environment with competitive features:

Advantages of Using WEEXEnhanced Security Protocols: Institutional-grade protection for your assetsUser-Friendly Interface: Intuitive design suitable for both beginners and experienced tradersCompetitive Fees: Cost-effective trading structureResponsive Support: Assistance available throughout your trading journeyConclusion: Navigating the Fogo (FOGO) Investment LandscapeFogo (FOGO) Coin represents the innovative yet uncertain frontier of emerging cryptocurrencies. While offering potential opportunities for growth, it carries significant risks that require careful navigation.

Ready to trade Fogo (FOGO) and other cryptocurrencies?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

Further ReadingFutures Trading in Crypto: A Beginner’s Guide in 2026Which Crypto Will Go 1000x in 2026?What Is zkPass (ZKP)? The Complete Guide to the Privacy-Powered Data Verification ProtocolDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

AI Avatar (AIAV): A Guide to the AI-Powered Crypto Project

Searching for the next major innovation where artificial intelligence meets the blockchain? Look no further than AI Avatar (AIAV). This groundbreaking project is not just another token; it's building the foundation for a new era of intelligent digital identity, where your online persona becomes a dynamic, AI-powered asset with real economic value.

In this definitive guide, we cut through the hype to give you a clear, actionable breakdown of the AI Avatar ecosystem. You'll understand exactly what AI Avatar (AIAV) is, how its technology works, the detailed economics behind the $AIAV Tokenomics, and your step-by-step pathway to acquire tokens—whether through the anticipated $AIAV airdrop or by learning precisely how to buy $AIAV on major exchanges.

What is AI Avatar (AIAV)?AI Avatar (AIAV) is a next-generation Web3 protocol designed to create, manage, and monetize intelligent digital identities. At its core, it transforms the concept of a simple profile picture or static NFT into a living, learning AI companion—a customizable digital avatar capable of interaction, adaptation, and autonomous activity across platforms.

Think of it as the evolution of digital self-expression: moving from a flat image you own to an interactive AI agent that represents you, learns your preferences, and can even act on your behalf in virtual spaces, social networks, and future metaverse applications.

How Does the AI Avatar Ecosystem Work?The project operates on a dual-layer architecture that seamlessly blends advanced AI with blockchain utility:

The AI Engine: Creation and IntelligenceThis layer is responsible for the "brain" and "face" of your avatar:

Dynamic Generation: Users generate unique avatars using AI models, selecting from a vast array of visual styles, personality traits, and behavioral parameters.Continuous Learning: Powered by machine learning, avatars evolve based on interactions, developing a distinct digital persona over time.Cross-Platform Agency: Your AI Avatar is designed as a portable identity that can represent you in compatible apps, games, and social environments.The Blockchain Backbone: Ownership and EconomyThe $AIAV token powers this layer, ensuring security, ownership, and economic activity:

Provable Ownership: Each AI Avatar is minted as a unique digital asset (like an advanced NFT) on the blockchain, with the $AIAV token facilitating creation and establishing verifiable ownership.Ecosystem Currency: All transactions within the platform—from purchasing avatar accessories and AI model upgrades to trading avatar assets—are conducted in $AIAV.Governance Mechanism: Token holders govern the platform's future, voting on key decisions regarding development, partnerships, and treasury management.$AIAV Tokenomics ExplainedA robust tokenomic model is crucial for long-term sustainability. Here’s a breakdown of the key elements that define $AIAV Tokenomics:

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

ComponentDetails & PurposeToken Name / TickerAI Avatar / $AIAVPrimary BlockchainTypically deployed on a high-throughput, low-cost chain like BNB Smart Chain (BSC) for accessibility.Total & Circulating SupplyFixed total supply (e.g., 1 billion tokens) to ensure scarcity, with a controlled release schedule.Core Utilities• Governance: Voting rights on ecosystem proposals.• Fuel: Payment for avatar creation, upgrades, and in-ecosystem services.

• Rewards: Distributed to users for social engagement ("Social Mining"), staking, and content creation.

• Access: Key to exclusive features, events, and virtual land.Value DriversDemand is driven by: growth in active users creating avatars, transaction fee burn/buyback mechanisms, and speculative interest in the AI + Web3 narrative.How to Participate: Airdrop and PurchaseQualifying for the $AIAV Airdrop

The $AIAV airdrop is a common strategy to reward early believers. To maximize your chances:

Join the Official Community: Follow AI Avatar's official Twitter (X), Telegram, and Discord channels.Complete Interactive Tasks: These may include signing up for a waitlist, referring friends, creating a test avatar, or engaging with specific social media content.Stay Alert for Announcements: Airdrop details and snapshots are always announced officially—never trust private messages offering guaranteed allocations.How to Buy $AIAVOnce $AIAV is listed, here is a straightforward process to acquire it on a supporting exchange like WEEX:

Create & Fund an Account: Register on WEEX Exchange and deposit funds (e.g., USDT) into your spot wallet.Locate the Trading Pair: Navigate to the spot trading section and search for AIAV/USDT.Execute Your Trade: Choose between a market order (instant buy at current price) or a limit order (set your desired price). Input the amount and confirm the purchase.Manage Your Assets: You can securely hold $AIAV in your exchange wallet or transfer it to a private wallet (e.g., MetaMask) for self-custody and direct interaction with the AI Avatar platform.Final Thoughts on AI Avatar (AIAV)AI Avatar (AIAV) represents a visionary step toward a future where our digital selves are as complex, valuable, and interactive as our physical identities. By successfully merging customizable AI with a tokenized economy, it creates a compelling new asset class: the intelligent digital identity.

For traders, believers in the AI revolution, or Web3 enthusiasts, understanding this project is key. Whether you aim to qualify for the $AIAV airdrop, analyze the $AIAV Tokenomics for investment, or simply learn how to buy $AIAV, this guide provides the foundation for your journey into this innovative convergence of technologies.

Ready to explore the future? Begin by joining the official AI Avatar community for the latest news and preparing your strategy for the ecosystem's launch.

FAQQ1: Where can I trade $AIAV?A: You can trade $AIAV on WEEX Exchange. Visit WEEX, find the AIAV/USDT trading pair in the spot market, and execute your trade.

Q2: What is the primary purpose of the AIAV token?A: The primary purpose of the $AIAV token is to incentivize user participation. It rewards users with tokens for engaging in conversations with AI avatars, which provides data to train and evolve the platform's AI models.

Q3: Is the AI Avatar project officially listed on Binance?A: No. As of early 2026, the AI Avatar ($AIAV) project is not officially listed on Binance or other major tier-1 exchanges. Social media rumors about a listing or airdrop are unverified.

Q4: Where can I read the AIAV whitepaper?A: A detailed technical whitepaper for AI Avatar is not currently public. The lack of this document means potential users should exercise caution and conduct thorough research.

What Is zkPass (ZKP)? The Complete Guide to the Privacy-Powered Data Verification Protocol

If you're searching for "what is zkPass (ZKP)" or tracking the "zkPass token price", you've come to the right place. In today's digital landscape where data privacy is paramount yet often compromised, zkPass emerges as a groundbreaking solution that bridges Web2 and Web3 without sacrificing user sovereignty. This comprehensive guide will explain exactly what zkPass is, how it works, and why the zkPass token is becoming increasingly important in the evolving data economy.

What is zkPass (ZKP)?zkPass (ZKP) is a decentralized, privacy-focused protocol designed for private data verification between traditional internet services and blockchain applications. It serves as critical infrastructure that enables users to selectively prove information from Web2 sources—such as bank accounts, social media profiles, or government databases—to Web3 smart contracts without ever revealing the actual data itself.

Think of it this way: with zkPass, you can prove to a DeFi lending platform that you have a credit score above 700 without disclosing your exact score, personal identity, or financial history. This represents a fundamental shift from today's model where users must either trust centralized intermediaries with their sensitive information or remain isolated from blockchain-based services.

The protocol achieves this through an innovative combination of established cryptographic techniques and novel implementation approaches, making it one of the most promising solutions in the growing privacy-tech sector.

How Does zkPass Work?The Core Technology: MPC + ZKPzkPass operates on two pillars of modern cryptography:

Multi-Party Computation (MPC): Allows multiple parties to jointly compute a function while keeping their inputs privateZero-Knowledge Proofs (ZKP): Enables one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itselfThese technologies work together to ensure that data verification occurs without data disclosure—a critical distinction that sets zkPass apart from conventional verification methods.

The TransGate Innovation: Three-Party TLS (3P-TLS)One of zkPass's most significant breakthroughs is its TransGate technology, which enables users to generate proofs from any HTTPS website using a modified Three-Party TLS handshake.

Here's how it works in practice:

Standard TLS: Normally, when you access a secure website (like your bank), there's a 2-party handshake between you (Client) and the serverzkPass's 3P-TLS: Introduces a third party—the Verifier (zkPass Node)—into the handshake processThe Verifier witnesses the data transfer to ensure authenticityThe Verifier never sees the unencrypted dataOnly cryptographic proof of the transaction is generatedThis means zkPass can work with any existing HTTPS website without requiring special APIs or cooperation from Web2 companies—a massive advantage over traditional oracle solutions.

The Verification Process: From Data to ProofThe complete workflow looks like this:

User Access: A user accesses their Web2 data source through the TransGate interface3P-TLS Verification: The modified handshake verifies the data's authenticity without exposing its contentProof Generation: Selected data points are converted into zero-knowledge proofs locally on the user's deviceOn-Chain Verification: These proofs are submitted to smart contracts for verificationAccess Granted: Based on the proof's validity, the user gains access to Web3 servicesThroughout this entire process, the actual sensitive data never leaves the user's control in readable form.

Real-World Applications: Where zkPass Creates ValueFinancial Services & DeFiUnder-Collateralized Lending: Prove creditworthiness without revealing financial detailsCompliance Verification: Meet regulatory requirements without exposing personal identityWealth Verification: Access premium services by proving asset thresholdsIdentity & Access ManagementAge Verification: Prove you're over 18 without sharing your birthdateCitizenship Proof: Verify nationality for services without passport disclosureKYC Compliance: Meet know-your-customer requirements privatelyGaming & Social EcosystemsAchievement Verification: Prove gaming accomplishments without exposing account detailsSocial Proof: Verify social media influence for DAO access or rewardsAsset Ownership: Confirm ownership of digital assets across platformsEnterprise & Institutional UseEmployment Verification: Prove employment status or income without HR disclosureEducation Credentials: Verify degrees or certifications privatelyProfessional Licensing: Confirm professional qualifications without exposing detailszkPass (ZKP): Network Fuel and GovernanceToken OverviewThe zkPass token (ZKP) serves as the native utility and governance token of the zkPass ecosystem. Built as an ERC-20 token with a maximum supply of 1 billion tokens, ZKP incorporates LayerZero technology for seamless cross-chain interoperability.

zkPass (ZKP) Use CasesPayment Mechanism: Users and applications pay ZKP tokens to generate proofs and verify dataSecurity Staking: Validators must stake ZKP tokens as collateral to ensure honest participationAccess Credential: Developers and enterprises need ZKP to access premium features and toolsGovernance Rights: Token holders participate in protocol upgrades and parameter adjustmentsWhy zkPass Matters Now More Than EverSolving Critical Web2-Web3 Integration ChallengesData Sovereignty: Users maintain complete control over their personal informationPrivacy Preservation: Verification occurs without unnecessary data exposureUniversal Compatibility: Works with any HTTPS website without API requirementsFraud Prevention: Direct source verification eliminates data manipulation risksAddressing Growing Market NeedsRegulatory Evolution: Increasing privacy regulations demand better data handlingUser Awareness: Growing concern about data privacy and securityIndustry Demand: DeFi, gaming, and social platforms need reliable verification methodsTechnological Maturity: Advancements in ZKP technology enable practical implementationFinal Thoughts: The Future of Private Data VerificationzkPass (ZKP) offers a groundbreaking solution to one of Web3’s biggest challenges: leveraging Web2 data without compromising privacy. By integrating proven cryptography with innovative implementation, zkPass effectively bridges the two ecosystems.

For users, developers, or investors tracking the zkPass token price, this protocol delivers practical answers to growing demands for private, secure data verification.

As privacy concerns and blockchain adoption rise, zkPass is positioned to become a key enabler across industries—allowing verification without exposure while working seamlessly within existing internet infrastructure.

Ready to trade zkPass (ZKP) and other cryptocurrencies?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

Further ReadingWhat Is Brevis (BREV) and How Does It Work?Why POPCAT Crashes? A Complete ExplanationWhat Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: What makes zkPass different from other privacy solutions?A: Unlike solutions that require specific API integrations or only work with pre-approved data sources, zkPass works with any HTTPS website through its innovative TransGate technology, making it universally applicable.

Q2: Is zkPass secure?A: Yes. The protocol uses established cryptographic techniques (MPC and ZKP) and has been through extensive security audits. The 3P-TLS implementation ensures data authenticity without exposing sensitive information.

Q3: How can I start using zkPass?A: Users can access zkPass through supported applications and platforms. Developers can integrate the protocol using available SDKs and documentation to add private verification capabilities to their applications.

Q4: Where can I track the zkPass token price?A: The zkPass token price can be monitored on major cryptocurrency exchanges, including WEEX, as well as through market data platforms and portfolio tracking applications.

Q5: What's the future roadmap for zkPass?A: The protocol continues to expand its compatibility with additional data sources and blockchain networks while improving proof generation efficiency and user experience.

What Is 小股东 (XiaoGuDong)? Solana Meme Coin Overview

If you've been exploring the dynamic world of Solana meme coins, you may have come across 小股东 (XiaoGuDong) – a token that's more than just a cryptocurrency; it's a cultural symbol for retail investors everywhere. Translating to "Little Shareholder," Xiao Gu Dong captures the spirit of everyday traders navigating the volatile crypto markets. Built on the high-speed Solana blockchain, this community-driven token has quickly gained traction among those who identify with the underdog narrative in investing.

In this guide, we’ll explore what Xiao Gu Dong is, why it's resonating with traders, how to buy and trade it safely, and what you need to know before getting involved.

What is 小股东 (XiaoGuDong)?小股东 (Xiao Gu Dong) is a Solana-based meme token inspired by Chinese internet culture and the retail trading experience. The name refers to the "little shareholder" – a term often used to describe individual investors who take on the markets with limited capital but big dreams. Unlike traditional cryptocurrencies, Xiao Gu Dong isn't focused on utility or technology; it’s driven by community, culture, and shared identity.

With a total supply of 1 billion tokens, Xiao Gu Dong is designed to be accessible and liquid, making it easy for small-scale traders to participate. It’s part of a growing wave of cultural meme tokens – like 牛马 (NIUMA) – that use social narratives to build engagement and value.

Why is 小股东 (XiaoGuDong) Trending?Cultural ConnectionThe term "小股东" resonates deeply within Chinese-speaking trading communities, symbolizing the collective experience of retail investors. By turning this identity into a token, Xiao Gu Dong has built an instant community of supporters who see themselves reflected in the project.

Solana's Speed and AffordabilityBuilt on Solana, Xiao Gu Dong benefits from fast transaction times and low fees – making it ideal for meme coin trading, which often involves rapid buying and selling.

Pure Community PowerWith no formal team, roadmap, or venture backing, Xiao Gu Dong is a true grassroots movement. Its value is driven entirely by social buzz, community engagement, and viral potential on platforms like X (Twitter), Telegram, and Chinese social media.

Key Risks to Consider Before Investing in 小股东 (XiaoGu Dong)High Volatility: 小股东 (Xiao Gu Dong) is a microcap meme coin with extreme price swings.No Formal Development: The project is community-run with no roadmap or long-term plan.Low Liquidity: This can lead to slippage and difficulty exiting positions.Speculative Nature: Value is based purely on social sentiment, not fundamentals.What Makes 小股东 (XiaoGuDong) Special?Xiao Gu Dong represents a new kind of crypto asset – one where culture and community drive value. Alongside tokens like 牛马 (NIUMA), it highlights how blockchain can turn shared identities and experiences into tradable digital assets.

For traders, 小股东 (XiaoGuDong) offers a way to participate in a social movement while speculating on viral trends. However, it should be approached as a high-risk, high-reward experiment – not a long-term investment.

Read More: What Is 牛马(NIUMA) Token ? BSC Meme Coin Explained

Where to Trade 小股东 (XiaoGuDong)?If you're looking to explore 小股东 (Xiao Gu Dong) and other emerging social tokens, consider trading on a secure and reliable platform like WEEX Exchange.

At WEEX, you can enjoy:

Low trading fees and deep liquidityHigh security24/7 multilingual customer serviceIntuitive interface for beginners and pros alikeWhether you're trading 小股东 (Xiao Gu Dong), Bitcoin (BTC), or AAPL/USDT perpetual futures, WEEX provides a reliable environment to engage with both crypto and crypto-linked markets.

Sign up and start your trading now!

Further ReadingWhat Is 我踏马来了? A New Horse Themed Meme CoinWEEX Step-by-Step Trading Guide for BeginnersHow to Invest in Crypto 2026? Everything You Need to KnowDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Top 4 Four.meme Ecosystem (BNB Memes) Coins Defining Current Market Cycles in January 2026

As the crypto market transitioned from 2025 into 2026, memecoins reclaimed center stage. This resurgence was distinct; they emerged not merely as speculative assets but as a reflection of on-chain cultural sentiment. While previous cycles were dominated by Ethereum and Solana-based memecoins, the narrative subtly shifted as the Binance Smart Chain (BSC) experienced a renewed wave of activity, significantly propelled by platforms like the Four.meme ecosystem.

This January 2026 memecoin cycle differed from the pure hype-driven frenzies of 2025. It exhibited more mature characteristics, including better liquidity retention, stronger community branding, and a clearer distinction between transient pump tokens and sustained memecoins. This article explores the top 5 Four.meme coins for January 2026, ranked by their market relevance, visibility, and trading activity, offering a structured overview for informed participation in this emerging narrative.

What is Four.meme Ecosystem in 2025–2026?The Four.meme ecosystem is best described as a native memecoin launch and discovery platform on the Binance blockchain (BNB Chain). It gained prominence by lowering the barriers for meme token creation and distribution while providing visibility through community curation, data aggregation, and categorization.

What’s New for Four.meme?From 2025 into early 2026, the ecosystem underwent critical transitions:

Improved Market Transparency: Consistent tracking via data aggregators increased the credibility and discoverability of listed memecoins.Narrative Maturation: Projects began focusing more on cultural satire, identity-based branding, and thematic depth, moving beyond simple animal memes.BNB Chain Tailwinds: Increased retail participation was fueled by network upgrades, renewed ecosystem incentives, and low transaction costs on the BNB Chain.Four.meme distinguishes itself not by competing with the high-frequency trading environment of Solana, but by emphasizing narrative continuity and community stickiness.

Top 4 Four.meme Ecosystem (BNB Memes) Coins for January 2026Here are the five tokens driving the January 2026 memecoin cycle on Four.meme.

币安人生 (BinanceLife)Key Metric: Market Cap ~$124.6MOverview: The flagship token of the ecosystem, 1. 币安人生 (BinanceLife) draws branding directly from the daily experiences, humor, and psychology of users within the Binance community. Its relatable theme has cemented its position as a blue-chip memecoin on BSC.2026 Outlook: It remains the benchmark asset for the Four.meme ecosystem, often setting sentiment for smaller tokens. It offers relatively lower volatility for traders seeking core exposure to the BNB meme narrative.Siren (SIREN)Key Metric: Market Cap ~$63.8MOverview: A purely momentum-driven memecoin designed for fast-paced speculative cycles. Siren (SIREN) thrives during short-term trading waves and liquidity rotations within the BNB ecosystem.2026 Outlook: Attractive to active, experienced traders seeking high volatility and tactical opportunities during meme rallies, though it carries a correspondingly high-risk profile.哈基米 (HAJIMI)Key Metric: Market Cap ~$37.4MOverview: 哈基米 (HAJIMI) represents regionally rooted meme culture, inspired by an adorable, viral cat character from Chinese internet culture. It demonstrates how localized humor can gain global accessibility via blockchain.2026 Outlook: Positioned as a case study in cultural specificity, it appeals to traders interested in authentic, grassroots community memecoins with expansion potential beyond their initial niche.CZ’s Dog (BROCCOLI)Key Metric: Market Cap ~$27.1MOverview: Leveraging narratives around Binance leadership and crypto personality culture, CZ’s Dog (BROCCOLI) is highly reactive to broader discussions and sentiment within the BNB ecosystem.2026 Outlook: Primarily offers short-term speculative opportunities driven by hype cycles, catering to traders who closely monitor meme market sentiments.Four.meme Ecosystem Outlook for 2026The 2025-2026 cycle has matured Four.meme from a hype-driven venue to a more selective environment focused on sustainable narratives. Success now favors tokens with active communities, recognizable branding, and resilience across market rotations.

The ecosystem will continue to serve as the primary cultural testing ground for memes on BNB Chain, benefiting from strong alignment with the chain's retail user base. While it may lack the blistering speed of Solana platforms, it compensates with consistent liquidity cycles tied to BNB Chain activity. The 2026 outlook prioritizes steady relevance and resilience over rapid, unsustainable expansion.

ConclusionThe Four.meme ecosystem vividly illustrates the evolution of memecoins from short-term speculative vehicles into recurring fixtures of crypto culture. The current cycle rewards consistency in narrative, brand recognition, and community endurance over fleeting monetary hype.

As a hub for accessible and familiar memes on BNB Chain, Four.meme is cementing its role as a permanent layer of the crypto landscape. However, it remains crucial for traders to remember that these are still high-risk, sentiment-based assets. Success requires cultural awareness, precise timing, and disciplined risk management. This evolution presents both informed opportunity and inherent risk, defining the next chapter for memecoin investors.

If you're still unsure where to purchase these trending memecoins, your answer is WEEX. Register now to start seamless trading on a platform designed for speed and accessibility.

Further ReadingWhere to Buy Bitcoin: Top Trusted Crypto Exchanges for BTC in 2026Futures Trading in Crypto: A Beginner’s Guide in 2026Is Cryptocurrency Safe in 2026?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

How to Invest in Crypto 2026? Everything You Need to Know

The cryptocurrency market offers far more than just Bitcoin and Ethereum. Today's investors have thousands of digital assets to choose from for portfolio diversification. Making sound investment decisions starts with a clear understanding of the main cryptocurrency categories, their distinct roles, and associated risk profiles.

Mainstream Coins: The Foundational “Core Assets”Mainstream coins are the established giants of the crypto market, typically ranking within the top 20 by market capitalization. They are characterized by massive user bases, deep liquidity, high trading volumes, and a proven track record of surviving multiple market cycles. Their broad community consensus, real-world utility, and resilience make them the essential cornerstone for any crypto portfolio.

Examples:

Bitcoin (BTC) is the original and preeminent decentralized digital currency.Ethereum (ETH) is the leading smart contract platform, foundational to DeFi, NFTs, and dApps.Solana (SOL) is a high-performance blockchain known for speed and a rapidly growing ecosystem.For beginners, allocating a significant portion of a portfolio to these blue-chip cryptocurrencies is a prudent strategy. They provide exposure to the crypto market's growth with relatively lower volatility and higher stability compared to newer, unproven projects.

Stablecoins: The Essential “Safety Pad”Stablecoins are cryptocurrencies pegged to the value of a stable asset, most commonly the US Dollar. They are designed to maintain a stable price, making them a crucial tool for preserving value, facilitating trades, and acting as a safe haven during market volatility. They serve as the primary bridge between traditional finance and the crypto economy.

Examples:

USDT (Tether) and USDC (USD Coin) are the most widely adopted fiat-backed stablecoins.In any investment strategy, stablecoins function as a parking spot for capital, a medium for transfers, and a key component for risk management, allowing investors to exit volatile positions without leaving the blockchain ecosystem.

High-Risk Altcoins: The “Potential High-Return” SegmentHigh-risk altcoins encompass all cryptocurrencies beyond Bitcoin and Ethereum. This category includes projects with smaller market capitalizations that often focus on niche innovations like privacy, oracle networks, or scalable smart contracts. While they can introduce groundbreaking technology, many lack widespread adoption and are subject to extreme price volatility and lower liquidity.

Examples:

Chainlink (LINK) is a decentralized oracle network.Cardano (ADA) is a research-focused smart contract platform.These assets can offer significant growth potential but come with substantially higher risk. Investing in them requires thorough fundamental analysis of the project's technology, team, and use case, and should only be done with capital one is prepared to lose.

Meme Coins: The Speculative “Emotional Assets”Meme coins are cryptocurrencies born from internet culture and social media trends, not technological fundamentals. Their value is almost entirely driven by community sentiment, viral hype, and speculative trading, leading to wild, unpredictable price swings. They represent the highest-risk, highest-volatility corner of the crypto market.

Examples:

Dogecoin (DOGE) is the original meme coin.Shiba Inu (SHIB) is a popular Ethereum-based successor.Investing in meme coins is akin to speculative gambling. Beginners should avoid them entirely or allocate only a tiny fraction of "entertainment money" they are fully prepared to lose, understanding that gains and losses can be equally dramatic.

Read More: Is Dogecoin(DOGE) a Good Investment in 2026? Everything You Should Know

How to Invest in Crypto?A prudent asset allocation strategy for new investors prioritizes capital preservation while allowing for measured growth. A balanced, risk-controlled framework is essential:

Foundation (80-90% of Portfolio): Allocate the majority to stablecoins and mainstream coins like BTC and ETH. This provides stability, liquidity, and core exposure to the market.Growth & Risk (Up to 10-15% of Portfolio): Dedicate a small portion to researched high-risk altcoins with strong fundamentals. This allows participation in innovative projects with higher return potential.Speculation (≤5% of Portfolio, Optional): If desired, use a minimal amount for meme coin speculation. Treat this as a learning experience with money you can afford to lose completely.This structured approach helps beginners manage downside risk systematically while progressively exploring different segments of the crypto ecosystem.

ConclusionNavigating the digital asset landscape requires recognizing that different cryptocurrency categories serve different purposes and carry vastly different risk-reward profiles. A successful investment strategy is not about chasing the highest returns but about constructing a balanced crypto portfolio aligned with your financial goals and risk tolerance.

By building a foundation with mainstream coins, using stablecoins for safety and flexibility, and cautiously exploring altcoins and meme coins, investors can participate in the dynamic crypto market with clarity and discipline.

Now that you understand how to invest in crypto, it's time to take action. If you're looking for a trusted platform to execute your strategy, choose WEEX. Register now to start seamless trading with 0 fees, a user-friendly interface, and a high-security environment.

Further ReadingWhere to Buy Bitcoin: Top Trusted Crypto Exchanges for BTC in 2026Futures Trading in Crypto: A Beginner’s Guide in 2026Is Cryptocurrency Safe in 2026?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What Is Solana OTC Crypto and How to Trade SOL OTC with Google Pay on WEEX Exchange?

Solana is a high-performance blockchain known for fast transactions and low fees, making SOL one of the most actively traded crypto assets in the market. As SOL liquidity grows, many traders prefer OTC crypto trading to execute larger or time-sensitive transactions with better price control. This article explains what Solana OTC crypto trading is, how a crypto OTC trading exchange works, and how WEEX Exchange supports efficient OTC trading. You will also learn how to trade SOL OTC using Google Pay on WEEX via web and app, followed by practical answers to common OTC crypto questions.

What Is the Solana OTC Crypto?Solana OTC crypto refers to over-the-counter trading of SOL, Solana’s native token. In this model, SOL is traded directly between counterparties rather than through public exchange order books. According to MoonPay’s overview of crypto OTC trading, OTC transactions are usually facilitated by brokers, OTC desks, or trusted peer-to-peer platforms that arrange pricing and settlement privately.

The main advantage of SOL OTC crypto trading is execution stability. Large SOL trades placed on public markets can trigger slippage or short-term volatility. OTC trading allows both parties to agree on a fixed price before execution, reducing market impact. This controlled approach is commonly used by institutional traders, high-net-worth individuals, and users who value predictable settlement and transaction privacy.

What Is Crypto OTC Trading Exchange?A crypto OTC trading exchange, sometimes called an OTC desk or platform, enables direct crypto transactions outside traditional spot markets. Instead of matching orders publicly, the platform provides quoted prices that are executed immediately once accepted. This structure eliminates slippage and protects traders from sudden price changes during large transactions.

OTC crypto exchanges also act as efficient fiat gateways. They allow users to convert fiat currencies into crypto or back into fiat quickly and securely. By connecting local banking systems with blockchain infrastructure, OTC platforms support multi-currency settlement and cross-border capital flow. For assets like SOL, OTC crypto trading offers speed, privacy, and price certainty that standard exchanges may not always deliver.

What Is WEEX OTC Crypto Trading Exchange?WEEX OTC Crypto Trading Exchange is designed to make fiat-to-crypto trading simple, fast, and accessible. WEEX has officially launched its WEEX OTC Quick Buy feature to streamline fiat deposits with a secure and seamless experience. The platform supports more than 200 trading pairs and multiple mainstream payment methods.

Through WEEX OTC, users can purchase cryptocurrencies anytime and anywhere using fiat currencies, completing transactions in just three steps. Pricing is transparent, settlement is fast, and the interface is suitable for both beginners and experienced traders. The integrated OTC entry allows users to move directly from fiat payment to crypto ownership without unnecessary complexity.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Solana with Google Pay on WEEX OTC Crypto Exchange?Trading SOL OTC with Google Pay on WEEX is designed for speed and clarity. Both the web platform and mobile app focus on transparent pricing, fast settlement, and secure payment flows.

Buy Solana OTC with Google Pay on WEEX (Web)Step 1: Select [Google Pay] and [SOL] crypto, then select the payment method.

Step 2: Input the payment amount, then click [Buy SOL] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Solana OTC with Google Pay on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [Google Pay] and [SOL] crypto.

Step 3: Input the payment amount, then click [Buy SOL] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ About Solana OTC Crypto TradingHow does buying SOL OTC crypto work?SOL OTC trading allows buyers to receive a fixed quote before execution. The transaction is completed privately through the platform, reducing slippage and ensuring stable pricing for larger trades.

What is an OTC crypto exchange?An OTC crypto exchange executes trades directly between counterparties outside public markets. It focuses on private, high-volume transactions with fixed pricing and flexible settlement methods.

Is OTC crypto trading legal?Yes, OTC crypto trading is legal in most regions when it complies with local regulations. Reputable platforms operate under regulatory frameworks to ensure transparency and security.

Does WEEX Exchange charge fees for OTC trading?WEEX Exchange applies different fees depending on the trading pair and payment method. The system automatically recommends the optimal option, and promotional campaigns may offer zero fees.

Is KYC required for Solana OTC trading on WEEX?For non-CNY fiat deposits, WEEX does not require KYC for OTC crypto trading. CNY-related transactions may follow separate regulatory requirements.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is Solana OTC Crypto Trading and How to Trade SOL OTC with PIX on WEEX Exchange?

Solana OTC crypto trading offers a practical way to buy or sell SOL directly with fiat currencies like PIX, without relying on public order books. This article explains what Solana OTC crypto is, how crypto OTC trading exchanges work, and why WEEX Exchange stands out as a reliable OTC crypto platform. You will also learn step by step how to trade SOL OTC with PIX on WEEX using both the web and app, along with clear answers to common questions beginners often ask.

What is the Solana OTC Crypto?Solana OTC Crypto refers to trading SOL through over-the-counter mechanisms rather than standard exchange order books. Crypto OTC trading means the direct purchase and sale of cryptocurrencies between parties, usually facilitated by an OTC desk, broker, or trusted P2P platform. According to this guide on what is crypto OTC trading, OTC transactions allow buyers and sellers to agree on prices privately, which reduces slippage and avoids unnecessary market volatility.

For Solana, this approach is especially useful for users executing larger trades. Instead of pushing SOL prices up or down on a public exchange, OTC trading keeps execution stable and discreet. Solana OTC crypto trading also supports flexible settlement options, including bank transfers, stablecoins, or other agreed methods, making it suitable for both individual investors and high-volume traders.

What is Crypto OTC Trading Exchange?A crypto OTC trading exchange functions as a private gateway between fiat and crypto markets. Unlike spot markets, where large orders can cause price shifts and slippage, an OTC crypto exchange provides fixed quotes with immediate settlement. This structure gives traders certainty on execution price and timing.

OTC crypto trading platforms are widely used as efficient fiat on-ramps. They allow investors to move funds quickly from bank accounts into digital assets or convert crypto back into fiat during volatile market conditions. With multi-currency infrastructure, OTC desks connect local payment systems with global liquidity. This makes it possible to buy SOL with PIX or trade USDT OTC using different regional currencies, while maintaining speed, privacy, and price stability.

What is WEEX OTC Crypto Trading Exchange?WEEX OTC Crypto Trading Exchange is designed to make fiat-to-crypto trading simple, fast, and accessible. WEEX has launched its OTC Quick Buy feature to streamline fiat deposits and crypto purchases with minimal steps. The WEEX OTC platform supports more than 200 trading pairs and multiple mainstream payment methods, allowing users to buy cryptocurrencies anytime and anywhere.

Through WEEX OTC Quick Buy, users can complete a crypto purchase in just three steps. The platform focuses on secure settlement, smooth user experience, and broad payment coverage, making it suitable for both beginners and experienced traders seeking reliable OTC crypto trading.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Solana with PIX on WEEX OTC Crypto Exchange?Trading Solana OTC with PIX on WEEX is straightforward and designed for speed and clarity.

Buy Solana OTC with PIX on WEEX (Web)Step 1: Select [PIX] and [SOL] crypto, then select the payment method.

Step 2: Input the payment amount, then click [Buy SOL] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Solana OTC with PIX on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [PIX] and [SOL] crypto.

Step 3: Input the payment amount, then click [Buy SOL] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Solana OTC Crypto TradingHow does buying crypto OTC work?OTC crypto trading allows buyers and sellers to trade directly at an agreed price. This method reduces market impact and provides fixed quotes, which is ideal for large or time-sensitive trades.

What is an OTC crypto exchange?An OTC crypto exchange specializes in executing private, high-volume trades outside public order books. It focuses on price stability, privacy, and flexible settlement options.

Is OTC crypto trading legal?OTC crypto trading is legal in most regions when it follows local regulations. Reputable platforms apply compliance standards such as AML checks where required.

Does WEEX Exchange charge fees for OTC trading?WEEX Exchange applies different fees depending on the trading pair and payment method. The platform automatically recommends the most cost-effective option, and promotional events may offer zero fees.

Is KYC required for OTC trading on WEEX?For non-CNY deposits, WEEX does not require KYC for OTC crypto trading. This makes it easier for global users to access the platform quickly.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is Solana OTC and How to Buy SOL OTC With PKR on WEEX Exchange?

Solana stands out for its high-speed, low-cost transactions, powering a growing ecosystem of decentralized applications. For investors and traders looking to acquire significant amounts of SOL with fiat currency efficiently, over-the-counter trading provides a strategic avenue. This guide explains Solana OTC crypto, how an OTC desk operates, and walks you through trading SOL with Pakistani Rupees (PKR) on the WEEX OTC platform.

What is the Solana OTC Crypto?Solana OTC (Over-The-Counter) trading is the direct, private purchase or sale of SOL tokens between two parties, facilitated outside of public exchange order books. These transactions are arranged through specialized brokers or OTC desks, which connect large buyers and sellers for direct negotiation.

The key advantage of using OTC for Solana is the ability to execute substantial orders without causing adverse price movement. On a standard exchange, a large SOL order can create slippage, increasing the average cost. OTC trading eliminates this risk by allowing parties to agree on a fixed price in advance. This ensures price certainty, minimizes market impact, and offers a discreet environment, making it ideal for venture capital firms, institutional investors, and projects building on the Solana network that need to manage large token allocations.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange is a specialized platform, commonly called an OTC desk, that facilitates private, bilateral cryptocurrency transactions. It differs from public spot markets by providing clients with a firm, fixed quote for their trade. This price is locked in and will not change during the settlement process, unlike the fluctuating prices on an open order book.

This model offers three core strategic benefits. First, it acts as the fastest fiat on-ramp, enabling the rapid conversion of traditional bank capital into crypto to seize timely market opportunities. Second, it guarantees zero slippage; the final execution price is exactly as quoted, protecting large capital allocations from intra-second volatility. Third, robust OTC platforms feature multi-currency and payment infrastructures, seamlessly bridging local banking systems like Pakistan's with global digital asset liquidity for efficient cross-border settlements.

What is WEEX OTC Crypto Trading Exchange?WEEX is a global cryptocurrency exchange that offers a dedicated, secure OTC trading desk. The WEEX OTC platform is engineered to provide a streamlined and confidential service for converting fiat currency into Solana and other leading digital assets.

A central feature designed for user convenience is the WEEX OTC Quick Buy service, which simplifies the purchase process into just a few intuitive steps. The platform supports instant transactions, allowing users to acquire crypto anytime, from anywhere. It delivers this reliable service by aggregating deep liquidity and integrating a wide array of mainstream global and local payment methods, creating a dependable bridge between traditional finance and the high-performance blockchain ecosystem.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Solana with PKR on WEEX OTC Crypto Exchange?Buy Solana OTC with PKR on WEEX (Web)Step 1: Select [PKR] fiat currency and [SOL] crypto, then select the payment method.

Step 2: Input the PKR payment amount, then click [Buy SOL] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Solana OTC with PKR on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [PKR] fiat currency and [SOL] crypto.

Step 3: Input the PKR payment amount, then click [Buy SOL] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC in crypto?OTC, or Over-the-Counter, in crypto refers to the method of buying and selling digital assets directly between two parties through a private broker or trading desk, instead of on a public exchange. This approach is used for large transactions to ensure a fixed price, avoid moving the market, and maintain transaction privacy.

How to buy crypto OTC?To buy crypto OTC, you typically engage with an OTC desk via a reputable exchange platform. You specify the cryptocurrency and amount you want, receive a firm price quote, and upon agreement, the desk facilitates a direct, off-exchange settlement with a seller, ensuring the trade is completed at the quoted price.

What is an OTC crypto desk?An OTC crypto desk is a specialized unit within a financial institution or exchange that handles large-volume cryptocurrency trades directly between counterparties. It operates privately to provide liquidity, negotiate custom terms, and ensure the discreet and efficient execution of trades that would be too large for public order books.