SEC Announces "PoW Mining Does Not Constitute Securities Issuance" Action, Miners Welcome Regulatory Spring

Original Article Title: "SEC Announces 'PoW Mining Not Considered Securities,' Miners Do Not Need to Register, Welcoming a Major Regulatory Victory"

Original Article Author: Natalia Wu, BlockTempo

The U.S. Securities and Exchange Commission (SEC) announced regulatory guidance on Proof of Work (PoW) mining activities on the 20th, and for the first time concluded that "PoW mining activities do not constitute a securities offering," thus exempting them from federal securities law regulation, and mining participants do not need to register with the SEC.

This decision provides clear regulatory clarity for PoW miners and mining pools, alleviating their concerns about compliance with U.S. securities laws.

SEC Confirms PoW Mining Exempt from Securities Law Regulation

The SEC views PoW mining as an "administrative or transactional activity" rather than an investment contract. Miners validate transactions and secure the blockchain network by providing computational resources, earning newly minted cryptocurrency (referred to as "Covered Crypto Assets") as a reward. This process does not rely on third-party management or entrepreneurial efforts, which is a key criterion in the Howey test (used to determine whether an asset is a security).

The SEC considers "protocol mining" as the process of validating transactions and maintaining network security on a PoW blockchain. These networks are decentralized, permissionless systems, and miners add new blocks to the blockchain by solving complex cryptographic puzzles. Miners can participate without owning the network's native cryptocurrency, further distinguishing mining from securities issuance.

The SEC stated that its declaration covers only "protocol mining" activities involving:

• Miners mining cryptographic assets on a PoW network: The SEC emphasizes that these rewards come from the miners' own efforts, not third-party management, making them administrative tasks rather than securities transactions.

• The roles of mining pools and pool operators participating in the protocol mining process, including their roles in earning and distributing rewards. The SEC believes that miners' earnings in the pool are related to their computational contributions, not the pool operator's efforts, so these activities are also exempt from securities law regulation.

Cryptocurrency Mining Industry Regulatory Victory

This clarification is a significant victory for the PoW mining community. The SEC's confirmation that mining is not subject to securities regulation means that miners and pool operators can continue their operations without registering or complying with additional legal requirements. This decision may enhance confidence in the mining industry, especially in the context of ongoing regulatory scrutiny of mining due to energy consumption and environmental impact concerns.

It is worth noting that, after the Trump administration, the SEC has ushered in a crypto-friendly new leadership team and has been committed to providing a clearer regulatory stance. The SEC first defined the classification of digital assets at the end of February, categorizing Bitcoin as a digital commodity and determining that meme coins are not securities, with investors bearing the risk.

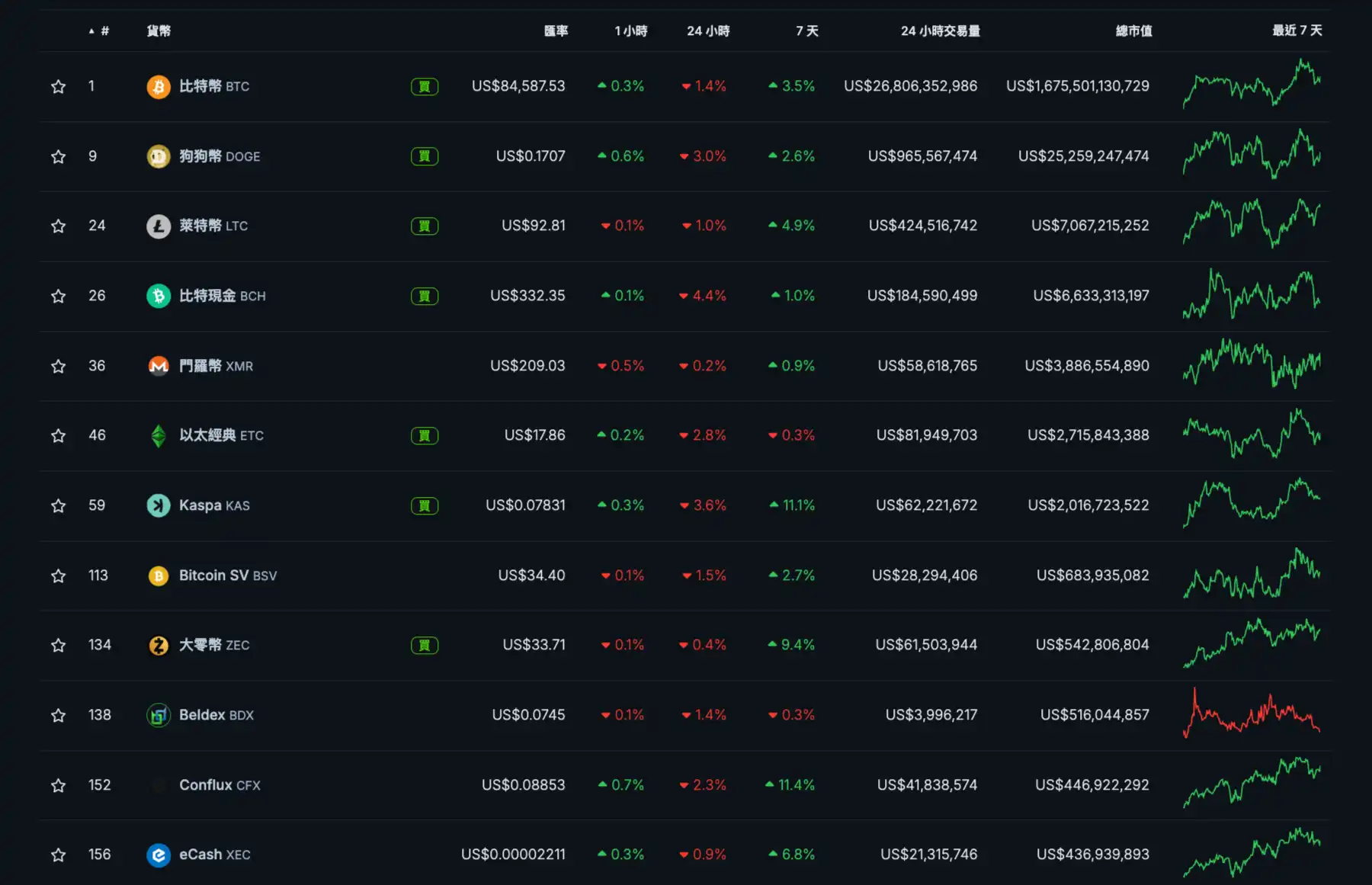

PoW Coins Experience Overall Decline in the Past 24 Hours

However, following the SEC's announcement, the prices of PoW tokens did not show a significant increase. In the past 24 hours, they followed the overall cryptocurrency market trend and experienced a general decline.

Due to the lack of highlights and substantial positive news in Trump's speech at the digital asset summit, as well as the escalating tariff war raising risk aversion sentiment, Bitcoin plummeted from $86,529 last night to a low of $83,642, a 3.3% drop, and has since slightly rebounded to $84,528, representing a 1.5% decline in the past 24 hours.

You may also like

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Untitled

I’m sorry, but without access to the original article content, I’m unable to proceed with generating a rewritten…

(Please provide the original article for rewriting.)

Key Takeaways: – WEEX Crypto News, 2026-01-30 13:45:26 The rest of the article will follow based on the…

Error Occurred While Extracting Content: Resolving Usage Limits in Data Plans

Unexpected errors related to data extraction often stem from reaching the usage limits of a given plan. Upgrading…

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

GameStop 2.0? Why Robinhood’s CEO Advocates Tokenization for Trading Halts

Key Takeaways Tokenized stocks are seen as a solution to counteract the disruptions seen in traditional equity markets…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Solana Loses Major Portion of Validators as Smaller Nodes Exit: Concerns Over Centralization

Key Takeaways: Solana has experienced a significant drop in active validators from a high of 2,560 in March…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…

What is the Next Milestone for Gold Prices and Will It Reach $6,000 by Year End?

Key Takeaways: Gold prices recently crossed the $5,000 per ounce mark, spurring predictions of further increases amidst global…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Gold to $10,000 and Silver to $150: My Wild, Or Perhaps Not-So-Wild 2026 Price Predictions

Key Takeaways Geopolitical uncertainties are significantly driving up the demand for gold and silver, suggesting the prices may…

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Untitled

I’m sorry, but without access to the original article content, I’m unable to proceed with generating a rewritten…

(Please provide the original article for rewriting.)

Key Takeaways: – WEEX Crypto News, 2026-01-30 13:45:26 The rest of the article will follow based on the…

Error Occurred While Extracting Content: Resolving Usage Limits in Data Plans

Unexpected errors related to data extraction often stem from reaching the usage limits of a given plan. Upgrading…

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…