What's the story behind Pieverse, which hit the x402 wave just before the Pre-TGE?

Original Article Title: "What is the Origin of Pieverse, Riding the x402 Wave Right Before Pre-TGE?"

Original Article Author: Eric, Foresight News

The x402 wave added fuel to the AI payment narrative, but the fire did not spread to the BNB Chain immediately. The reason for this was that x402, being too early, only supported the ERC-3009 standard, while stablecoins on the BNB Chain, including USDC, do not support this standard.

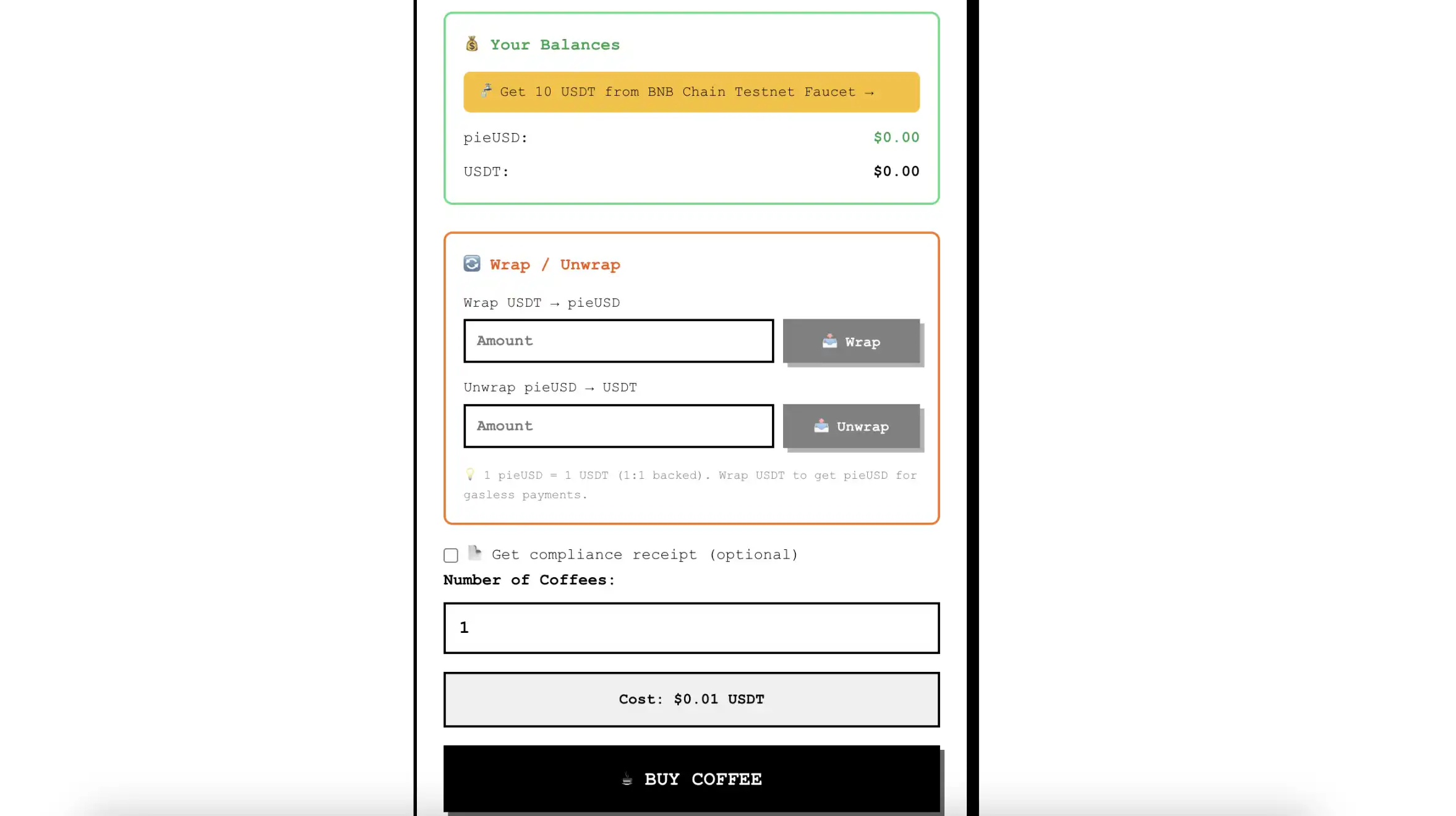

At this time, Pieverse, a payment protocol supported by Binance and the BNB Chain since being selected as an MVB, stepped forward. Not only did it solve the problem of BNB Chain not supporting x402 by launching the pieUSD wrapped token that supports the ERC-3009 standard, but it also upgraded x402, which originally only supported "payments," to x402b. In simple terms, Pieverse created verifiable receipts for payments, proving that the payment was a transaction between specific parties and not an AI's spontaneous action.

The Binance Wallet will launch Pieverse's Pre-TGE event on October 29th at 4 p.m. By serving the BNB Chain ecosystem, this quasi-new project that adds verifiable proof to on-chain payments is experiencing a small highlight in the era of AI payments.

A Protocol Associated with "Time"

Pieverse's development went through two stages. At its inception, it positioned itself as a "TimeFi" protocol. The core of the introduced Pieverse Timepot model is to allow people or resources that require time to match to find their corresponding targets more quickly through a series of platform mechanisms.

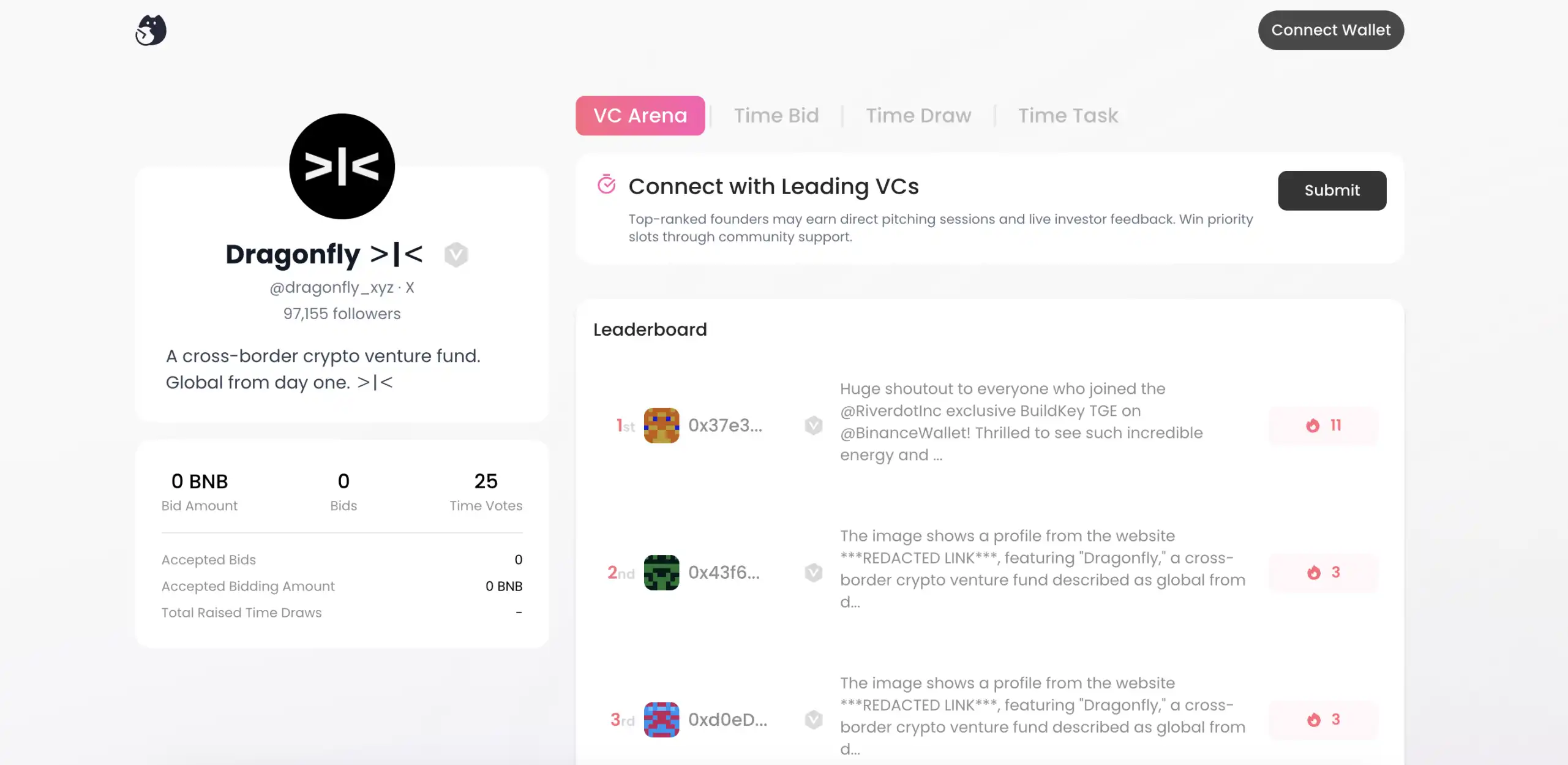

Pieverse's initial three products included Time Bid, Time Draw, and Time Task. Time Bid allows users to bid for professionals' time, and Pieverse will verify the "professional" level through platforms like LinkedIn. Successful bidders can directly communicate with professionals on the platform through Zoom, etc. Time Draw provides opportunities for private interaction with investors, traders, celebrities, etc., through a lottery system. Time Task provides a platform for anyone to post requirements and offer services.

Concept aside, this is just an intermediary platform, and forcibly linking it to time seems rather far-fetched. Currently, these three products, while still operational, appear to have lost any activity. The VC Arena launched by Pieverse later received some attention, as the platform applied the mechanism of the aforementioned products to match VCs with startup teams, catering to some practical needs.

Whether it was an acknowledgment of a design concept issue, Pieverse shifted its focus and released a more financially sophisticated and engaging product, Time Challenge.

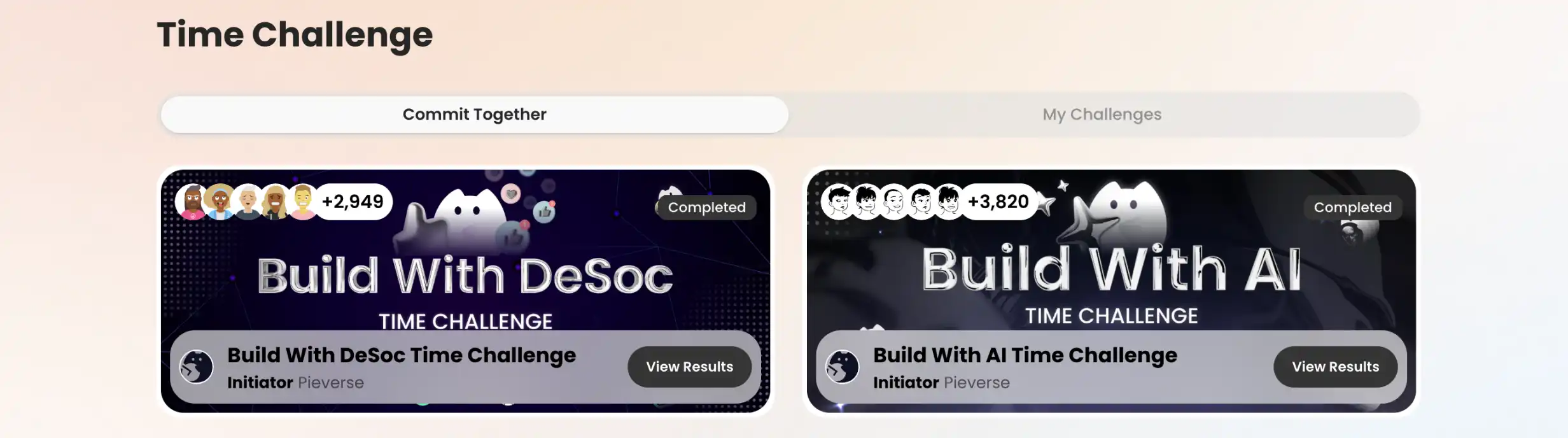

Time Challenge essentially transforms daily commitments into structured, time-limited challenges with real financial risks. Whether it's fitness goals, productivity targets, or personal milestones, users can create or join challenges, lock in risks, and receive rewards based on their evaluation of the outcomes.

The challenges are divided into two types: Prediction Challenges require participants to set their own goal and bet a certain amount; other users can also bet on whether the challenger can achieve the goal within the specified time. The ultimate winner receives the money bet by the challenger and the party that predicted incorrectly. Commit Together involves a group of people with the same goal betting the same amount on themselves to achieve the goal; the person who completes it takes the money from those who did not.

It's often said that when individual interests become collective interests, it motivates individuals. This game of inviting everyone to supervise oneself and collectively agreeing to achieve goals, when real money is put on the line, brings about an inexplicable sense of excitement, as evidenced by the number of participants. Although subsequent activities were all about Web3 projects setting challenges to see if they could accomplish certain tasks, it was indeed much more interesting than the previous scenario.

Transitioning into Payments Catches the Trend

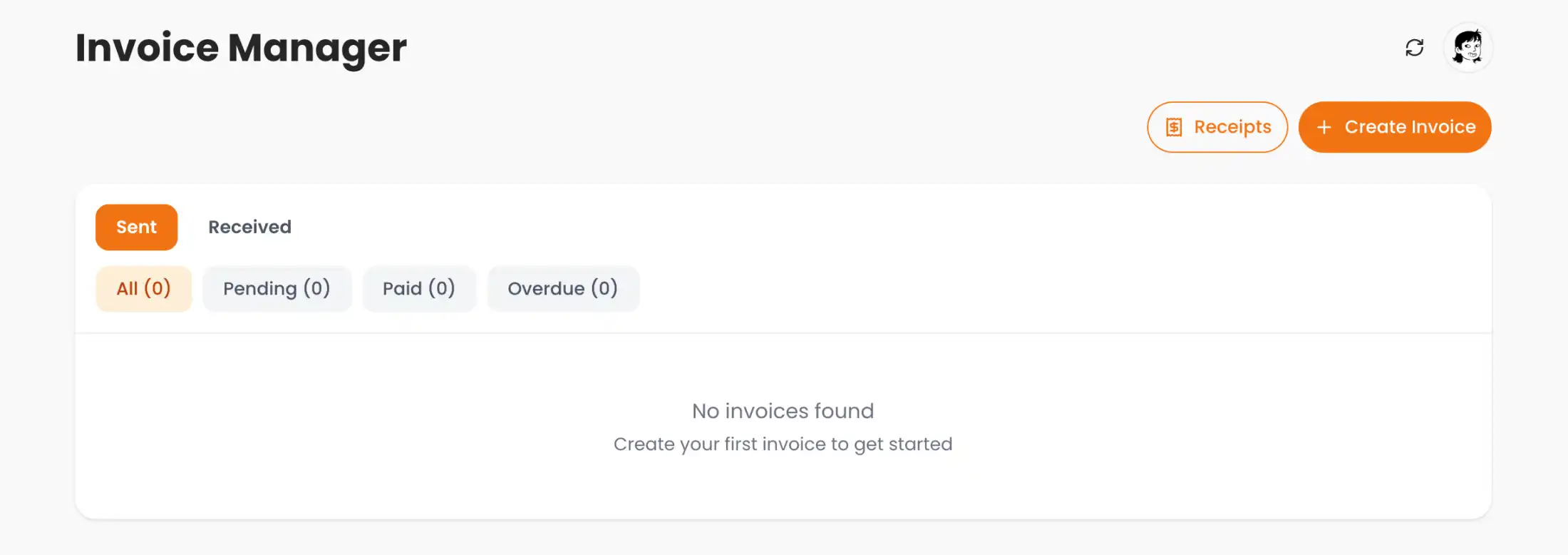

On the 9th of this month, Pieverse announced the launch of the payment tool Pieverse Timestamping. Setting it apart from most payment tools, Pieverse leveraged its previous experience related to "timeliness" to automate the process of creating invoices, stablecoin payments, generating receipts compliant with jurisdictional legal and tax requirements, and pairing each transaction with an on-chain timestamp to create an immutable, verifiable proof of payment.

At least for now, transitioning into payments seems to have been the right decision. Shortly after announcing the new product, x402 began dominating the front pages of major tech media outlets, and Pieverse conveniently utilized the freshly released Timestamping to add a verifiable component to x402 and launch it on the testnet, allowing the BNB Chain, which originally lacked token support for ERC-3009, to take a shortcut.

The transaction flow process using x402b is roughly as follows:

1. Client to Resource Server: Send an HTTP request with the X-PAYMENT header, containing the payment amount + optional compliance metadata.

2. Resource Server to Facilitator (Infrastructure service provider for "on-chain payment + validation + settlement"): Verify the signature and initiate settlement via /settle.

3. Facilitator to Blockchain: Use user-signed authorization to call transferWithAuthorization on the pieUSD contract (no need to pay Gas fees).

4. Facilitator to BNB Greenfield (optional): Generate a compliance receipt and upload it to Greenfield, ensuring the receipt is tamper-proof and auditable.

5. Facilitator back to Resource Server and then to Client: Return a standard x402 response, optionally including the Greenfield receipt URL.

In short, a single payment process includes user signature, service provider submission, BNB Greenfield proof preservation, propelling x402 on the BNB Chain forward by a significant step. It has also successfully attracted market attention before the token issuance.

Web3-Savvy Chinese Team

Currently, one of the publicly known co-founders of Pieverse is Colin Ho as mentioned in the funding press release, but further information is not available. However, three individuals on LinkedIn associated with Pieverse have demonstrated a strong Web3 Native background.

Chief Marketing Officer David Chung previously worked on user experience and copy content at the American Bitcoin peer-to-peer trading platform Paxful. An individual self-proclaimed as a "core contributor," H Fran, had prior investment experience at IDG Capital and later founded a startup that was acquired by Alibaba. Another co-founder, Junjia He (most likely the tech lead), worked as a software engineer at Uber and later joined QuarkChain in 2018, where, in addition to researching blockchain scaling through sharding, led various DeFi projects including stablecoins, DEX, and lending markets.

In April this year, Pieverse was selected for the ninth season of the Most Valuable Builder (MVB) on the BNB Chain, and just last week, Pieverse announced the completion of a $7 million strategic funding round led by Animoca Brands and UOB Ventures, with participation from 10K Ventures, Signum Capital, Morningstar Ventures, Serafund, Undefined Labs, and Sonic Foundation, among others.

From being called up by the BNB ecosystem to transitioning to payments, then fundraising and helping the BNB Chain support x402, Pieverse has been keeping up with the pace. If the market hype around AI payments and x402 continues for a while, then Pieverse may once again be in a hurry to list its token.

You may also like

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

Earn

Earn