Predicting a Market Crash in Advance? Warren Buffett's Credibility Is Still on the Rise

Original Article Title: "Predicting a Market Crash in Advance? The Shine of Stock God Buffett Continues to Rise"

Original Article Author: Mary Liu, BitpushNews

“Be fearful when others are greedy and greedy when others are fearful.” This simple yet profound wisdom comes from the mouth of Warren Buffett, a 94-year-old billionaire investor.

This figure, known as the "Oracle of Omaha" market forecaster, once again demonstrated the value of this adage with his precise judgment—he seems to have foreseen long ago that Donald Trump's policies could bring a storm to Wall Street.

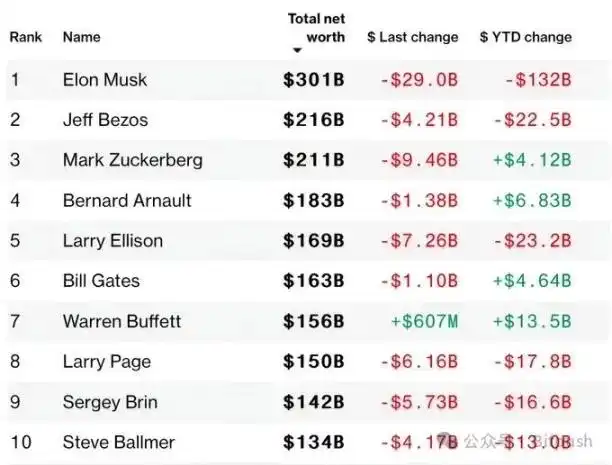

Yesterday, Wall Street experienced a "Black Monday," with a significant market downturn, confirming Buffett's "prediction." Investor concerns about an economic recession intensified, triggering panic selling in the market. The S&P 500 index plummeted more than 9% from its historical high on February 19, nearing a "correction" (defined as a drop of 10% or more from the previous high), with only Buffett's net worth rising against the trend among the Top 10 richest people.

For Buffett, the market's plunge undoubtedly once again proved the foresight and correctness of his investment strategy.

Positioning Ahead of the "Trump Recession"

Berkshire Hathaway, under Buffett's leadership, has been steadily reducing its stock holdings in recent years, amounting to billions of dollars, and instead accumulating massive amounts of cash.

Data shows that Buffett has been selling more stocks than buying for nine consecutive quarters, including significantly reducing stakes in several well-known companies. As early as last year, even before the Trump administration took office, Buffett began selling off most of his Apple stock and reduced investments in Bank of America and Citigroup.

Over the past few months, Berkshire Hathaway's cash reserves have soared to an astonishing $334 billion, accounting for more than one-third of its entire investment portfolio. Surprisingly, this cash reserve size exceeds the total market value of all companies listed on the UK's FTSE 100 index.

Buffett is a typical long-term investor who prefers to sit on the sidelines, patiently waiting for the best opportunity, rather than blindly chasing market hotspots and the latest trends.

Despite holding a huge amount of cash, Buffett explicitly denies the claim that he "prefers cash over stocks." In his February shareholder letter, he emphasized, "While some commentators continue to view Berkshire's enormous cash position as a mistake, you should be aware that your company's most important asset, by far, is its insurance operation, not its investment portfolio. We differ from some commentators in that view."

Panic Spreads as Buffett's Adage Once Again Rings True

Amidst market turbulence, it may be worthwhile to once again heed the advice of this investment legend.

In his 2017 letter to shareholders, he wrote, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." However, he quickly added that if a significant decline were to occur, remember the following lines from Rudyard Kipling's classic poem, written around 1895:

"If you can keep your head when all about you are losing theirs . . . If you can wait and not be tired by waiting . . . If you can think – and not make thoughts your aim . . . If you can trust yourself when all men doubt you . . . Yours is the Earth and everything that’s in it."

Why Does Keeping a Cool Head Pay Off?

It's worth noting that Buffett is referring to a major drop in the U.S. stock market, such as the bear market from 2007 to 2009, during which the S&P 500 index lost over 50% of its value. In comparison to that period, the current pullback experienced by investors is far from those tumultuous times.

In fact, market pullbacks are a normal part of the capital markets. Data from Bedell Frazier Investment Counselling shows that since 1980, the S&P 500 index has experienced 21 declines of 10% or more, with an average intra-year drop of 14%.

Indeed, during times of market turmoil, investors often find it challenging to predict the future accurately. Just as Buffett wrote in 2017:

"No one can tell you when these (plunges) will happen. The light can at any time go from green to red without any yellow light to cushion the transition."

Buffett firmly believes that periods of market distress present "extraordinary opportunities." Historical data has repeatedly shown that the market will eventually recover its upward trajectory. What value investors need to do is simply wait patiently and take full advantage of the market's downturn to "pick up" undervalued assets.

Data from Hartford Funds shows that since 1928, the average bear market in the U.S. has lasted less than 10 months — a bear market is defined as a decline of 20% or more from a recent high. For investors planning for investments spanning decades, the impact of a bear market is but a brief moment in the long river of investment.

Therefore, even in the midst of bear market panic and agony, always keep your eyes on the ultimate "prize" — your long-term financial goal that you are striving for. Continuing to invest during a market downturn is akin to actively buying during a stock discount sale. As long as you adhere to a diversified investment strategy, the deeper the stock prices fall, the better the "bargain" you will get.

Buffett's investment philosophy, echoed in a famous quote from his 2009 shareholder letter, emphasizes the importance of seizing investment opportunities when the market is depressed: "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble."

You may also like

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Untitled

I’m sorry, but without access to the original article content, I’m unable to proceed with generating a rewritten…

(Please provide the original article for rewriting.)

Key Takeaways: – WEEX Crypto News, 2026-01-30 13:45:26 The rest of the article will follow based on the…

Error Occurred While Extracting Content: Resolving Usage Limits in Data Plans

Unexpected errors related to data extraction often stem from reaching the usage limits of a given plan. Upgrading…

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

GameStop 2.0? Why Robinhood’s CEO Advocates Tokenization for Trading Halts

Key Takeaways Tokenized stocks are seen as a solution to counteract the disruptions seen in traditional equity markets…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Solana Loses Major Portion of Validators as Smaller Nodes Exit: Concerns Over Centralization

Key Takeaways: Solana has experienced a significant drop in active validators from a high of 2,560 in March…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…

What is the Next Milestone for Gold Prices and Will It Reach $6,000 by Year End?

Key Takeaways: Gold prices recently crossed the $5,000 per ounce mark, spurring predictions of further increases amidst global…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Gold to $10,000 and Silver to $150: My Wild, Or Perhaps Not-So-Wild 2026 Price Predictions

Key Takeaways Geopolitical uncertainties are significantly driving up the demand for gold and silver, suggesting the prices may…

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Untitled

I’m sorry, but without access to the original article content, I’m unable to proceed with generating a rewritten…

(Please provide the original article for rewriting.)

Key Takeaways: – WEEX Crypto News, 2026-01-30 13:45:26 The rest of the article will follow based on the…

Error Occurred While Extracting Content: Resolving Usage Limits in Data Plans

Unexpected errors related to data extraction often stem from reaching the usage limits of a given plan. Upgrading…

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…