Larry is Farcaster's silver shovel?

Recently, innovations in asset issuance methods on Base have continued to emerge: "Can you really play Base Clanker?", many new products have emerged in the community, and Larry is one of the most distinctive ones.

At 12 noon on December 5, David Fulong (@df), senior developer of Farcaster and founder of Frame protocol, published a cast, announcing the birth of Larry.

Team background: Larry vs Clanker

Clanker was founded by @_proxystudio and @JackDishman, and Larry was founded by @davidvfurlong and @stephancill.

Farcaster veteran player @0xLuo popular science: Clanker's founding team is a new developer of Farcaster, Larry's founding team is Farcaster OG, @davidvfurlong's resume is particularly impressive: his company has received investment from A16Z (note that A16Z did not invest in Larry), and he himself is also the proposer of the Frame protocol - Frame is a major innovation of Farcaster, and it is also the key to the Farcaster team's ability to get $150 million "on the surface".

In contrast, Larry's team is more politically successful; but Farcaster's OG status is a negative buff for the publisher, after all, it is well known that Farcaster is a mosque...

From an operational perspective, Clanker does understand memes better. Its founder @proxystudio.eth often contributes various "god comments" to Farcaster, and Clanker's official account (@_proxystudio ) is also very funny:

On the other hand, Larry, maybe because it was just launched less than a week ago, the entire team's energy was completely focused on product development and mechanism design, and there was almost no support for ecological projects and operation of official brands and communities - this is an important reason why its leading token $LARRY (currently around 3M, up to 7M) lags far behind Clanker's leading token $CLANKER (currently around 50M, up to 150M) in market value.

Asset Issuance Mechanism: Larry vs Clanker

In a nutshell, Larry and Clanker are both AI Agents that issue tokens as soon as they post. Larry’s asset issuance method imitates Pumpfun’s internal and external pool mechanism, while Clanker’s asset issuance method is fair launch - the former’s shortcoming is that the threshold restricts retail investors from participating in the early stage, while the latter’s shortcoming is that it is difficult to overcome robot sniping.

Asset issuance mechanism: Clanker

Specifically, by tagging Clanker on Farcaster and stating the token name, ticker, and header image, Clanker can add a Uniswap pool with a starting market value of approximately $30,000 on Base for free (the threshold is that the Farcaster account Neynar score must be high enough, which means it is difficult for newcomers to issue tokens). All deployed tokens can be viewed on the official website.

Unlike PumpFun, which charges 1% transaction fee + 2 Sols on Raydium fee during the bonding curve, Clanker does not have a bonding curve, but charges 1% handling fee from Uni v3 as income: 40% to the issuer and 60% to the Clanker team - this split ratio may change, see official documentation for details.

Asset issuance mechanism: Larry

Like Clanker, Larry also issues tokens by posting with a threshold limit.

After receiving the message, Larry AI Agent will initiate an internal market on its official website Larry.club : The latest rule is that the upper limit of the internal market fundraising time is changed to 69 minutes, each person can put in a maximum of 0.25E, and all people can put in a total of 3E. After it is full, it will wait for a while before adding a pool to open on V3. (Previously it was 15 minutes and over-subscription was allowed)

The specific details are that a launch button will appear on the page, and then an internal user is required to confirm and pay the gas fee (Note: the dev sold displayed on GMGN is actually the user who clicked the launch button, not the real developer...)

A very criticized point in the whole mechanism is that the neynar score needs to be higher than 0.8 to fill the internal plate, and ordinary retail investors can't get in at all. They can only watch Farcaster OGs fill the internal plate and then take their chips on the external plate - in fact, they can understand the intentions of the mechanism designers: after all, this is an era where whoever has the bottom chips is the dealer, and the team hopes that the "dealers" will cherish their feathers and not smash them as soon as the market opens - but the reality is: many plates on Larry are drilled into the ground in 10 seconds, because people on the internal plate know how bad the experience of people on the external plate is. If the angle is not tricky enough, no one will come to take it, thus forming a stampede on the internal plate...

Currently The voice of FUD Larry tokens is dominant. Apart from the leading $LARRY, no other token can survive the second wave of drilling, let alone take off like $ANON $CLANKER $LUM on Clanker... (For the launch of various tokens on Larry in the past few days, see this tweet)

But it’s still early days, the mechanism design may change at any time, and the team is also constantly thinking about how to best couple the internal mechanism with the real-name PVP Socialfi game - let us continue to observe. (For a more detailed comparison between Clanker and Larry, see this tweet.)

Larry’s development history: from drilling into the ground to V-reversal

BUG storm: explosive pull and then drilling into the ground

Open the candlestick chart of $LARRY, you will find that it pulled up on the first day, and then continued to drill into the ground for the next two days.

(Note again: the dev sold shown on GMGN is actually the user who clicked the launch button, not the real developer)

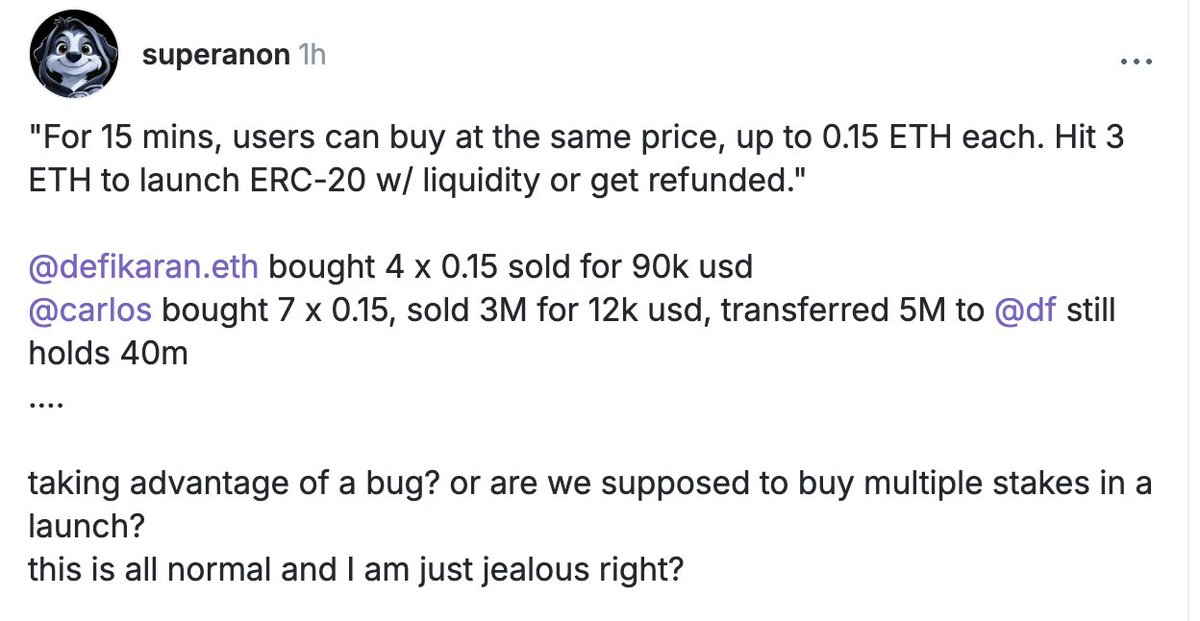

Why? The most important reason is that Larry's software crashed at the beginning. On the one hand, it could not issue coins. On the other hand, it was caught in a public opinion storm that the software had a bug and introduced internal insider trading: An anonymous person claimed that two participants used 0.6 ETH and 1.05 ETH at the bottom to sell when the market was rising, and each earned 90k and 12k...

The founder @davidvfurlong admitted the software bug and apologized, and then fixed the vulnerability. He also kept fixing bugs for the next two days, which was quite embarrassing: the coin price plummeted all the way, from a high of 7M to less than 1M...

Continuous construction: drilling is rising again

BUG After repairs and mechanism optimization, the K-line of Drilling has risen again, and is currently fluctuating between 2M and 4M.

Two days ago, the founder @davidvfurlong did another big thing: he released a Farcaster AI template as an open source for later developers to quickly deploy AI Agents on Farcaster, which led to a series of AI Agents interacting with Larry, including the dqau (the corresponding token is @freysa_ai "man-machine game" story that went viral on Twitter) reproduced on Farcaster.

Where is Larry's future?

The editor observed the community and found that the evaluation of Larry by community members can be summarized in eight words: "Sorry for his misfortune, angry at his lack of competition."

"Sorry for his misfortune" means that Larry's release did not cater to the right time: on the day of Larry's release, Clanker was making a fortune and was in the limelight; in addition, the liquidity of the Farcaster ecosystem was far from sufficient for people to chase the second dragon; and who would have thought that the products of the two super developers would have a lot of bugs as soon as they went online - the leading token $LARRY and its ecological tokens were continuously suppressed, and many "precious angles" were wasted...

"Angry at his lack of competition" means that Larry's team is too pure, does not know how to make things, and more importantly, does not know how to make markets - this is actually a common problem of all Farcaster tokens.

This wave of memes is a key step in the process of Farcaster's de-halalization. People will gradually flock in: from the lone P players to the real dealers, who can only pull up the lever to bring about a flood of money - I hope this day will come soon.

You may also like

CLARITY Act Stalled: How Coinbase's Revolt Against U.S. Crypto Rules Could Freeze the Crypto Market (2026 Update)

Jan 2026: The CLARITY Act imploded when Coinbase opposed Senate's stablecoin yield ban. Explore the 3 'poison pills' that froze crypto regulation and moved markets.

Bitcoin Surges Past Key Levels—Potential Liquidations Loom

Key Takeaways Bitcoin could trigger $1.71 billion in short liquidation on major CEXs if it surpasses $92,262. Conversely,…

Bitcoin Faces Rare Fourth Consecutive Monthly Decline

Key Takeaways Bitcoin is on the brink of its fourth consecutive monthly decline, a situation unseen since the…

Penguin Token Sells Off Amid Market Fluctuations

Key Takeaways A significant PENGUIN token holder has started liquidating their holdings, resulting in $40,000 worth of tokens…

Insider Whale Acquires Additional 22,000 ETH

Key Takeaways The “1011 Insider Whale” has added another 22,000 ETH to their holdings. The ETH purchase is…

OWL Tokens Transferred in Potential Sell-off Alert

Key Takeaways $2.1 million in OWL tokens were moved from a team’s wallet, raising concerns about a possible…

Ethereum Price Fluctuations Could Trigger Massive Liquidations

Key Takeaways If Ethereum’s price falls below $2,754, significant liquidation of long positions totaling $1.361 billion is anticipated…

Major Whale Amplifies Short Position on xyz:SILVER Contract

Key Takeaways A significant player, termed “Silver Iron Head Short Army,” has increased their short position on the…

Fed’s January Rate Decision and Bitcoin’s Outlook

Key Takeaways The Federal Reserve is anticipated to announce its first interest rate decision for 2026, with market…

Cardano Faces Downside Risks as Market Seeks Support at $0.27

Key Takeaways Cardano’s price has seen a significant decline, retreating to $0.34 following a three-week correction period since…

Cathie Wood Boosts Investment in Cryptocurrency Stocks

Key Takeaways Cathie Wood’s ARK Invest has significantly increased its investment in Coinbase, Circle, and Bullish to the…

USD Weakens as DXY Falls Below 97, Boosting Bitcoin Prospects

Key Takeaways The US Dollar Index (DXY) dropped below 97, reaching its lowest level since September of the…

Global Risks Influence Bitcoin Fluctuations: QCP Asia’s Insight

Key Takeaways Persistent macroeconomic uncertainties cause global markets to retreat into risk-off mode. Japanese bond yields surge to…

Dormant Ethereum Whale Transfers 50,000 ETH to Gemini, Market Reacts

Key Takeaways A significant dormant Ethereum whale transferred 50,000 ETH, valued at approximately $145 million, to the Gemini…

Digital Asset Fund Outflows Lead to Market Volatility

Key Takeaways Digital asset funds experienced net outflows of $1.73 billion last week, the largest since mid-November last…

Ethereum Whales Signal Possible Market Surge with Bold Moves

Key Takeaways Ethereum whales are actively participating in the market with divergent strategies, buying in bulk and selling…

XRP Price Shows Potential for Rebound as Market Conditions Shift

Key Takeaways XRP’s price is under pressure but shows signs of a potential rebound driven by technical indicators…

Whale Leverages a 2x Long Position on 3,436 ETH

Key Takeaways A crypto whale utilized 2x leverage to go long on 3,436 ETH with an average entry…

CLARITY Act Stalled: How Coinbase's Revolt Against U.S. Crypto Rules Could Freeze the Crypto Market (2026 Update)

Jan 2026: The CLARITY Act imploded when Coinbase opposed Senate's stablecoin yield ban. Explore the 3 'poison pills' that froze crypto regulation and moved markets.

Bitcoin Surges Past Key Levels—Potential Liquidations Loom

Key Takeaways Bitcoin could trigger $1.71 billion in short liquidation on major CEXs if it surpasses $92,262. Conversely,…

Bitcoin Faces Rare Fourth Consecutive Monthly Decline

Key Takeaways Bitcoin is on the brink of its fourth consecutive monthly decline, a situation unseen since the…

Penguin Token Sells Off Amid Market Fluctuations

Key Takeaways A significant PENGUIN token holder has started liquidating their holdings, resulting in $40,000 worth of tokens…

Insider Whale Acquires Additional 22,000 ETH

Key Takeaways The “1011 Insider Whale” has added another 22,000 ETH to their holdings. The ETH purchase is…

OWL Tokens Transferred in Potential Sell-off Alert

Key Takeaways $2.1 million in OWL tokens were moved from a team’s wallet, raising concerns about a possible…