Ethereum's Identity Crisis: Cryptocurrency or Bitcoin's Shadow?

Original Article Title: The ETH Debate: Is it Cryptomoney?

Original Article Author: @AvgJoesCrypto, Messari

Translation: Luffy, Foresight News

Among all mainstream cryptocurrency assets, Ethereum has sparked the most intense debate. While Bitcoin has been widely recognized as the leading cryptocurrency, Ethereum's position has always been in question. To some, Ethereum is seen as the only credible non-sovereign monetary-like asset apart from Bitcoin; while others believe Ethereum is fundamentally a business that has seen declining revenues, tightening profit margins, and faces fierce competition from many other public chains offering faster transactions and lower costs.

This debate seemed to reach its peak in the first half of this year. In March, Ripple (XRP) briefly surpassed Ethereum in fully diluted valuation (notably, all Ethereum tokens are in circulation, while only about 60% of Ripple's total supply is circulating).

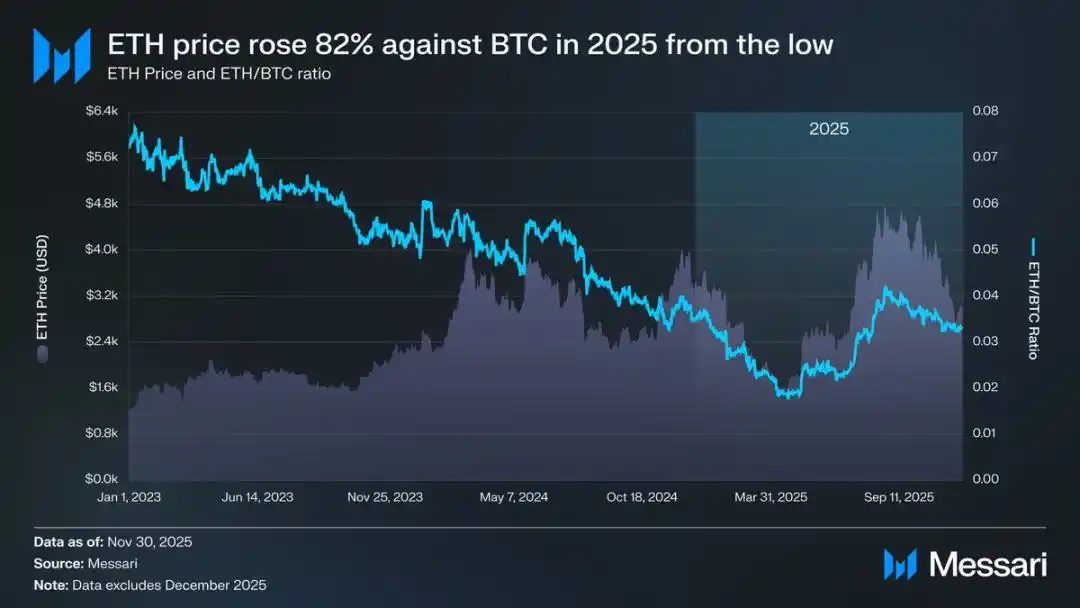

On March 16th, Ethereum's fully diluted valuation was $227.65 billion, while Ripple's equivalent valuation reached $239.23 billion. This result was almost unimaginable a year ago. Subsequently, on April 8th, 2025, Ethereum's exchange rate to Bitcoin (ETH/BTC) fell below 0.02, hitting a record low since February 2020. In other words, Ethereum has completely retraced all its gains relative to Bitcoin from the previous bull run. At that time, market sentiment towards Ethereum hit rock bottom.

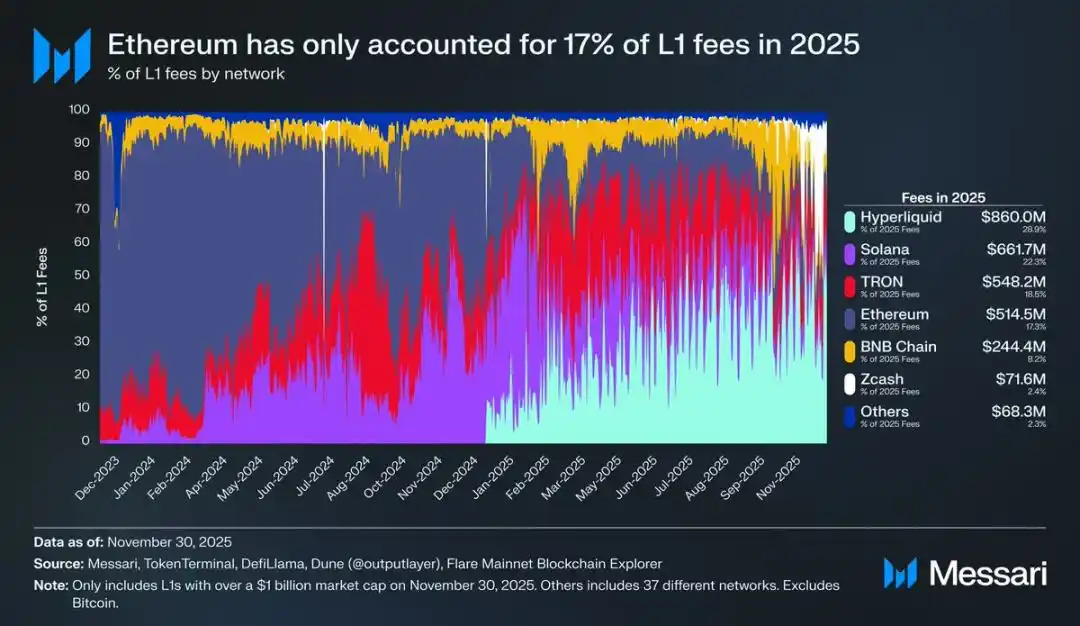

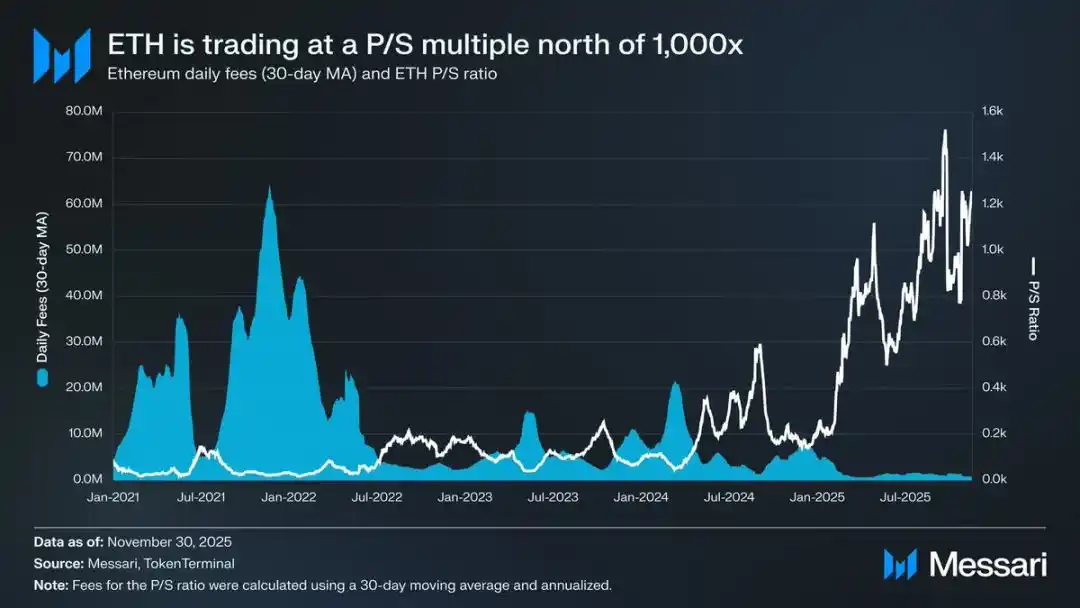

To make matters worse, the price decline was just the tip of the iceberg. As competitors' ecosystems flourished, Ethereum's share of the on-chain fee market continued to shrink. In 2024, Solana made a comeback; in 2025, Hyperliquid emerged. Together, the two pushed Ethereum's fee market share down to 17%, ranking it fourth among public chains—a cliff-like drop from its top spot a year ago. While fees may not tell the whole story, they are a clear signal of economic activity flow. Today, Ethereum is facing the most challenging competitive landscape in its development history.

However, historical experience has shown that significant reversals in the cryptocurrency market often begin at the most pessimistic moment of market sentiment. When Ethereum is pronounced by the outside world as a "failed asset," most of its apparent decline has already been absorbed by market prices.

In May 2025, signs of market overbearishness towards Ethereum began to emerge. It was during this period that Ethereum experienced a strong rebound in both its exchange rate against Bitcoin and its price in USD. The Ethereum-to-Bitcoin exchange rate climbed from a low of 0.017 in April to 0.042 in August, representing a 139% increase. During the same period, Ethereum's USD price surged from $1646 to $4793, marking a 191% increase. This upward trend peaked on August 24th when the price of Ethereum reached $4946, setting a new all-time high. After this reevaluation of value, Ethereum's overall trajectory clearly returned to an upward trend. The Ethereum Foundation's leadership transition and the emergence of a group of treasury companies focused on Ethereum injected confidence into the market.

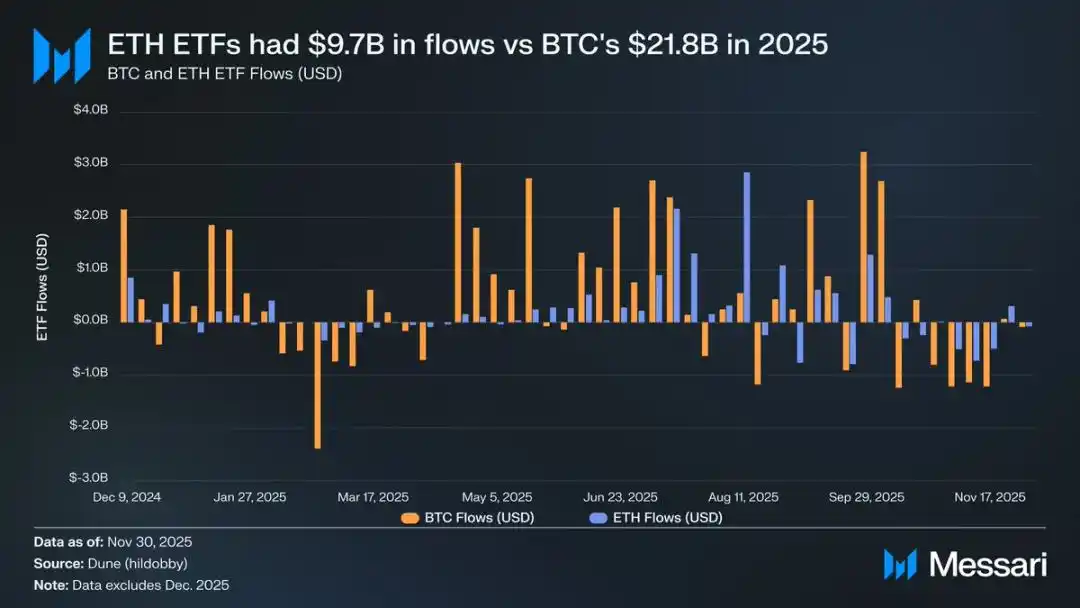

Prior to this round of growth, the diverging fortunes of Ethereum and Bitcoin were vividly reflected in the exchange-traded fund (ETF) markets for both. In July 2024, an Ethereum spot ETF was launched, but its fund inflows were very weak. In the first six months post-listing, its net inflow was only $2.41 billion, showcasing a stark contrast to the record-breaking performance of the Bitcoin ETF.

However, with Ethereum's strong recovery, concerns about its ETF fund inflows dissipated. Looking at the entire year, the net inflow of the Ethereum spot ETF reached $9.72 billion, while the Bitcoin ETF reached $21.78 billion. Considering that Bitcoin's market cap is nearly five times that of Ethereum, the disparity in the scale of ETF fund inflows is only 2.2 times, much lower than market expectations. In other words, when adjusted for market cap size, the market demand for Ethereum ETFs actually exceeds that of Bitcoin. This result completely reversed the narrative that "institutions lack genuine interest in Ethereum." Moreover, during specific time periods, the inflow of funds into the Ethereum ETF even surpassed Bitcoin directly. From May 26th to August 25th, the net inflow into the Ethereum ETF was $10.2 billion, exceeding the $9.79 billion for the Bitcoin ETF during the same period, marking the first clear tilt of institutional demand towards Ethereum.

Looking at the performance of ETF issuers, BlackRock continued to lead the market. By the end of 2025, BlackRock's Ethereum ETF holdings reached 3.7 million ETH, representing 60% of the Ethereum spot ETF market share. Compared to the year-end 2024 holding of 1.1 million ETH, this marked a 241% increase, with an annual growth rate far exceeding other issuers. Overall, the Ethereum spot ETF's holdings at the end of 2025 were 6.2 million ETH, accounting for approximately 5% of its total token supply.

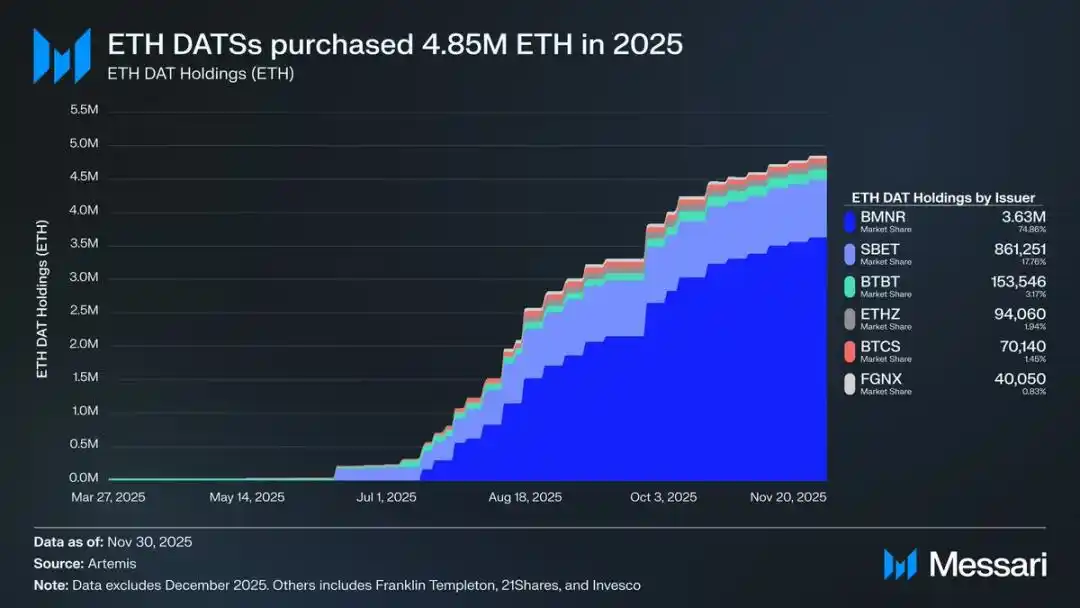

Behind Ethereum's strong rebound, the key driver has been the rise of Ethereum treasury companies. These reserve vaults have created unprecedented stable and sustained demand for Ethereum, providing support that narrative-driven or speculative funds cannot match. If Ethereum's price action marks a clear inflection point, then the continued accumulation by treasury companies represents a profound, structural shift that brought about this turning point.

By 2025, Ethereum treasury companies had accumulated 4.8 million Ethereum, representing 4% of its total supply, significantly impacting Ethereum's price. Among them, the most prominent performer is Bitmine led by Tom Lee (stock code BMNR). This company, originally focused on Bitcoin mining, began converting its reserve funds and capital to Ethereum in July 2025. From July to November, Bitmine acquired a total of 3.63 million Ethereum, holding 75% of the market share in the Ethereum treasury company market.

Despite Ethereum's strong rebound, the upward momentum eventually cooled off. As of November 30, Ethereum's price had retraced from its August high to $2,991, even lower than the previous bull market's peak of $4,878. While Ethereum's situation has significantly improved from its April low, this round of rebound has not completely dispelled the structural concerns that initially triggered market pessimism. On the contrary, the controversy surrounding Ethereum's positioning is once again in the public eye with even more intensity.

On one hand, Ethereum is exhibiting many features similar to Bitcoin, which are key to Bitcoin's ascent as a monetary asset. Today, Ethereum ETF inflows are no longer weak, and the Ethereum treasury company has become a source of its sustained demand. Perhaps most importantly, an increasing number of market participants are starting to differentiate Ethereum from other altcoins, incorporating it into the same monetary framework as Bitcoin.

On the other hand, the core issues that dragged Ethereum down in the first half of this year have yet to be resolved. Ethereum's core fundamentals have not fully recovered: its share of the public chain transaction fee market continues to be squeezed by strong competitors like Solana and Hyperliquid; the transaction activity on the Ethereum base layer is still far below the peak levels of the previous bull market; despite a significant price rebound, Bitcoin has easily surpassed its all-time high, while Ethereum is still lingering below its all-time high. Even in Ethereum's strongest months, there are still many holders who see this rally as an opportunity to cash out rather than a recognition of its long-term value.

The core issue of this controversy is not whether Ethereum has value, but how the asset ETH can accumulate value from the development of the Ethereum network.

In the previous bull market, the market widely believed that ETH's value would directly benefit from the success of the Ethereum network. This is the core logic of the "Sound Money Thesis": the utility of the Ethereum network will drive a significant demand for token burning, thereby establishing a clear and mechanized value support for Ethereum assets.

Today, we can almost certainly say that this logic will no longer hold. Ethereum's fee revenue has plummeted significantly and shows no signs of recovery; meanwhile, the two core areas driving Ethereum network growth — Real-World Assets (RWAs) and the institutional market — settle in USD as their core settlement currency, not in Ethereum.

The future value of Ethereum will depend on how it can indirectly benefit from the development of the Ethereum network. However, this indirect value accumulation carries great uncertainty. Its premise is that as the systemic importance of the Ethereum network continues to rise, more and more users and capital are willing to see Ethereum as a cryptocurrency and store of value tool.

Unlike direct, mechanized value accumulation, this indirect path has no certainty whatsoever. It relies entirely on market social preferences and collective consensus. Of course, this is not a flaw in itself; but it means that Ethereum's value growth will no longer have a necessary causal relationship with Ethereum network economic activity.

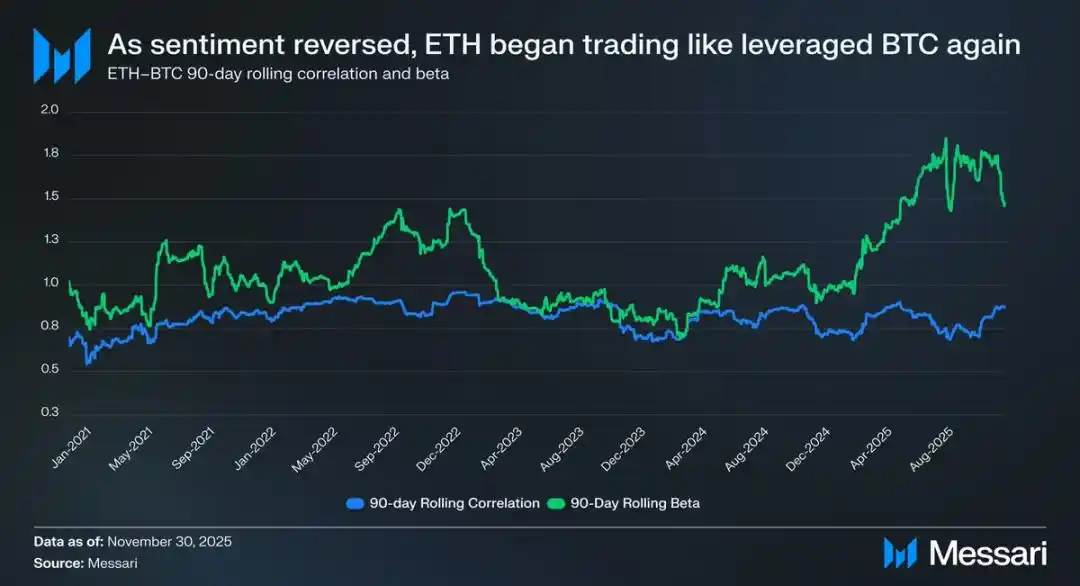

All of this will bring Ethereum's controversy back to its most core contradictory point: Ethereum may indeed be gradually accumulating a monetary premium, but this premium always lags behind Bitcoin. The market once again sees Ethereum as a "leverage expression" of Bitcoin's currency attributes rather than an independent monetary asset. Throughout the year 2025, Ethereum's 90-day rolling correlation with Bitcoin remained between 0.7 and 0.9, with the rolling beta coefficient skyrocketing to multi-year highs, briefly exceeding 1.8. This means that Ethereum's price volatility far exceeds Bitcoin's, but it is also always attached to Bitcoin's trend.

This is a subtle yet crucial distinction. The currency attributes that Ethereum possesses today are still recognized by the market as rooted in Bitcoin's currency narrative. As long as the market believes in Bitcoin's non-sovereign store of value attributes, some fringe market participants will be willing to extend this trust to Ethereum. Therefore, if Bitcoin's trend remains strong in 2026, Ethereum will also recapture more lost ground.

Currently, the Ethereum treasury company is still in its early stages of development, and its acquisition of Ethereum funds mainly comes from common stock issuance. However, if the cryptocurrency market experiences a new bull market, such institutions may explore more diversified financing strategies, such as borrowing from the strategy of expanding Bitcoin holdings, issuing convertible bonds and preferred stock.

For example, a Ethereum Treasury company like BitMine can finance itself by issuing low-interest convertible bonds and high-yield preferred shares, using the raised funds to directly accumulate Ethereum, while staking this Ethereum to earn ongoing rewards. Under reasonable assumptions, the staking rewards can partially offset the bond interest and preferred share dividend payments. This model allows the treasury to continue accumulating Ethereum using financial leverage when market conditions are favorable. Assuming a full-fledged bull market for Bitcoin in 2026, this "second growth curve" of the Ethereum Treasury company will further strengthen Ethereum's high beta attribute relative to Bitcoin.

Ultimately, the current market pricing of Ethereum's monetary premium is still based on Bitcoin's trajectory. Ethereum has not yet become a standalone currency asset with independent macroeconomic fundamental support; it is merely a secondary beneficiary of Bitcoin's currency consensus, and this beneficiary group is gradually expanding. The recent strong rebound of Ethereum reflects that some market participants are willing to see it as akin to Bitcoin rather than just an ordinary public chain token. However, even during a period of relative strength, market confidence in Ethereum remains closely linked to Bitcoin's narrative of continued strength.

In summary, while Ethereum's narrative of monetization has moved beyond its fractured state, it is far from settled. In the current market structure, combined with Ethereum's high beta attribute relative to Bitcoin, as long as Bitcoin's currency narrative continues to play out, Ethereum's price is poised for significant gains. The structural demand from Ethereum Treasury companies and corporate funds will provide tangible upward momentum. However, ultimately, in the foreseeable future, Ethereum's monetization process will still be tied to Bitcoin. Unless Ethereum can achieve a low correlation and low beta coefficient with Bitcoin over an extended period, a goal it has never achieved, Ethereum's premium space will always remain overshadowed by Bitcoin's halo.

You may also like

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

XRP “Millionaire” Wallets Rise Despite Modest Price Dip: Santiment

Key Takeaways: The count of XRP wallets holding over 1 million tokens is increasing, despite a slight dip…

Russia Caps Crypto Investments at $4,000 Annually for Non-Qualified Investors – Will Others Follow Suit?

Key Takeaways Russia’s proposal sets a $4,000 annual investment limit for non-qualified crypto investors, sparking discussions on regulatory…

Japan’s Metaplanet Announces $137 Million Capital Raise Via Third-Party Allotment

Key Takeaways Japanese firm Metaplanet Inc. has strategized a $137 million capital raising through the third-party allotment of…

Crypto Price Prediction for January 28 – XRP, Solana, Bitcoin

Key Takeaways Bitcoin price recently hit $90,000 but struggled to maintain this peak. XRP and Solana are following…

Sygnum Bank Secures Over 750 BTC for Bitcoin Yield Fund’s Growth

Key Takeaways: Sygnum Bank has raised over 750 BTC in the initial phase of the Starboard Sygnum BTC…

Asia Market Open: Bitcoin Holds Steady Near $88K Amidst Asia’s Tech Slowdown and Gold Surge

Key Takeaways Bitcoin remains stable at nearly $88,000 as Asian tech markets show signs of cooling. Global markets…

Dogecoin Price Prediction: DOGE Founder Reveals True Cause of Crypto Market Downturn

Key Takeaways: The recent downturn in the cryptocurrency market, including Dogecoin, is attributed to shifting investor behavior rather…

We Hacked China’s Alibaba AI to Predict the Price of XRP, Solana and Dogecoin By the End of 2026

Key Takeaways Alibaba’s AI model, KIMI, forecasts significant price increases for XRP, Solana, and Dogecoin by the end…

US Senators Criticize DOJ Over Crypto Crime Unit Closure Amid Financial Conflict Concerns

Key Takeaways: Six US senators have criticized Deputy Attorney General Todd Blanche for shutting down the DOJ’s crypto…

Why Is Crypto Down Today? – January 29, 2026

Key Takeaways The crypto market has fallen by 1.7% over the past 24 hours, with significant declines in…

Bitcoin Retreats as Hawkish Fed and Outflows Pressure Market: Analyst

Key Takeaways: Bitcoin’s value dipped below the $89,000 mark due to restrictive financial conditions and growing geopolitical stress.…

Strive Retires Majority of Debt and Expands Bitcoin Holdings Following Preferred Stock Offering

Key Takeaways: Strive successfully retired 92% of debt inherited from acquiring Semler Scientific, amid a significant preferred stock…

Ethereum Price Prediction: Wall Street Firm Begins to Buy and Lock ETH – Is This Brave or Insane?

Key Takeaways BitMine’s significant investment in Ethereum by securing 4.2 million ETH and staking 2.2 million ETH showcases…

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

XRP “Millionaire” Wallets Rise Despite Modest Price Dip: Santiment

Key Takeaways: The count of XRP wallets holding over 1 million tokens is increasing, despite a slight dip…