APRO (AT) Coin Price Prediction & Forecasts for November 2025: Up 10% in a Day – Can It Keep Climbing?

APRO (AT) Coin has been turning heads since its listing on WEEX Exchange earlier this week on November 5, 2025. As a data oracle protocol focused on delivering real-world info to blockchains, it’s carving out a niche in areas like real-world assets, AI, prediction markets, and DeFi. With a recent 10.52% surge in the last 24 hours, pushing its price to $0.428247, investors are buzzing about its potential. In this article, we’ll dive into APRO (AT) Coin’s short-term and long-term price forecasts, backed by technical analysis, market trends, and expert insights. Whether you’re a beginner eyeing your first trade or a seasoned trader, you’ll get actionable advice to navigate this AI-driven token’s outlook.

APRO (AT) Coin’s Market Position and Investment Value

If you’re new to crypto, think of APRO (AT) Coin as the bridge that brings off-chain data—like stock prices or weather info—straight into blockchain smart contracts. This makes it essential for apps in DeFi, where accurate data can mean the difference between a successful trade and a flop. Launched on the Binance Smart Chain, APRO integrates machine learning for data validation, positioning it well in the growing AI and oracle sectors.

As of November 7, 2025, APRO sits at #311 in market cap rankings with a current price of $0.428247, a market cap of $98,496,756, and a circulating supply of 230,000,000 AT out of a max of 1,000,000,000. Its 24-hour trading volume hit $138,975,331, showing strong liquidity. For investors, this token’s value lies in its utility within the expanding Web3 ecosystem—think powering AI-driven predictions or RWA tokenization. While it’s not a blue-chip like Bitcoin, its focus on practical blockchain data could drive adoption as more projects rely on oracles. This article breaks down price trends from now through 2030, offering strategies to spot opportunities without overhyping the hype.

APRO (AT) Coin Price History Review and Current Market Status

APRO (AT) Coin’s price journey has been a mix of steady builds and market-driven swings since its inception. It reached an all-time high earlier this year amid broader AI crypto enthusiasm, but like many altcoins, it dipped during summer volatility tied to global economic jitters. The all-time low came during a bearish phase in mid-2025, bottoming out around $0.20, which savvy traders used as a buying opportunity.

Right now, on November 7, 2025, things look upbeat. The token is up 10.52% in the last 24 hours, reflecting fresh momentum from its WEEX listing. Over the past week, it’s climbed about 15%, and monthly trends show a 20% gain, bucking some of the broader market’s hesitation. The Fear & Greed Index for crypto overall is at 65—greed territory—which aligns with APRO’s surge. On decentralization, top holders control around 40% of supply, per APRO on CoinMarketCap data, raising questions about whale influence but not derailing its community-driven growth. This setup suggests APRO could ride AI hype waves, but watch for corrections if sentiment shifts.

Key Factors Influencing APRO (AT) Coin’s Future Price

Several elements will shape APRO (AT) Coin’s trajectory, starting with its tokenomics. With a max supply of 1 billion AT and mechanisms for data validation rewards, it encourages long-term holding—think staking for oracles that could create deflationary pressure as usage grows. Institutional interest is budding too; whales have accumulated during dips, and partnerships in AI-DeFi could boost adoption.

Broader macro conditions matter: In a high-inflation environment, cryptos like APRO often act as hedges, but rising interest rates might pull capital away. Ecosystem-wise, its Binance Smart Chain mainnet supports fast, low-cost transactions, ideal for AI integrations. Cross-chain expansions could link it to Ethereum or Solana, amplifying reach. However, competition from established oracles like Chainlink means APRO must innovate—machine learning for data sourcing sets it apart, but execution is key. Overall, positive factors outweigh if AI adoption accelerates.

APRO (AT) Coin Price Prediction

Forecasting APRO (AT) Coin involves blending technicals, history, and market vibes. Let’s break it down step by step.

Technical Analysis and Key Indicators

APRO’s chart shows bullish signals post-listing. The RSI sits at 68, indicating overbought but not extreme—room for more upside before a pullback. MACD lines are crossing positively, suggesting momentum buildup, while Bollinger Bands are expanding, pointing to volatility with an upward bias. Moving averages? The 50-day EMA crossed above the 200-day, a golden cross hinting at a trend reversal. Fibonacci retracements from the recent low place key levels at $0.38 (support) and $0.50 (resistance)—breaking $0.50 could spark a rally.

Support at $0.40 is crucial; it’s held during recent tests, backed by high volume. Resistance at $0.45 has been sticky, but today’s 10% jump tests it. If breached, next stop could be $0.55, per historical patterns.

Support and Resistance Levels

These levels aren’t arbitrary—they stem from past price action and volume clusters. Current support at $0.38 aligns with the 61.8% Fibonacci retracement, a common bounce point. Resistance at $0.50 ties to psychological barriers and prior highs. Watching these helps time entries: Buy on support dips, sell on resistance tests.

Price Drop Analysis

Despite today’s gains, APRO saw a 5% dip mid-week before rebounding, mirroring moves in similar AI tokens like Fetch.ai (FET). FET dropped 7% in October 2025 amid regulatory news on AI cryptos, then recovered 12% as adoption stories emerged—external factors like U.S. election uncertainty hit both. For APRO, the brief drop likely stemmed from profit-taking post-listing, compounded by Bitcoin’s volatility.

Hypothetically, recovery could follow FET’s V-shaped pattern: A quick rebound if volume stays above $100M daily, supported by FET on CoinGecko trends. If broader market fear spikes (say, Index drops to 40), APRO might test $0.35 before climbing. Objection: Some say AI tokens are overhyped, but data shows 30% sector growth in Q3 2025 per Deloitte reports, refuting bubble fears by connecting to real AI utility in DeFi.

Now, for structured forecasts based on these trends:

| APRO (AT) Coin Price Prediction For Today, Tomorrow, and Next 7 Days | ||

|---|---|---|

| Date | Price | % Change |

| November 7, 2025 | $0.428 | 0% (current) |

| November 8, 2025 | $0.435 | +1.6% |

| November 9, 2025 | $0.442 | +1.6% |

| November 10, 2025 | $0.450 | +1.8% |

| November 11, 2025 | $0.445 | -1.1% |

| November 12, 2025 | $0.452 | +1.6% |

| November 13, 2025 | $0.460 | +1.8% |

| November 14, 2025 | $0.455 | -1.1% |

| APRO (AT) Coin Weekly Price Prediction | |||

|---|---|---|---|

| Week | Min Price | Avg Price | Max Price |

| Nov 4-10, 2025 | $0.400 | $0.430 | $0.450 |

| Nov 11-17, 2025 | $0.440 | $0.455 | $0.470 |

| Nov 18-24, 2025 | $0.450 | $0.465 | $0.480 |

| Nov 25-Dec 1, 2025 | $0.460 | $0.475 | $0.490 |

| APRO (AT) Coin Monthly Price Prediction 2025 | ||||

|---|---|---|---|---|

| Month | Min Price | Avg Price | Max Price | Potential ROI |

| November 2025 | $0.420 | $0.450 | $0.480 | 12% |

| December 2025 | $0.460 | $0.490 | $0.520 | 21% |

| APRO (AT) Coin Long-Term Forecast | |||

|---|---|---|---|

| Year | Min Price | Avg Price | Max Price |

| 2025 | $0.420 | $0.500 | $0.600 |

| 2026 | $0.550 | $0.700 | $0.850 |

| 2027 | $0.700 | $0.900 | $1.100 |

| 2028 | $0.850 | $1.100 | $1.350 |

| 2029 | $1.000 | $1.300 | $1.600 |

| 2030 | $1.200 | $1.500 | $1.800 |

These predictions assume continued AI growth; adjust for news like partnerships.

APRO (AT) Coin Potential Risks and Challenges

Volatility is the big one—APRO could swing 20% in a day on sentiment alone, as seen in similar tokens. Competition from Chainlink might erode market share if APRO doesn’t scale. Regulatory hurdles? Oracles handling real-world data could face scrutiny in places like the EU, hiking compliance costs. Technically, smart contract vulnerabilities pose risks; a bug could tank confidence. Broader market downturns, like a crypto winter, amplify these. Questioning assumptions: Many assume AI cryptos are immune to crashes, but 2022 showed otherwise—diversify to mitigate.

Conclusion

APRO (AT) Coin offers solid long-term promise as an AI oracle, potentially hitting $1.50 by 2030 if ecosystem growth pans out, but short-term volatility demands caution. I’ve traded through cycles, and tokens like this thrive on real utility—APRO’s machine learning edge could set it apart, unlike fleeting meme coins. For beginners, start small via spot trading on platforms like WEEX, perhaps in the AT/USDT pair, and learn by tracking oracles. Experienced folks, diversify into it as 5-10% of your portfolio. Institutions, watch for DeFi integrations. Remember, crypto’s about informed risks—research deeply.

FAQ about APRO (AT) Coin

What is APRO (AT) Coin?

APRO (AT) Coin powers a data oracle protocol that feeds real-world info to blockchains, supporting AI, DeFi, and more. It’s on BSC with machine learning for accuracy.

Is AT a good investment?

It could be if you’re into AI cryptos—up 10% recently with strong volume. But it’s high-risk; weigh against your tolerance and market trends.

What is the 2025 price prediction for AT?

We forecast an average of $0.50 by year-end, potentially up to $0.60 if adoption grows, based on current momentum.

How to buy APRO (AT) Coin?

Start by registering on WEEX, deposit funds, and trade the AT/USDT pair. Always use secure wallets.

Which cryptos are expected to lead the next bull run?

AI-focused ones like APRO, alongside Bitcoin and Ethereum, per analyst views from CoinDesk.

What are the main risks of investing in APRO (AT) Coin?

Volatility, regulatory changes, and competition—crypto can lose value fast, so never invest what you can’t lose.

DISCLAIMER: WEEX and affiliates provide digital asset exchange services, including derivatives and margin trading, only where legal and for eligible users. All content is general information, not financial advice-seek independent advice before trading. Cryptocurrency trading is high-risk and may result in total loss. By using WEEX services you accept all related risks and terms. Never invest more than you can afford to lose. See our Terms of Use and Risk Disclosure for details.

You may also like

What Is USOR? Is USOR Crypto Legit or Fake?

USOR (United States Oil Reserve) is a cryptocurrency built on the Solana blockchain. Its core proposition is to offer a transparent, digital representation of themes associated with U.S. strategic oil reserves.

COPPERINU USDT Debuts on WEEX: Copper Inu (COPPERINU) Coin Listing

WEEX Exchange is thrilled to announce the listing of Copper Inu (COPPERINU) Coin, bringing fresh meme token excitement…

What is Eva Everywhere (EVASOL) Coin?

Eva Everywhere (EVASOL) is the latest sensation in the cryptocurrency world, making its debut on the WEEX Exchange.…

EVASOL USDT Exclusive Debut: Eva Everywhere (EVASOL) Coin Lists on WEEX

Meta Description: Discover the exclusive world premiere of Eva Everywhere (EVASOL) Coin on WEEX Exchange. Trade EVASOL USDT…

What is 潜龙勿用 (QLWY) Coin?

潜龙勿用 (QLWY) Coin has recently been listed on WEEX, opening a new avenue for trading on January 27,…

What is Cummingtonite (CUM) Coin?

The Cummingtonite (CUM) coin has made its debut in the crypto market as a meme token, originating from…

What is CLAWDBASE (CLAWD) Coin?

Recently, the cryptocurrency landscape welcomed a new entrant, CLAWDBASE (CLAWD) Coin, a unique community-driven token. Launched on January…

CLAWDBASE USDT World Premiere: clawd.atg.eth Coin Lands on WEEX

WEEX Exchange proudly announces the global exclusive first launch of clawd.atg.eth (CLAWDBASE) Coin, a groundbreaking meme token tied…

潜龙勿用 Coin Price Prediction & Forecasts for January 2026: Could This New Meme Token Surge 50% Post-Launch?

潜龙勿用 Coin just hit the market today, January 27, 2026, as an exclusive premiere on WEEX Exchange, blending…

Cummingtonite (CUM) Coin Price Prediction & Forecast for January 2026: Surging Meme Momentum Ahead?

Cummingtonite (CUM) Coin burst onto the scene today, January 27, 2026, as a fresh Solana-based meme token inspired…

clawd.atg.eth (CLAWDBASE) Coin Price Prediction & Forecasts for January 2026 – Could This Meme Token Surge After Exclusive Launch?

As a seasoned crypto trader who’s been in the game since the early days of Ethereum, I’ve seen…

World Mobile Token (WMTX) Coin Price Prediction & Forecasts for February 2026 – Potential Rebound After Recent 5% Dip?

World Mobile Token (WMTX) Coin has been navigating a tough spot in the crypto market lately, with a…

Capybobo (PYBOBO) Coin Price Prediction & Forecasts for January 2026: Analyzing the 3% Dip and Potential Rebound

Capybobo (PYBOBO) Coin has been turning heads in the GameFi space since its launch, blending art toys with…

What Is USOR Crypto? An Ultimate 2026 Guide to the USOR Coin Meme Token

What is USOR crypto in 2026? Learn how USOR coin works, why it went viral, its oil narrative, on-chain risks, and what traders should know before investing.

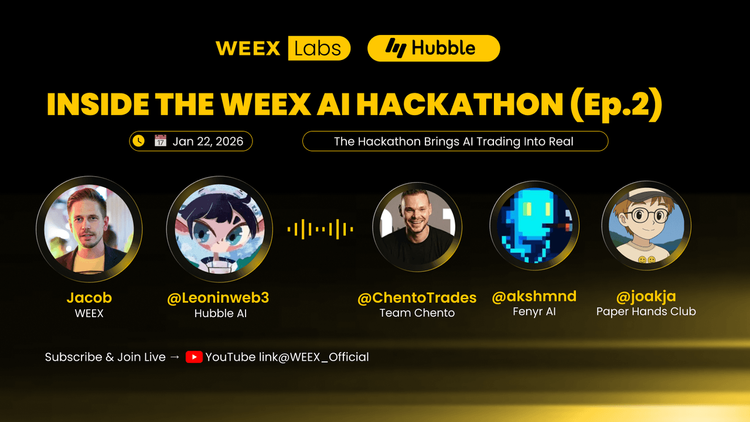

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Introducing Pump.fun Complete Guide to $PUMP and Airdrop Opportunities

Pump.fun ($PUMP) is the turbocharged memecoin launchpad shaking up the Solana ecosystem, letting anyone spin up a token in seconds and trade it instantly—no presales, no rugs, just pure, chaotic fun. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 $PUMP airdrop until Feb.03 2026!

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is USOR? Is USOR Crypto Legit or Fake?

USOR (United States Oil Reserve) is a cryptocurrency built on the Solana blockchain. Its core proposition is to offer a transparent, digital representation of themes associated with U.S. strategic oil reserves.

COPPERINU USDT Debuts on WEEX: Copper Inu (COPPERINU) Coin Listing

WEEX Exchange is thrilled to announce the listing of Copper Inu (COPPERINU) Coin, bringing fresh meme token excitement…

What is Eva Everywhere (EVASOL) Coin?

Eva Everywhere (EVASOL) is the latest sensation in the cryptocurrency world, making its debut on the WEEX Exchange.…

EVASOL USDT Exclusive Debut: Eva Everywhere (EVASOL) Coin Lists on WEEX

Meta Description: Discover the exclusive world premiere of Eva Everywhere (EVASOL) Coin on WEEX Exchange. Trade EVASOL USDT…

What is 潜龙勿用 (QLWY) Coin?

潜龙勿用 (QLWY) Coin has recently been listed on WEEX, opening a new avenue for trading on January 27,…

What is Cummingtonite (CUM) Coin?

The Cummingtonite (CUM) coin has made its debut in the crypto market as a meme token, originating from…