Hong Kong Virtual Asset Trading Platform New Regulations (Part 2): New Circular Issued, Has the Boundary of Virtual Asset Business Been Redefined?

Original Title: "Web3 Lawyer In-Depth Policy Analysis | Hong Kong Virtual Asset Trading Platform New Regulations (Part 2): New Guideline Released, Has the Boundary of Virtual Asset Business Been Redefined?"

Original Source: Crypto Law Sandbox

Introduction

At the end of the year, riding on the wave of HashKey's listing, the Hong Kong Treasury Department and Securities and Futures Commission jointly announced that, in addition to following the original regulatory framework, they will proceed as planned to regulate "virtual asset trading" and "virtual asset custody" services under the Anti-Money Laundering Ordinance (AMLO). In addition, they are also preparing to introduce new licenses for two types of services: one for "providing advice on virtual assets" and the other for "virtual asset management," and have already begun public consultations. If all goes well, the mainstream core services of virtual assets, including "trading," "custody," "investment advisory," and "asset management," will all be interconnected, all subject to separate licensed regulation.

At this point, do any readers find it strange that these services cannot currently be provided in Hong Kong? It feels like the train has been ready to depart for a long time, but when looking back, the tickets haven't even gone on sale yet?

As of now, in China's Hong Kong, only 11 specialized platforms holding a VATP license can operate virtual asset trading platforms, while separate services related to virtual assets, such as trading, investment advisory, and asset management, have achieved compliance through upgrades under traditional licenses (1, 4, 9), essentially creating a temporary structure on the basis of traditional licensed rules. The significance of the new regulations is to separate out these important individual services and assign them their own licenses. Crypto Law Sandbox believes that the signal being sent is quite clear: the regulation of virtual assets requires a separate path, and this path should also be built separately.

However, obtaining separate official licenses is estimated to have to wait until 2026. Looking back, this year for licensed virtual asset trading platforms, the Securities and Futures Commission issued two key circulars on November 3, 2025. Crypto Law Sandbox had previously analyzed one of them in the previous article: Interpretation of New Regulations for Hong Kong Virtual Asset Trading Platforms (Part 1): "Circular on Shared Liquidity of Virtual Asset Trading Platforms". Today, let's delve into the second part: "Circular on Expanding Products and Services of Virtual Asset Trading Platforms".

What Does the Circular Say?

Those on the industry frontlines can clearly feel that the real-world virtual asset business has already clearly surpassed the original VATP regulatory framework's vision. The initial licensing system was solely designed around "centralized virtual asset trading platforms," with a core focus on trade matching, client asset segregation, and basic market order maintenance. However, as stablecoins, tokenized securities, RWAs, and various investment products linked to digital assets continue to emerge, the roles platforms play in practice are no longer limited to being just a pure trading venue.

In this context, the real contradiction faced by regulation is no longer "whether these businesses should exist" because if they continue to operate outside a clear regulatory framework, it will only allow the market to evolve in a gray area. Instead of letting practitioners find ways to bypass the rules, it is better to directly outline what can be done, while also clearly assigning the respective responsibilities. We believe this is the starting point of this circular.

Specifically, the circular has brought several seemingly "relaxed" measures at the platform level, which actually reallocate various responsibilities.

First, there is the adjustment regarding the token listing rules. In the past, for a virtual asset to be listed on a VATP platform, it usually needed to meet a minimum of 12 months of trading history, which essentially adopted a time-based risk filtering standard. However, in practice, this approach is not always reasonable: a project's longer lifespan does not necessarily mean complete information or manageable risk; conversely, a newly launched project may not necessarily lack sufficient disclosure and careful evaluation.

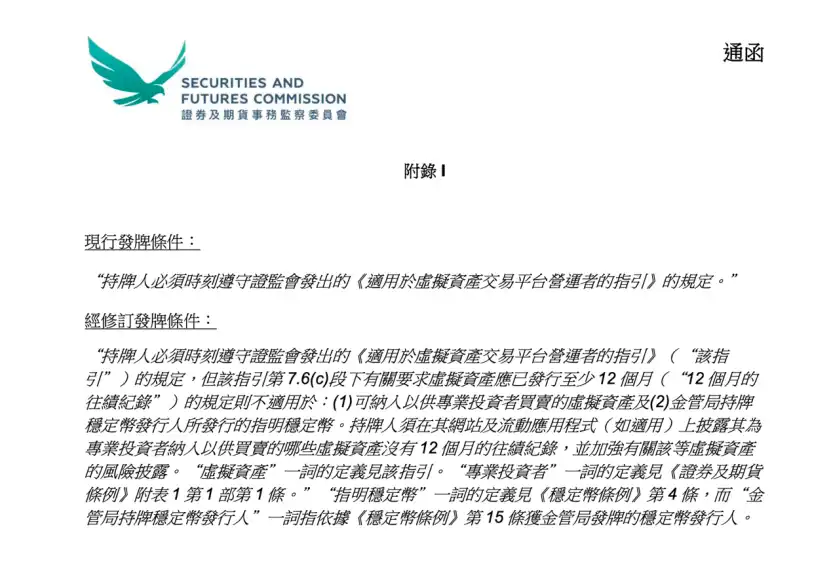

It is important to note that this circular did not completely eliminate the 12-month track record requirement but explicitly provided exemptions in two specific circumstances:

First, only virtual assets offered to professional investors, and second, specified stablecoins issued by license holders of the regulatory authority. In other words, the securities regulator did not deny the value of track records but acknowledged that the risk assessment approach should not be one-size-fits-all for different investor groups and asset types. Instead of using a formalistic time threshold to "shield the platform from risk," it is better to require the platform to undertake a more substantial judgment responsibility.

Correspondingly, the circular also reinforced disclosure requirements. For virtual assets that do not have a 12-month track record but are only offered to professional investors, licensed platforms must clearly indicate the relevant information on their website or application and provide sufficient risk warnings.

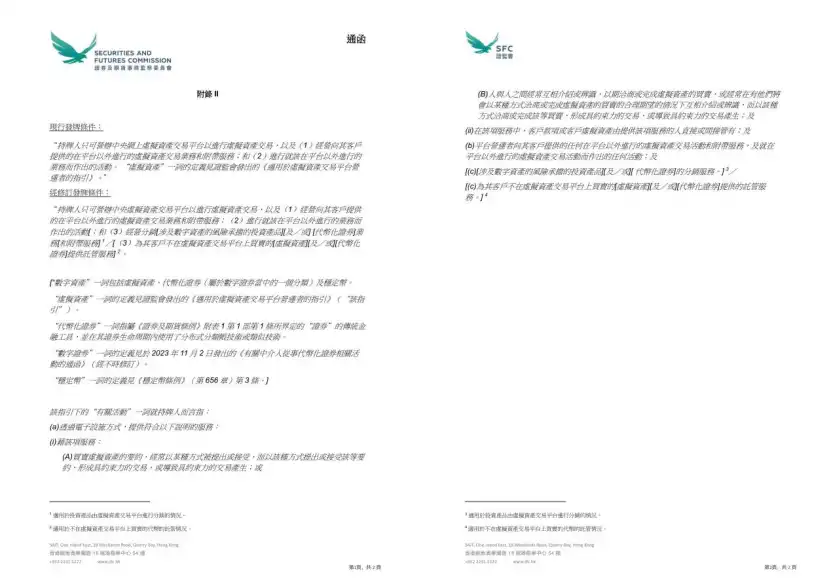

The second significant change is that the regulator has explicitly stated, for the first time at the licensing condition level, that VATP platforms can distribute tokenized securities and investment products related to digital assets while complying with the existing regulatory framework.

Now, VATPs have already taken on a role similar to "product gatekeeping" in practice. Once they assume a new distribution role, the platform faces not only counterparty risk but typical financial product distribution responsibilities, including product understanding, suitability assessment, and disclosure obligations. This is not a regulatory concession but a responsibility shift brought about by a role change.

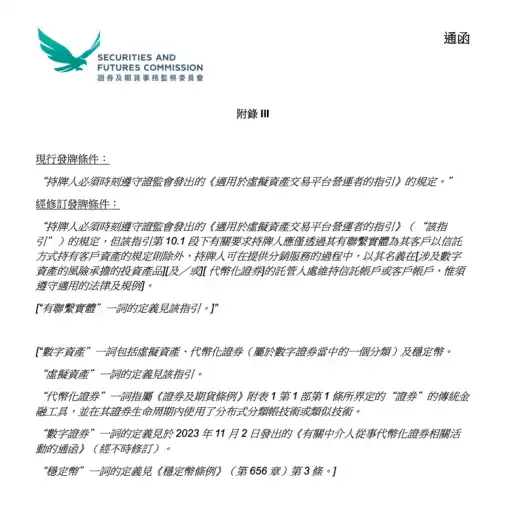

The third adjustment focuses on custody rules. The circular allows licensed platforms to provide custody services for virtual assets or tokenized securities that are not traded on the platform through their affiliated entities.

What changes will this bring about? In current practice, many projects' assets may not necessarily need to be traded on the platform, but clients still want the assets to be held or managed by a regulated institution. Therefore, the design of such requirements is not smooth, often requiring multi-layer arrangements to barely achieve. After the circular takes effect, essentially, it supplements a clearer compliance path for these existing business needs.

If the circular outlines the overall policy direction, then the three appendices more reflect the regulator's considerations on the operational level of "how to implement."

Appendix I, which revises the token inclusion rules, seemingly lowers the threshold for the launch of some products, but in essence, it does not weaken the platform's due diligence obligations. The threshold has not disappeared; it's just that the VATP needs to support its judgment with more robust due diligence and disclosure.

Appendices II and III further clarify the boundaries of the platform's business scope and the customer asset holding arrangements during distribution. By redefining the "relevant activities," the regulator formally includes in the VATP's scope of practice the distribution of investment products related to digital assets, tokenized securities, and custody services for off-platform trading assets. At the same time, in the distribution business, the platform is allowed to open and maintain trust accounts or client accounts in its own name at the relevant custodians to enable clients to hold these assets. These adjustments do not lower the requirements for protecting client assets but rather make the business structure truly "compliant" at the legal and regulatory levels.

After the circular, what changes should practitioners pay attention to?

With the issuance of the new circular, for VATPs, activities that were previously unified into the scope of "platform services," such as trading, custody, research, product introduction, and even some distribution activities, as long as they were overall included in the VATP license supervision, now must more clearly distinguish which behaviors belong to the core functions of the trading platform, which are already close to independent custody, distribution, or advisory activities, and correspondingly achieve compliance effects through different entity arrangements and business boundary divisions.

For other participants such as OTC, custodians, etc., spaces that previously operated relying on role ambiguity or functional conflation are rapidly narrowing, and now they must more clearly answer a question: Specifically, what type of virtual asset service are they engaged in? And under what regulatory framework should they assume corresponding responsibilities?

Conclusion

Overall, what this circular reflects is not a sudden shift in regulatory attitude, but a more pragmatic choice: The VATP platform is gradually evolving from a single trading venue to a compliant node that connects trading, products, and asset management, and regulators are accordingly shifting their focus from formal requirements to whether the platform is truly taking on its due responsibility.

This circular does not mean that businesses have been suddenly "unshackled" overnight, but the change in regulatory attitude is clear: Compliance is no longer just about "staying within the lines," but about taking responsibility for one's own judgment; for project parties and investors, it also means that regulatory expectations are gradually becoming clearer, rather than continuing to rely on a vague space for survival.

Going forward, how far the market can go no longer depends on whether regulation allows for leeway, but on whether participants are truly ready to operate under a more clear and serious rule system.

This article is contributed content and does not represent the views of BlockBeats.

You may also like

CLARITY Act Stalled: How Coinbase's Revolt Against U.S. Crypto Rules Could Freeze the Crypto Market (2026 Update)

Jan 2026: The CLARITY Act imploded when Coinbase opposed Senate's stablecoin yield ban. Explore the 3 'poison pills' that froze crypto regulation and moved markets.

Penguin Token Sells Off Amid Market Fluctuations

Key Takeaways A significant PENGUIN token holder has started liquidating their holdings, resulting in $40,000 worth of tokens…

OWL Tokens Transferred in Potential Sell-off Alert

Key Takeaways $2.1 million in OWL tokens were moved from a team’s wallet, raising concerns about a possible…

Global Risks Influence Bitcoin Fluctuations: QCP Asia’s Insight

Key Takeaways Persistent macroeconomic uncertainties cause global markets to retreat into risk-off mode. Japanese bond yields surge to…

Whale Leverages a 2x Long Position on 3,436 ETH

Key Takeaways A crypto whale utilized 2x leverage to go long on 3,436 ETH with an average entry…

Avantis Token Experiences Surge as It Faces Key Resistance

Key Takeaways Avantis token (AVNT) recorded a single-day surge exceeding 27%, outperforming other tokens in its sector such…

Enso’s Recent Liquidation Sparks Market Volatility

Key Takeaways Enso experienced a dramatic $11.67 million in liquidations, with a significant 70.7% involving short positions, indicating…

PENGUIN Token Skyrockets Fueled by White House Post

Key Takeaways The Nietzschean Penguin (PENGUIN) token has experienced a significant price surge following a social media post…

Crypto Traders Shift from PENGUIN to GHOST

Key Takeaways After significant gains, PENGUIN investors are reallocating their funds to newer cryptocurrencies such as GHOST. On-chain…

U.S. Government Shutdown Threat Impacts Bitcoin and Crypto Markets

Key Takeaways The risk of a U.S. government shutdown has surged, with predicted odds now approaching 80% as…

Crypto Users Face Threat from Massive 149 Million Credential Infostealer Data Breach

Key Takeaways: A massive data breach involving 149 million records was discovered, posing rising risks for crypto users.…

Crypto Takeaways from Davos: When Politics and Finances Collide

Key Takeaways Trump’s Geopolitical Crypto Push: U.S. President Trump emphasized the urgency of crypto regulation as a geopolitical…

South Korea’s Coinone Considers Stake Sale Amid Rising Coinbase Interest

Key Takeaways Coinone, a regulated cryptocurrency exchange in South Korea, is contemplating a significant stake sale as consolidation…

PENGUIN Memecoin Surges 564% Following Viral White House Social Media Post

Key Takeaways The Nietzschean Penguin (PENGUIN) memecoin skyrocketed by 564% after a White House social media post went…

Could Europe Sell US Debt if a Greenland Deal Doesn’t Come Through?

Key Takeaways The geopolitical tensions involving Greenland could lead Europe to consider offloading US debt as a strategic…

In the Battle of Chains, Distribution Reigns Supreme

Key Takeaways: The future of blockchain dominance is predicted to favor established companies with large user bases, as…

Crypto’s Next Battle: Privacy Faces a Chicken-Egg Dilemma with Regulators

Key Takeaways The integration of cryptocurrencies into bank systems is fueling a privacy versus transparency conflict. Privacy-preserving tech…

FCA Approaches Final Consultation Phase on Key Crypto Regulations

Key Takeaways The UK’s Financial Conduct Authority (FCA) is in the final stage of consultations concerning new crypto…

CLARITY Act Stalled: How Coinbase's Revolt Against U.S. Crypto Rules Could Freeze the Crypto Market (2026 Update)

Jan 2026: The CLARITY Act imploded when Coinbase opposed Senate's stablecoin yield ban. Explore the 3 'poison pills' that froze crypto regulation and moved markets.

Penguin Token Sells Off Amid Market Fluctuations

Key Takeaways A significant PENGUIN token holder has started liquidating their holdings, resulting in $40,000 worth of tokens…

OWL Tokens Transferred in Potential Sell-off Alert

Key Takeaways $2.1 million in OWL tokens were moved from a team’s wallet, raising concerns about a possible…

Global Risks Influence Bitcoin Fluctuations: QCP Asia’s Insight

Key Takeaways Persistent macroeconomic uncertainties cause global markets to retreat into risk-off mode. Japanese bond yields surge to…

Whale Leverages a 2x Long Position on 3,436 ETH

Key Takeaways A crypto whale utilized 2x leverage to go long on 3,436 ETH with an average entry…

Avantis Token Experiences Surge as It Faces Key Resistance

Key Takeaways Avantis token (AVNT) recorded a single-day surge exceeding 27%, outperforming other tokens in its sector such…