Bitcoin Gains Momentum as Selling Pressure Eases

Key Takeaways:

- Bitcoin has shown signs of recovery following a significant price drop, sparking optimism among analysts about a continued upward trajectory.

- The decline in selling pressure and expectations of a Federal Reserve rate cut are believed to be boosting Bitcoin’s potential for recovery.

- Recent movements have seen Bitcoin establish a potential market bottom, with experts suggesting the worst of the selling may be over.

- A shift in market liquidity, driven by possible Federal Reserve actions, could further bolster Bitcoin and other high-risk assets.

Introduction to Bitcoin’s Recent Recovery

Bitcoin is drawing attention with its apparent recovery from recent market volatility. The cryptocurrency recently rebounded after experiencing a sharp dip nearing $82,000, giving rise to optimism about its potential upward trajectory. Analysts are closely examining trends indicating that selling pressure has substantially eased, paving the way for what they believe could be a sustained climb in Bitcoin’s value.

Analyzing Market Dynamics

Market Reactions and Influences

The recent fluctuations in Bitcoin prices are primarily tied to broader market dynamics, with movements heavily influenced by changing expectations of potential Federal Reserve rate cuts. Amid sharp corrections in both tech stocks and crypto markets, analysts, including Charles Edwards of Capriole Fund, point to the volatile sentiment driven by anticipated monetary policy shifts.

Bitcoin’s trajectory has been intertwined with the Federal Reserve’s considerations regarding rate adjustments. Notably, the probability of a rate cut in December shifted drastically, with odds rising from 30% to approximately 70%. Tools like the CME Fed Watch provide insights into these shifting probabilities, which are critical in shaping market participants’ expectations and behaviors.

Identifying a Market Bottom

Swissblock’s market analysts underscore that Bitcoin is potentially forming a market bottom after its recent downturn. A stark drop in the “Risk-Off Signal” suggests a reduced selling pressure, potentially marking the end of the worst sell-off phase. While analysts caution that a secondary wave of selling could still occur, this phase is often characterized by less intensity and may indicate seller exhaustion, paving the way for bullish control.

The Federal Reserve’s Role and Future Expectations

Rate Cut Prospects

The possibility of a Federal Reserve rate cut has become a focal point of discussion among market analysts and economists. The likelihood of a rate cut has seen significant shifts, impacting market forecasts and participant strategies. Such a move is generally expected to inject liquidity into the market, creating a conducive environment for high-risk assets like Bitcoin to thrive.

Potential Liquidity Injection

Amid these discussions, experts speculate about potential actions the Federal Reserve might undertake to manage reserves and expand liquidity. Market analyst “Sykodelic” predicts that the central bank may soon find it necessary to enhance liquidity to maintain financial stability. The implications of this could be substantial, potentially driving rallies across markets, including cryptocurrencies.

Exploring Future Market Trends

The Impact of Increased Liquidity

Past experiences with quantitative easing have shown that increased liquidity often leads to significant rallies in high-risk asset classes. Should the Federal Reserve engage in similar measures, Bitcoin, with its historical volatility and attractive risk-reward profile, could see substantial upward momentum.

Bitcoin’s Long-term Outlook

Looking ahead, Bitcoin’s prospects remain strong, buoyed by a combination of easing selling pressure and changing monetary policy expectations. Despite inevitable fluctuations, the general sentiment is cautiously optimistic. Analysts continue to monitor potential market bottoms, trend reversals, and macroeconomic developments that could influence Bitcoin’s future movements.

Conclusion

In conclusion, Bitcoin’s recent behavior underscores the complex interplay between market dynamics, investor sentiment, and macroeconomic factors. With selling pressures easing, and with anticipation of potential favorable moves by the Federal Reserve, Bitcoin seems poised for a potential upward journey. The coming weeks and months will be critical in shaping this narrative, as market participants remain vigilant, navigating the intricate web of economic indicators and sentiment that drive the cryptocurrency markets.

Frequently Asked Questions

What is causing the current Bitcoin recovery?

Bitcoin’s recovery is largely attributed to a decrease in selling pressure and optimism regarding Federal Reserve monetary policy, particularly prospects of a rate cut, which tends to favor high-risk assets like Bitcoin.

How do rate changes by the Federal Reserve impact Bitcoin?

Changes in the Federal Reserve’s interest rates can influence Bitcoin by affecting market liquidity. Generally, rate cuts enhance liquidity and are supportive of asset price growth, including cryptocurrencies.

What is the significance of identifying a market bottom for Bitcoin?

Identifying a market bottom is crucial as it suggests the end of a significant sell-off period. It indicates a potential shift in momentum from bearish to bullish, which often leads to sustained price recoveries.

Why is increased liquidity beneficial for Bitcoin?

Increased liquidity often spurs investment in high-risk assets like Bitcoin. It enhances market conditions by lowering borrowing costs and fostering investor confidence, potentially leading to significant price rallies.

What should investors watch for in Bitcoin’s future?

Investors should monitor market sentiment, Federal Reserve decisions, selling pressure dynamics, and any secondary waves of correction. Keeping an eye on macroeconomic indicators and policy announcements can provide insights into future market trends.

You may also like

Who Owns World Liberty Financial? Exploring Ownership, WLFI Token Insights, and Market Outlook

World Liberty Financial has been making waves in the crypto space lately, especially with its WLFI token climbing…

What Is USOR Crypto? Exploring the U.S. Oil Token’s Rise and Future in the Energy-Backed Crypto Space

U.S. Oil (USOR) crypto has caught attention recently with a sharp 34.63% price surge over the last 24…

Where to Buy USOR Crypto: Best Platforms and Strategies for Beginners

With USOR crypto surging 39.48% in the last 24 hours to hit $0.027753 USD, as reported by CoinMarketCap…

Where Can I Buy USOR Crypto? Is USOR Crypto Legit? Your Guide to Getting Started

The USOR crypto token, tied to the U.S Oil project, has caught attention with its recent surge. As…

Nietzschean Penguin (PENGUIN) Coin Price Prediction & Forecasts for January 2026: Surging 28% Amid Meme Coin Hype

Nietzschean Penguin (PENGUIN) Coin has been turning heads in the meme coin space, blending Nietzschean philosophy with adorable…

USOR Crypto Price Analysis: Surging Trends and 2026 Forecasts for Savvy Traders

The USOR crypto price has been making waves lately, with a remarkable 39.48% surge in the last 24…

What is 潜龙勿用 (QLWY) Coin?

潜龙勿用 (QLWY) Coin has recently been listed on WEEX, opening a new avenue for trading on January 27,…

What is Cummingtonite (CUM) Coin?

The Cummingtonite (CUM) coin has made its debut in the crypto market as a meme token, originating from…

潜龙勿用 Coin Price Prediction & Forecasts for January 2026: Could This New Meme Token Surge 50% Post-Launch?

潜龙勿用 Coin just hit the market today, January 27, 2026, as an exclusive premiere on WEEX Exchange, blending…

Cummingtonite (CUM) Coin Price Prediction & Forecast for January 2026: Surging Meme Momentum Ahead?

Cummingtonite (CUM) Coin burst onto the scene today, January 27, 2026, as a fresh Solana-based meme token inspired…

clawd.atg.eth (CLAWDBASE) Coin Price Prediction & Forecasts for January 2026 – Could This Meme Token Surge After Exclusive Launch?

As a seasoned crypto trader who’s been in the game since the early days of Ethereum, I’ve seen…

World Mobile Token (WMTX) Coin Price Prediction & Forecasts for February 2026 – Potential Rebound After Recent 5% Dip?

World Mobile Token (WMTX) Coin has been navigating a tough spot in the crypto market lately, with a…

Capybobo (PYBOBO) Coin Price Prediction & Forecasts for January 2026: Analyzing the 3% Dip and Potential Rebound

Capybobo (PYBOBO) Coin has been turning heads in the GameFi space since its launch, blending art toys with…

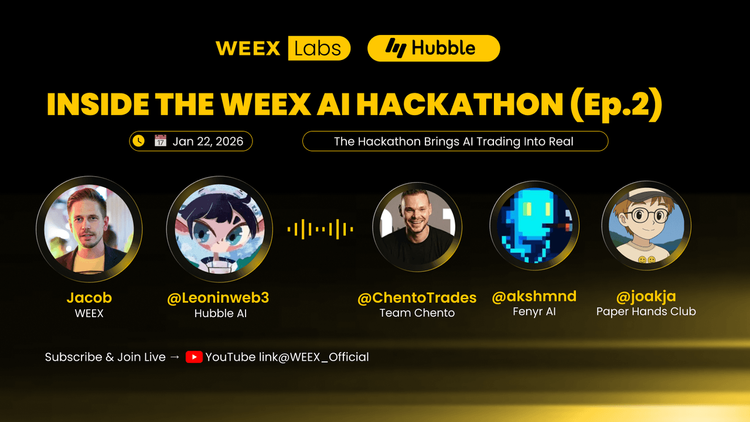

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

What Is Nietzschean Penguin (PENGUIN)? Nietzschean Penguin (PENGUIN) Price Prediction 2026

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Who Owns World Liberty Financial? Exploring Ownership, WLFI Token Insights, and Market Outlook

World Liberty Financial has been making waves in the crypto space lately, especially with its WLFI token climbing…

What Is USOR Crypto? Exploring the U.S. Oil Token’s Rise and Future in the Energy-Backed Crypto Space

U.S. Oil (USOR) crypto has caught attention recently with a sharp 34.63% price surge over the last 24…

Where to Buy USOR Crypto: Best Platforms and Strategies for Beginners

With USOR crypto surging 39.48% in the last 24 hours to hit $0.027753 USD, as reported by CoinMarketCap…

Where Can I Buy USOR Crypto? Is USOR Crypto Legit? Your Guide to Getting Started

The USOR crypto token, tied to the U.S Oil project, has caught attention with its recent surge. As…

Nietzschean Penguin (PENGUIN) Coin Price Prediction & Forecasts for January 2026: Surging 28% Amid Meme Coin Hype

Nietzschean Penguin (PENGUIN) Coin has been turning heads in the meme coin space, blending Nietzschean philosophy with adorable…

USOR Crypto Price Analysis: Surging Trends and 2026 Forecasts for Savvy Traders

The USOR crypto price has been making waves lately, with a remarkable 39.48% surge in the last 24…