Life charts can't cure anxiety, and predicting the market can't foresee the outcome

Source: TechFlow (Shenchao)

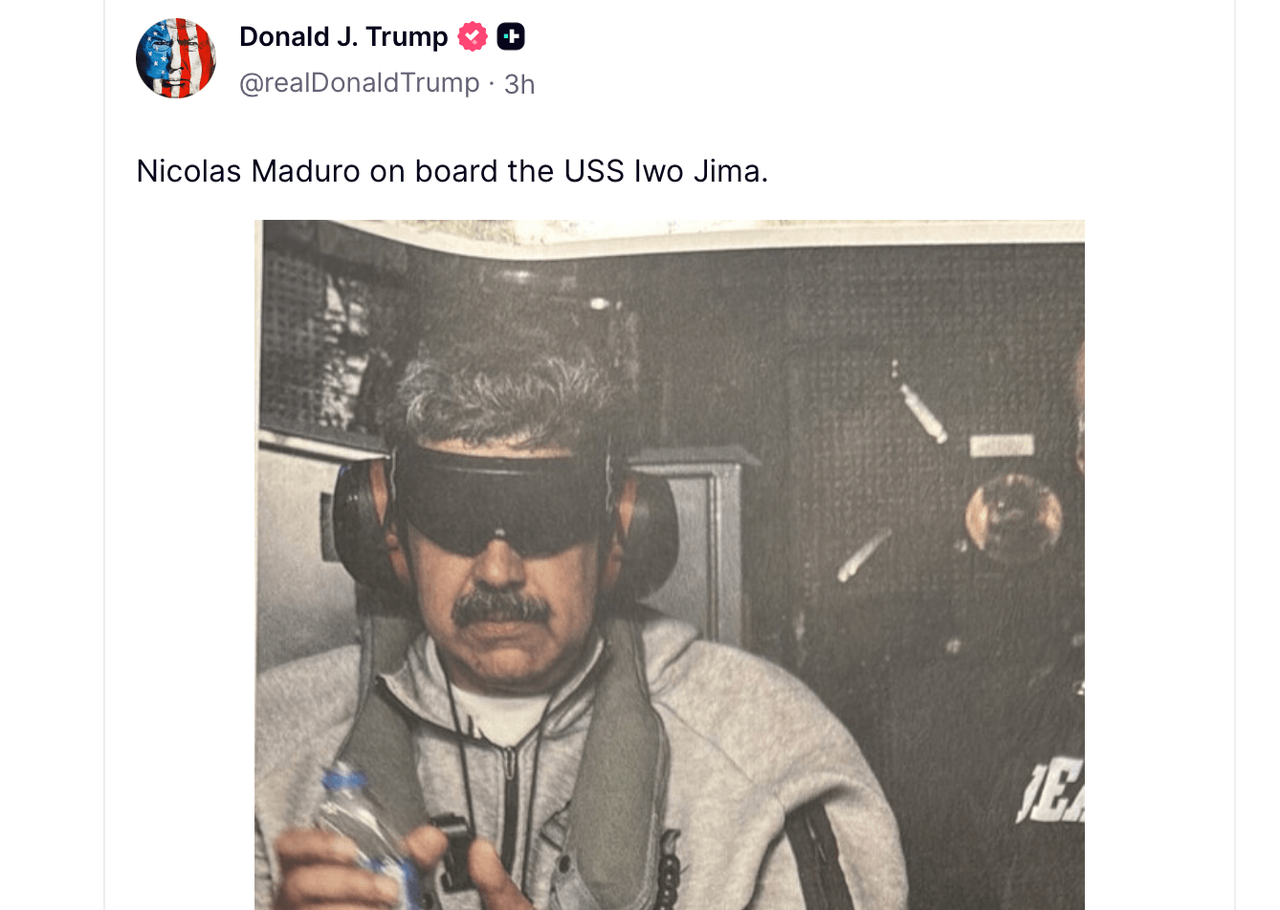

At the beginning of 2026, a sudden geopolitical event shocked the world: On January 3, the United States launched a military operation codenamed "Operation Absolute Resolve," successfully capturing President Nicolás Maduro and his wife Celia Flores, and quickly transporting them to New York to face criminal charges in Manhattan federal court, including drug terrorism conspiracy, cocaine import conspiracy, and weapons charges.

Despite the long-standing standoff between the US and Venezuela, the secrecy and explosiveness of this operation completely defied expectations. Just 24 hours before the raid, everything seemed normal in Caracas, with no public signs of a breakdown in diplomatic efforts. This event quickly made global headlines, not only for its political significance but also because it revealed a stark reality: true historical turning points often occur in the blink of an eye.

Just before the raid, contracts on Polymarket betting on Maduro's potential removal from power were trading at only about 5 to 7 cents, meaning the market generally considered him extremely safe in the short term. No one anticipated his arrest, which brought huge profits to traders who placed bets shortly before the operation was made public.

Despite the unpredictability of life, humanity's desire to predict the future has never been more urgent. At the end of 2025, two tools unexpectedly formed a kind of intertextuality: one is the "life chart," which visualizes the Chinese astrological system, and the other is a prediction market that presents odds on global events.

We attempt to use the former to calculate an individual's fate and the latter to predict the world's destiny. What they both promise is a quantifiable future.

Life charts, through symbolic visualization, provide a sense of certainty; prediction markets, through price signals, offer probabilistic certainty. It seems that by reading these signals early enough, we can prepare in advance, hedge against uncertainty, and seemingly gain a head start. But is this truly the case?

The viral popularity of life charts reflects a psychological need for certainty. Users input their birth information, AI automatically generates a chart, predicts major life cycles, and outputs a candlestick chart; the fluctuations of the graph provide a readable life curve. Under the dual pressures of employment and emotional fluctuations, it acts as a coordinate axis, providing a framework for self-narration and emotional catharsis. This candlestick chart doesn't sell science, but rather meaning and comfort—unquestionable emotional value.

Prediction markets, on the other hand, promise verifiable predictions through financialized language. In 2025, Polymarket and Kalshi dominated the prediction market sector, with sports, political, and economic events becoming predictable and betting targets, and trading volume extending from peak election periods to everyday life. Platforms allowed users to place bets with real money, and prices formed a probabilistic consensus amidst liquidity and divergence.

Amidst the triple anxieties of economic volatility, geopolitical tensions, and AI disruption, young people don't need accurate predictions, but rather the illusion that their destiny is in their hands. These two types of tools offer two heterogeneous forms of "control," seemingly allowing them to hedge against macroeconomic risks and gain an edge in an uncertain world by simulating life and event trajectories in advance.

However, such preparation inevitably has limitations and even carries significant risks. Cultural biases introduced by model training, algorithmic black boxes, and "black swan" events like Maduro's arrest all demonstrate the questionable accuracy of future predictions.

But such preparation inevitably has limitations and carries significant risks. Cultural and algorithmic biases introduced by model training, and the risks of black swan events, all indicate that the true accuracy of future predictions is questionable. The risks of over-focusing on predictions cannot be ignored. While life charts may be presented as entertainment, they can influence crucial individual choices. Cases of market manipulation are frequent, with insider trading and large-scale price manipulation being proven realities.

But this isn't the most dangerous aspect. A deeper crisis lies in the fact that the act of observation itself can interfere with the system, a concept already metaphorically described by Heisenberg's uncertainty principle. The more users blindly trust the probabilities output by tools, the more likely they are to lose their keen intuition for sudden risks. We stare at dashboards for so long that we forget to look up and see where we're going.

Predictive tools can identify trends, but they can never foresee true turning points. They are rearview mirrors, reflecting current anxieties and consensus, but unable to become searchlights illuminating the fog.

Ultimately, uncertainty is the underlying code of the world. After the frequent black swan events of 2025, the best preparation is not staring at candlestick charts or odds on a screen, but acknowledging the limitations of algorithms.

After all, real life often unfolds beyond the candlestick charts. Going with the tide and building individual resilience amidst immense uncertainty may be the only true path we can truly grasp.

You may also like

OWL Tokens Transferred in Potential Sell-off Alert

Key Takeaways $2.1 million in OWL tokens were moved from a team’s wallet, raising concerns about a possible…

Global Risks Influence Bitcoin Fluctuations: QCP Asia’s Insight

Key Takeaways Persistent macroeconomic uncertainties cause global markets to retreat into risk-off mode. Japanese bond yields surge to…

Avantis Token Experiences Surge as It Faces Key Resistance

Key Takeaways Avantis token (AVNT) recorded a single-day surge exceeding 27%, outperforming other tokens in its sector such…

PENGUIN Token Skyrockets Fueled by White House Post

Key Takeaways The Nietzschean Penguin (PENGUIN) token has experienced a significant price surge following a social media post…

South Korea’s Coinone Considers Stake Sale Amid Rising Coinbase Interest

Key Takeaways Coinone, a regulated cryptocurrency exchange in South Korea, is contemplating a significant stake sale as consolidation…

PENGUIN Memecoin Surges 564% Following Viral White House Social Media Post

Key Takeaways The Nietzschean Penguin (PENGUIN) memecoin skyrocketed by 564% after a White House social media post went…

Could Europe Sell US Debt if a Greenland Deal Doesn’t Come Through?

Key Takeaways The geopolitical tensions involving Greenland could lead Europe to consider offloading US debt as a strategic…

Matcha Meta Breach Associated with SwapNet Exploit Alleviates Up to $16.8M

Key Takeaways Matcha Meta DEX aggregator suffered a significant exploit through its liquidity provider, SwapNet, with losses estimated…

A16z-Supported Crypto Venture Entropy Winds Down, Returns Investor Funds

Key Takeaways Entropy, a startup supported by Andreessen Horowitz and Coinbase Ventures, is closing due to scalability challenges…

Japan Considers a New Framework Allowing Crypto ETFs by 2028

Key Takeaways Japan’s regulators are contemplating changes to allow cryptocurrency exchange-traded funds (ETFs) by 2028, marking a significant…

![[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of $100,000 in Rewards](https://images-cms.weex.com/medium_Win_a_Share_of_100_000_in_Rewards_75e69c3539.PNG)

[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of $100,000 in Rewards

Discover how WEEX VIP traders participate in the VIP Spot Sprint and compete for a share of the $100,000 rewards pool. Clear rules, performance-based rankings.

Trade Finance: Unleashing Blockchain’s Most Potent Opportunity

Key Takeaways Blockchain technology has the potential to revolutionize the $9.7-trillion global trade finance market by addressing its…

Massachusetts Judge Prohibits Kalshi from Offering Sports Bets

Key Takeaways A judge in Massachusetts has prohibited the prediction markets platform, Kalshi, from facilitating sports betting within…

VF-26 Unveiled: Zoomex and TGR Haas F1 Team Enter New Phase of Collaboration in 2026

Key Takeaways The unveiling of the VF-26 race car marks a new phase in the TGR Haas F1…

AI News Today: Can AI Make Blockchain Systems More Reliable in Live Crypto Markets?

Learn how AI is used in blockchain systems to detect risks, improve reliability, and support secure crypto trading in live crypto market environments.

Analyzing the Impact of Cryptocurrency Regulations

Key Takeaways: Cryptocurrency regulations continue to evolve, impacting both global markets and individual investors. Rules and guidelines vary…

What Is AI Trading in Crypto Markets and Why WEEX Alpha Awakens Matters in 2026

Learn what AI trading is and how WEEX Alpha Awakens tests AI trading strategies in live crypto markets, helping traders evaluate real AI trading platforms in 2026.

AI Wars Forked Entry Enters Key Phase as 8–10 AI Strategies Per Group Compete for a Single Final Spot

WEEX AI Wars is an AI trading competition and hackathon focused on real-market execution. Learn how AI trading strategies, algorithmic trading, and the prize pool work.

OWL Tokens Transferred in Potential Sell-off Alert

Key Takeaways $2.1 million in OWL tokens were moved from a team’s wallet, raising concerns about a possible…

Global Risks Influence Bitcoin Fluctuations: QCP Asia’s Insight

Key Takeaways Persistent macroeconomic uncertainties cause global markets to retreat into risk-off mode. Japanese bond yields surge to…

Avantis Token Experiences Surge as It Faces Key Resistance

Key Takeaways Avantis token (AVNT) recorded a single-day surge exceeding 27%, outperforming other tokens in its sector such…

PENGUIN Token Skyrockets Fueled by White House Post

Key Takeaways The Nietzschean Penguin (PENGUIN) token has experienced a significant price surge following a social media post…

South Korea’s Coinone Considers Stake Sale Amid Rising Coinbase Interest

Key Takeaways Coinone, a regulated cryptocurrency exchange in South Korea, is contemplating a significant stake sale as consolidation…

PENGUIN Memecoin Surges 564% Following Viral White House Social Media Post

Key Takeaways The Nietzschean Penguin (PENGUIN) memecoin skyrocketed by 564% after a White House social media post went…