The Trump Family's WLFI Project Launches Lending Platform, USD1 Utility Milestone?

Original Title: "DeFi Platforms Also 'Undergo Metamorphosis': Why Did Trump's WLFI Put on the National Bank Coat?"

Original Author: Sanqing, Foresight News

On January 12, a Trump family member project, World Liberty Financial (WLFI), launched the lending platform World Liberty Markets.

Previously, on January 7, WLFI announced that its subsidiary, WLTC Holdings LLC, had submitted an application to the Office of the Comptroller of the Currency (OCC) to establish World Liberty Trust Company, National Association (WLTC), a national trust bank designed for stablecoin operations.

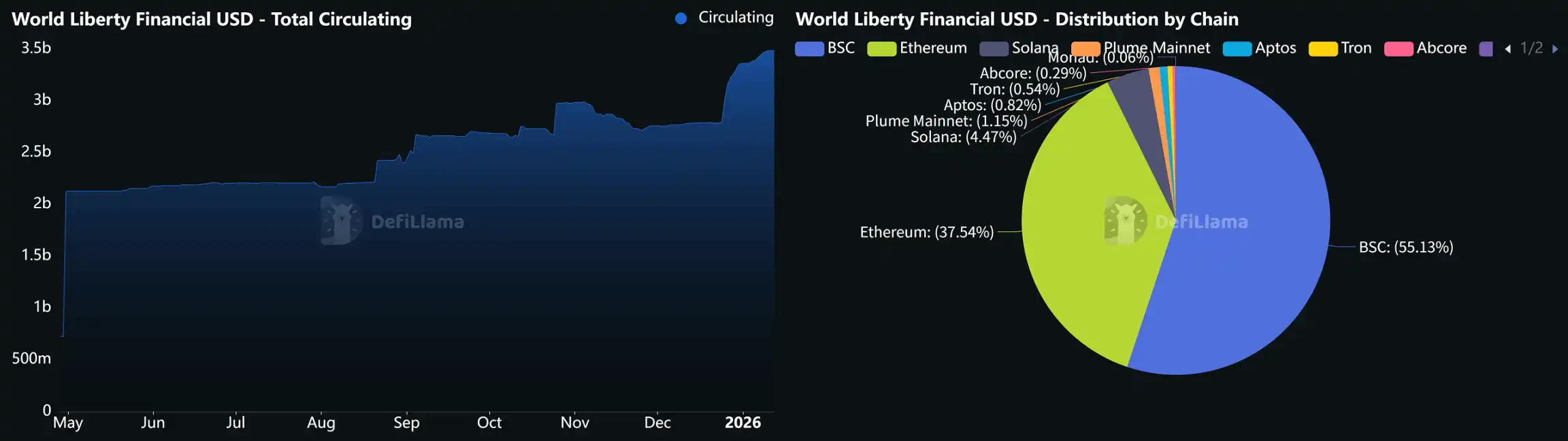

WLFI's USD-pegged stablecoin USD1 achieved a circulating supply of over $3.4 billion within a year (CoinMarketCap data), becoming one of the fastest-growing USD-pegged stablecoins.

Through the federal regulatory system and the liquidity lending market, WLFI is not only seeking applications for USD1 but also attempting to bridge the gap between TradFi and DeFi.

USD1 Total Market Value Curve and Chain Distribution | Source: DeFiLlama

DeFi Lending Platform World Liberty Markets: Practical Landing of USD1

Five days after submitting the licensing application, WLFI's launch of World Liberty Markets marked the entry of its DeFi business into the operational stage. The platform, built on the Dolomite protocol, initially debuted on Ethereum and showed an intention for multi-chain expansion.

World Liberty Markets is positioned as a lending market revolving around USD1. Users can not only deposit assets on the platform to earn interest but also use their held assets as collateral to borrow other tokens.

The lending asset system is centered around USD1 while also accommodating various collaterals such as ETH, USDC, USDT, WLFI, cbBTC, covering mainstream crypto assets and protocol-native tokens. This platform structure caters to both the demand for USD1 stability and provides the liquidity foundation for its presence in DeFi.

Supported Currencies on WLFI Markets | Image Source: WLFI Website

On the governance side, WLFI token holders have proposal and voting rights, allowing them to make decisions on key matters such as adding new collateral assets, adjusting interest rate parameters, or setting user incentives.

Immediately after the platform's launch, it triggered a market response. Dolomite, as the provider of the underlying protocol architecture, saw its native token DOLO rise by 71.9% on the same day.

Additionally, WLFI also launched early incentive activities to attract initial users by increasing the USD1 deposit yield. According to the WLFI Markets page, the USD1 lending incentive feature is provided by Merkle, with the annualized interest rate updating in real time.

While the regulatory application is still under review, the launch of World Liberty Markets has allowed WLFI to advance its business scenarios. Regardless of the final outcome of the license, USD1 has begun to transition from a concept issuance to on-chain lending use, truly entering the race to compete with the mainstream DeFi ecosystem.

National Trust Bank Charter Application: Stablecoin Business Moving Towards Regulatory Compliance

Through its intended subsidiary World Liberty Trust Company (WLTC), WLFI aims to obtain a national trust bank charter issued by the OCC. If approved, this means that the operation of USD1 will transition from a third-party collaborative model to a federally regulated "full-stack" model.

The envisioned scope of WLTC's business includes directly handling the minting and burning of USD1 without relying on external intermediaries; providing direct exchange services between the US dollar and USD1; and offering regulated custody services for assets like USD1, gradually replacing third-party service providers like BitGo.

The significance of this charter goes far beyond business integration. Obtaining OCC approval means the project is entering a federally regulated system, with profound implications for user trust and institutional adoption.

Currently, Binance has been deeply involved in the creation of USD1 and has added trading pairs, while Coinbase has also listed the asset. This regulatory endorsement can further reduce user concerns, and by embracing federal regulation directly, WLFI can better comply with regulatory requirements such as the GENIUS Act.

The WLFI team also aims to block any potential conflicts of interest through the architecture design. To address potential political scrutiny, WLFI CEO Zach Witkoff stated that the trust company's architecture is designed to avoid conflicts, with neither Trump nor his family members serving as executives or exercising daily control.

Meanwhile, USD1 has been gradually gaining more institutional support, demonstrating its increasing penetration in the industry. Abu Dhabi investment firm MGX previously used USD1 to purchase $2 billion worth of Binance shares, a transaction that also served as a significant external endorsement.

Despite rapid progress, WLFI still faces multiple uncertainties. The OCC's discussion on conflicts of interest during the approval process will be a focal point. While Zach Witkoff emphasizes that the Trump family does not hold executive positions and has no voting rights, the approval of the application remains uncertain in the current highly politically charged environment.

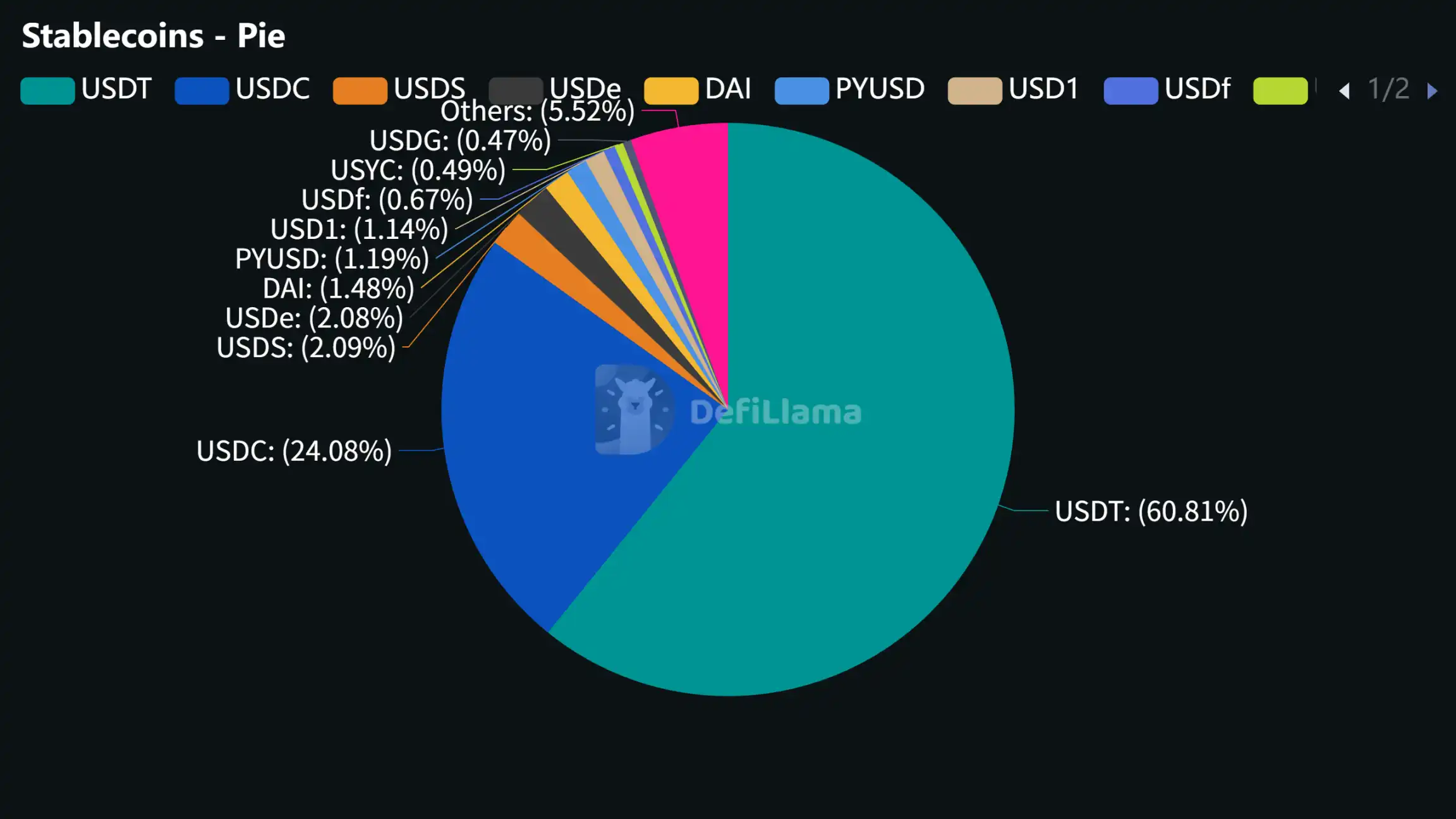

Additionally, although USD1 has grown rapidly, there remains a significant gap in liquidity depth and use cases compared to the two leading stablecoins, USDT and USDC. To further expand, WLFI needs to prove that its advantage lies not only in compliance narratives and endorsements but also in providing a technology experience, capital efficiency, and DeFi composability that are at least equivalent to, if not better than, mainstream products.

Stablecoin Market Cap Share | Source: DeFiLlama

Relationship Between Licensing and DeFi Lending: Indirect but Strategically Complementary

As the OCC gradually approves companies including Circle, Ripple, BitGo, Paxos, and Fidelity for similar licenses, a regulated cryptocurrency banking system is taking shape.

There is no direct regulatory linkage between the national trust bank license and DeFi lending, but there is a significant indirect boost.

Enhancing USD1's credibility and liquidity in DeFi. The federal regulatory identity endorses USD1, attracting more funds into liquidity pools, thus enhancing the depth and stability of the lending market.

Bridging TradFi and DeFi. The license's fiat onramp reduces user barriers, facilitating traditional users' participation in DeFi lending.

Building a truly closed-loop business ecosystem. In the future, WLFI plans to launch a mobile app, USD1 debit card, and RWA integration (such as tokenized real estate as collateral), all of which will benefit from regulatory clarity and credit endorsement.

You may also like

Solana Price Prediction: Institutions Just Chose SOL Over BTC, ETH, and XRP – Is This the Beginning of a Massive Flippening?

Key Takeaways Institutional investors are increasingly favoring Solana over traditional giants like Bitcoin (BTC), Ethereum (ETH), and XRP.…

XRP Price Prediction: XRP Ledger Blasts Past $2 Billion in Tokenized Assets – Why This Could Catapult XRP Parabolic

Key Takeaways XRP Ledger’s (XRPL) tokenized assets have surged past $2 billion, cementing its position in both traditional…

Ethereum Price Prediction: Ethereum Developers Prepare for Quantum Computers – Major Update on the Horizon?

Key Takeaways The Ethereum Foundation has initiated a post-quantum security team to counteract threats posed by future quantum…

6 Leading Decentralized Prediction Markets Without KYC in 2026

Key Takeaways Decentralized prediction markets enable users to speculate on various real-world events without intermediaries, offering freedom from…

8 Most Expensive Cryptocurrencies by Price in 2026

Key Takeaways Bitcoin remains the most expensive cryptocurrency as of January 2026, valued at $88,877.30 per coin, highlighting…

MoonPay Review 2026

Key Takeaways MoonPay offers a user-friendly platform that allows individuals to purchase and sell over 140 digital assets…

Layer-1 Protocol Saga Temporarily Halts SagaEVM Chain After $7M Exploit

Key Takeaways Saga’s Network Paused: Layer-1 network Saga has temporarily halted its SagaEVM chain due to a $7…

Dogecoin (DOGE) Price Outlook 2026, 2027 – 2030

Key Takeaways Dogecoin has entrenched itself as a prominent player in meme culture and the cryptocurrency market, aided…

Top Bitcoin & Crypto Gambling Sites of January 2026 Ranked

Key Takeaways: Discover the best-rated Bitcoin and crypto gambling sites of 2026, offering anonymity, quick transactions, and diverse…

CLARITY Act Stalled: How Coinbase's Revolt Against U.S. Crypto Rules Could Freeze the Crypto Market (2026 Update)

Jan 2026: The CLARITY Act imploded when Coinbase opposed Senate's stablecoin yield ban. Explore the 3 'poison pills' that froze crypto regulation and moved markets.

Penguin Token Sells Off Amid Market Fluctuations

Key Takeaways A significant PENGUIN token holder has started liquidating their holdings, resulting in $40,000 worth of tokens…

Insider Whale Acquires Additional 22,000 ETH

Key Takeaways The “1011 Insider Whale” has added another 22,000 ETH to their holdings. The ETH purchase is…

Ethereum Price Fluctuations Could Trigger Massive Liquidations

Key Takeaways If Ethereum’s price falls below $2,754, significant liquidation of long positions totaling $1.361 billion is anticipated…

Cathie Wood Boosts Investment in Cryptocurrency Stocks

Key Takeaways Cathie Wood’s ARK Invest has significantly increased its investment in Coinbase, Circle, and Bullish to the…

Dormant Ethereum Whale Transfers 50,000 ETH to Gemini, Market Reacts

Key Takeaways A significant dormant Ethereum whale transferred 50,000 ETH, valued at approximately $145 million, to the Gemini…

Digital Asset Fund Outflows Lead to Market Volatility

Key Takeaways Digital asset funds experienced net outflows of $1.73 billion last week, the largest since mid-November last…

Ethereum Whales Signal Possible Market Surge with Bold Moves

Key Takeaways Ethereum whales are actively participating in the market with divergent strategies, buying in bulk and selling…

Whale Leverages a 2x Long Position on 3,436 ETH

Key Takeaways A crypto whale utilized 2x leverage to go long on 3,436 ETH with an average entry…

Solana Price Prediction: Institutions Just Chose SOL Over BTC, ETH, and XRP – Is This the Beginning of a Massive Flippening?

Key Takeaways Institutional investors are increasingly favoring Solana over traditional giants like Bitcoin (BTC), Ethereum (ETH), and XRP.…

XRP Price Prediction: XRP Ledger Blasts Past $2 Billion in Tokenized Assets – Why This Could Catapult XRP Parabolic

Key Takeaways XRP Ledger’s (XRPL) tokenized assets have surged past $2 billion, cementing its position in both traditional…

Ethereum Price Prediction: Ethereum Developers Prepare for Quantum Computers – Major Update on the Horizon?

Key Takeaways The Ethereum Foundation has initiated a post-quantum security team to counteract threats posed by future quantum…

6 Leading Decentralized Prediction Markets Without KYC in 2026

Key Takeaways Decentralized prediction markets enable users to speculate on various real-world events without intermediaries, offering freedom from…

8 Most Expensive Cryptocurrencies by Price in 2026

Key Takeaways Bitcoin remains the most expensive cryptocurrency as of January 2026, valued at $88,877.30 per coin, highlighting…

MoonPay Review 2026

Key Takeaways MoonPay offers a user-friendly platform that allows individuals to purchase and sell over 140 digital assets…