Weekly Passive Income Guide: Smart Yield Plays for June 2025

The DeFi landscape continues to offer compelling yield opportunities for investors looking to put capital to work without constant portfolio babysitting. This week's guide highlights several protocols with strong risk-adjusted returns and upcoming catalyst events that deserve attention.

Top Yield Opportunities This Week

Huma 2.0 Reopens Deposits (June 10)

After hitting capacity limits in its first phase, Huma Finance will reopen deposits on June 10 at 10:00 UTC. HUMA stakers get priority access starting 24 hours earlier.

The setup:

Deposit allocation tied to HUMA staking (1 HUMA = $0.04 deposit limit)

Season 2 airdrop confirmed at 2.1% of supply (vs 5% for Season 1)

RateX LP strategy still viable for double-dipping

Why it matters:

Huma's first season participants did exceptionally well with the initial token distribution. The reopening provides a clean entry for those who missed the first wave, with a clear catalyst timeline for the Season 2 airdrop. The protocol has gained significant traction since its initial launch.

BounceBit's USD1 Incentives Launch (June 9)

BounceBit is pushing adoption of USD1 with an aggressive 15% APR incentive program launching today with a hard cap on total deposits.

The setup:

Deposits open June 9 at 19:00 Beijing time

$1M total capacity (expect quick filling)

15% APR for 30 days, no token lockups

Clean UI with straightforward deposit process

Why it matters:

This is essentially free yield with minimal strings attached. The limited deposit window and hard cap create scarcity, likely driving rapid uptake. Set an alarm - these allocation slots typically fill within minutes for incentive programs this generous.

Cove Protocol: $3M Raise with Clear Token Signals

Recently backed by Electric Capital and other prominent VCs, Cove's portfolio management protocol offers one of the clearest "deposit-to-token" pathways currently available.

The setup:

8.08% base APY on coveUSD deposits

Team explicitly confirmed token rewards for early depositors

1% management fee on deposits

Why it matters:

Electric Capital's involvement signals substantial upside potential given their track record. The management fee structure suggests targeting this for 3+ month horizons to fully capitalize on the inevitable token launch. This looks similar to early Sommelier, which delivered exceptional returns for early LPs.

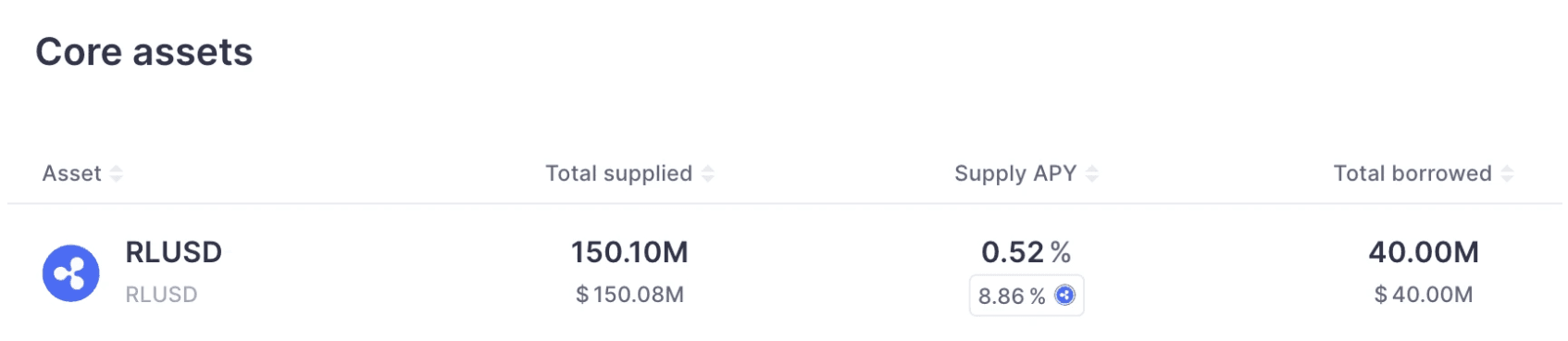

Ripple's RLUSD: Corporate Giant's DeFi Play

Ripple is making a serious push into DeFi with its RLUSD stablecoin, offering substantial incentives for Aave depositors.

The setup:

9.38% total APY on Aave (8.86% incentives + 0.52% base)

Rewards paid directly in RLUSD

Zero lockups or complicated strategies required

Why it matters:

This represents institutional capital subsidizing retail yields to gain market share. Ripple's regulatory clarity post-SEC settlement makes this one of the safer yield plays in the current environment. The strategy requires nothing beyond a standard Aave deposit with boosted returns.

InfiniFi: Electric Capital's Other High-Conviction Bet

Electric Capital is betting big on yield aggregation, with InfiniFi representing their second major play in this vertical this year.

The setup:

11.25% base APY, scaling to 22.64% with 8-week lockup

Points program active with clear token intent

Whitelist/referral code required for access

Why it matters:

The 8-week lockup tier represents one of the highest risk-adjusted yields available right now. The dual rewards structure (yield + points) resembles early Morpho, which delivered 10x on early deposits. The whitelist restriction creates artificial scarcity that typically precedes substantial token upside.

Other Noteworthy Developments

Avantis Secures $8M Series A from Thiel & Pantera

Base ecosystem DEX Avantis just closed an $8M Series A led by Founders Fund (Peter Thiel) and Pantera Capital, with Symbolic, SALT and Flowdesk participating.

The setup:

Low-risk LP vault yielding 5.73% APR (base rate)

Lockup tiers boost returns to 20.5%

Second season points campaign running

The angle:

The involvement of traditional venture heavyweights signals institutional confidence. Avantis isn't new, but the fresh capital injection and current point campaign make this an opportune entry timing for those who haven't participated yet. LP structuring mitigates typical impermanent loss concerns.

Sky Introduces Stablecoin Rewards for Stakers

Sky (formerly Maker) has implemented USDS rewards for SKY stakers, creating interesting neutral strategies.

The setup:

SKY staking currently yields 15.96% in USDS

Position can be hedged via MKR shorts

Enables delta-neutral yield farming

The angle:

For sophisticated players, this creates one of the cleanest delta-neutral setups available. The fixed SKY/MKR redemption ratio provides a natural hedge mechanism for those looking to isolate the staking yield without directional exposure.

Yield Strategy Comparison

| Protocol | Base APY | Max APY | Token Upside | Lock Period | Capital Efficiency |

|---|---|---|---|---|---|

| Huma 2.0 | ~5% | ~8% | High (Season 2) | None | Medium |

| BounceBit | 15% | 15% | Unknown | 30 days | High |

| Cove | 8.08% | 8.08% | High | None | Medium |

| RLUSD/Aave | 9.38% | 9.38% | Low | None | Very High |

| InfiniFi | 11.25% | 22.64% | High | Optional | Medium-High |

| Avantis LP | 5.73% | 20.5% | Medium | Tiered | Medium |

| Sky/MKR | 15.96% | 15.96% | None | None | Low (hedging) |

Execution Strategy for This Week

If capital deployment is the goal this week, here's the optimal sequencing:

Today (June 9): Set alarms for BounceBit USD1 deposits opening at 19:00 Beijing time

Tomorrow (June 10): Prepare for Huma reopening - HUMA stakers should access at 18:00 Beijing time (24h early)

After securing allocations: Distribute remaining capital across Ripple's RLUSD strategy (for safer allocation) and InfiniFi's 8-week tier (for higher returns)

For larger portfolios: Consider a Sky staking + MKR short position sized at 10-15% of total capital

The beauty of this approach is the minimal maintenance required after initial setup. Most of these positions require attention only at maturity or when specific catalyst events occur.

Final Thoughts

The current yield environment represents a sweet spot where institutional capital is subsidizing retail yields to gain market share and protocol adoption. These opportunities typically shrink as markets mature, so capitalizing on them while maintaining appropriate risk management makes sense for most portfolios.

Smart players will diversify across several of these opportunities rather than concentrating in any single protocol, regardless of how attractive the headline rates appear.

This guide represents personal research and opinion, not financial advice. Smart contract risk always exists in DeFi - size positions accordingly and never deploy capital you cannot afford to lose.

For reliable trading infrastructure to access these opportunities, WEEX provides institutional-grade exchange services with deep liquidity pools across major pairs.

You may also like

Stop Talking About Gold, Bitcoin Is Not a Safe Haven Asset

Aave Founder: What Is the Secret of the DeFi Lending Market?

The Trader's Playbook: 7 Market Cycle Lessons From LALIGA’s 90 Minutes

What do LALIGA matches teach about crypto markets? Learn how consolidation, breakouts, and late-cycle volatility shape disciplined trading decisions.

How Smart Money Tracker Survived Live AI Trading at WEEX AI Hackathon

Discover how WEEX AI Trading Hackathon tested strategies with real capital—no simulations. See how Smart Money Tracker survived flash crashes and leveraged 18x in live markets.

80% Win Rate to 40% Drawdown: An AI Trader's Brutal Recalibration at WEEX AI Wars

Dive into the technical blueprint of an AI trading system built on LLaMA reasoning and multi-agent execution. See how Quantum Quaser uses confidence thresholds & volatility filters at WEEX AI Wars, and learn the key to unlocking 95% win rate trades.

AI Trading Strategy Explained: How a Beginner Tiana Reached the WEEX AI Trading Hackathon Finals

Can AI trading really outperform human emotion? In this exclusive WEEX Hackathon finalist interview, discover how behavioral signal strategies, SOL trend setups, and disciplined AI execution secured a spot in the finals.

When AI Takes Over the 'Shopping Journey,' How Much Time Does PayPal Have Left?

Bloomberg: Aid Turkey Freeze $1 Billion Assets, Tether Remakes Compliance Boundary

Polymarket vs. Kalshi: The Full Meme War Timeline

Consensus Check: What Consensus Was Born at the 2026 First Conference?

Resigned in Less Than a Year of Taking Office, Why Did Yet Another Key Figure at the Ethereum Foundation Depart?

Russian-Ukrainian War Prediction Market Analysis Report

Ethereum Foundation Executive Director Resigns, Coinbase Rating Downgrade: What's the Overseas Crypto Community Talking About Today?

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

Stop Talking About Gold, Bitcoin Is Not a Safe Haven Asset

Aave Founder: What Is the Secret of the DeFi Lending Market?

The Trader's Playbook: 7 Market Cycle Lessons From LALIGA’s 90 Minutes

What do LALIGA matches teach about crypto markets? Learn how consolidation, breakouts, and late-cycle volatility shape disciplined trading decisions.

How Smart Money Tracker Survived Live AI Trading at WEEX AI Hackathon

Discover how WEEX AI Trading Hackathon tested strategies with real capital—no simulations. See how Smart Money Tracker survived flash crashes and leveraged 18x in live markets.

80% Win Rate to 40% Drawdown: An AI Trader's Brutal Recalibration at WEEX AI Wars

Dive into the technical blueprint of an AI trading system built on LLaMA reasoning and multi-agent execution. See how Quantum Quaser uses confidence thresholds & volatility filters at WEEX AI Wars, and learn the key to unlocking 95% win rate trades.

AI Trading Strategy Explained: How a Beginner Tiana Reached the WEEX AI Trading Hackathon Finals

Can AI trading really outperform human emotion? In this exclusive WEEX Hackathon finalist interview, discover how behavioral signal strategies, SOL trend setups, and disciplined AI execution secured a spot in the finals.