Bybit Hack Marks the Largest Crypto Heist in History: How Can I Save ETH Safely?

In an unprecedented breach, the Bybit Hack has sent shockwaves through the cryptocurrency world, with losses estimated at $1.5 billion—making it one of the largest crypto heists in history. As millions of dollars were stolen and investigations continue, the hack has raised serious concerns about the security practices of crypto exchanges and how individuals can better protect their digital assets. With the dust still settling, one crucial question remains: How can you securely store your ETH in the wake of such a devastating attack? In this article, WEEX will explore the Bybit Hack, its far-reaching consequences, and provide practical tips on safeguarding your ETH and other assets, particularly for those holding Bybit Token or the Bybit native token.

The Bybit Hack: The Largest Crypto Heist in History

The Bybit Hack involved a sophisticated attack on the platform, which resulted in the loss of a massive amount of funds. The hack compromised users' wallets, and the stolen assets included both Bybit coin and various cryptocurrencies like ETH USDT. This attack, believed to be carried out by advanced hackers, has shocked the industry due to its scale and precision.

As one of the leading exchanges globally, Bybit’s security breach has caused concern among its millions of users, and many are now reconsidering how and where to store their crypto assets. The incident underscores the vulnerabilities inherent in centralized exchanges and serves as a wake-up call to the broader crypto community.

What Happened During the Bybit Hack?

During the Bybit hack, attackers were able to breach the exchange’s security systems, gaining unauthorized access to Bybit tokens and customer wallets. The Bybit token name was also targeted, and large amounts of Bybit native token were siphoned off. As a result, many users were left scrambling to secure their remaining funds and assess the impact of the breach.

The attack has raised questions about the exchange’s security protocols, highlighting the importance of safeguarding assets in a volatile and high-risk market. Although Bybit has committed to reimbursing users who were affected by the hack, the breach has underscored the growing need for users to take control of their own security measures, especially when it comes to storing ETH and other tokens.

How Can I Save ETH Safely After the Bybit Hack?

After the Bybit hack, it is crucial to rethink how you store and manage your Ethereum (ETH) and other crypto assets. Here are some essential strategies to keep your ETH safe:

1. Use Hardware Wallets for Secure Storage

Hardware wallets like the Ledger Nano S or Trezor provide offline storage for your ETH and other cryptocurrencies. This method ensures your assets are kept far from online threats like hacks or phishing attacks, offering the highest level of security.

2. Enable Two-Factor Authentication (2FA)

Always enable 2FA on your exchange accounts, including Bybit. While it won't prevent a hack on the exchange's servers, it can add an extra layer of security to your personal account. Use an authenticator app (Google Authenticator or Authy) rather than SMS-based 2FA for better protection.

3. Store ETH in Decentralized Wallets

Consider storing your ETH in decentralized wallets such as MetaMask or Trust Wallet. These wallets give you complete control over your private keys, ensuring your assets are safe even if an exchange like Bybit gets hacked.

4. Withdraw Your Funds to a Secure Wallet

If you’re holding large amounts of ETH or Bybit coin, it's recommended to withdraw your funds to a personal wallet that you control. Bybit’s native token and other assets should only remain in exchange wallets for trading purposes, and only in small amounts.

5. Stay Vigilant and Avoid Phishing Attacks

After a major hack like the Bybit hack, phishing attacks targeting users are more common. Be cautious about unsolicited emails, fake websites, and other scams. Always double-check the URL and make sure you're logging into the correct platform.

6. Consider Storing ETH on Multiple Platforms

For added security, consider diversifying the storage of your ETH across multiple wallets or platforms. This will reduce the risk of losing all your assets if one platform is compromised, offering a level of redundancy.

How to Spot Suspicious Transactions Like the Bybit Hack

It’s crucial for crypto users to be vigilant in monitoring their assets. Here are key red flags to watch for:

- Unusual Wallet Activity: Sudden large withdrawals, such as a $1.5 billion outflow in minutes, are a major red flag.

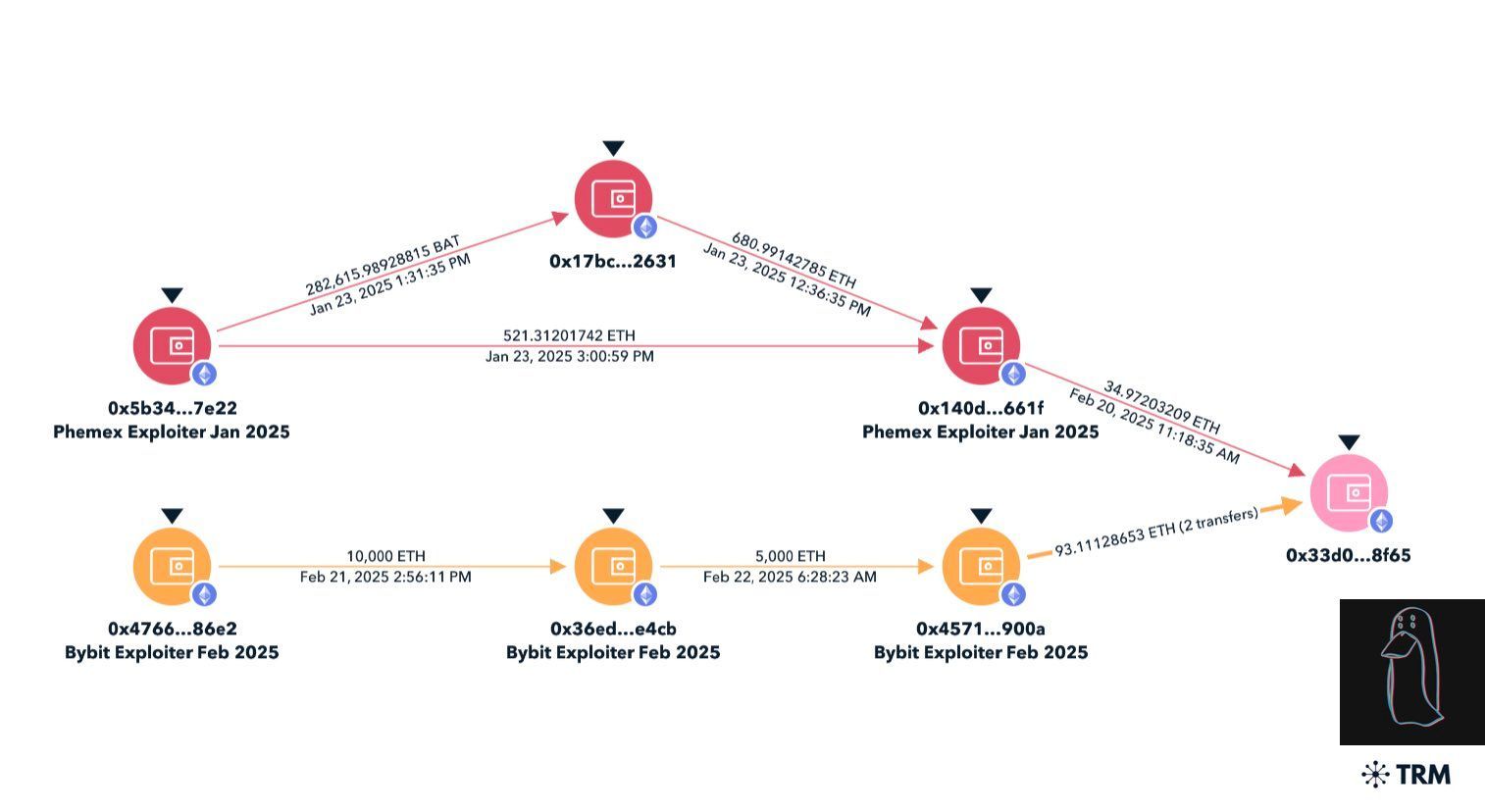

- High-Frequency Transfers: Hackers often split stolen funds into smaller amounts and move them across numerous wallets as part of a laundering tactic.

- Interaction with Mixers: Watch for transactions routed through privacy tools like Tornado Cash or Wasabi Wallet, which are often used to obscure the origins of stolen funds.

- Mismatched Timestamps: Transactions occurring during off-peak hours or low-traffic periods could be an attempt to avoid scrutiny.

- Smart Contract Anomalies: Unverified contracts that are receiving or draining funds can be a sign of malicious activity.

Tools to Monitor Transactions

To stay ahead of potential threats, use these tools to track and monitor suspicious activity:

- Blockchain Explorers: Platforms like Etherscan or BscScan allow you to track the movement of ETH and Bybit Token (BIT) on the blockchain.

- Alert Systems: Set up notifications for large wallet movements using services like Whale Alert, which notifies you about high-value transactions.

- Risk Assessment Platforms: Use tools like Chainalysis or TRM Labs to screen addresses for illicit links and suspicious activity.

How Does the Bybit Hack Affect the Bybit Token?

With the massive loss of Bybit tokens in the hack, the price of the Bybit native token has experienced volatility. The value of Bybit coin has been under pressure as traders and users move their funds off the exchange in light of the security breach. However, Bybit has assured its community that they are working to resolve the issue and strengthen their security measures.

Despite this assurance, the hack has prompted many crypto investors to reconsider their reliance on centralized exchanges like Bybit for long-term holdings. Users are now more inclined to secure their Bybit coin and other assets by transferring them to private wallets or decentralized exchanges.

Why This Hack is a Wake-Up Call for Crypto Users

The Bybit Hack is a significant reminder of the risks involved in crypto trading, especially when assets are stored on centralized exchanges. While exchanges like Bybit provide convenience and liquidity, they also pose a risk to users who leave their funds on the platform for extended periods.

As the hack demonstrates, users must take proactive steps to safeguard their digital assets, especially high-value tokens like ETH and Bybit coin. Utilizing personal wallets, setting up robust security protocols, and staying informed about the latest threats are critical steps in protecting your investments in the volatile world of cryptocurrency.

Conclusion: Take Control of Your Crypto Security Today

In the aftermath of the Bybit hack, it's more important than ever to understand the risks associated with storing ETH and other tokens on centralized exchanges. By following the tips above, you can take control of your digital assets and safeguard them against future hacks. Whether you're holding Bybit tokens, ETH, or Bybit native token, securing your assets is crucial to ensuring they remain safe in the long term.

Be sure to explore hardware wallets, decentralized options, and never leave your assets exposed. Stay informed about the latest developments from Bybit and the crypto world, and always prioritize security when dealing with your digital wealth.

Stay safe, stay secure, and trade with peace of mind.

You may also like

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Introducing Pump.fun Complete Guide to $PUMP and Airdrop Opportunities

Pump.fun ($PUMP) is the turbocharged memecoin launchpad shaking up the Solana ecosystem, letting anyone spin up a token in seconds and trade it instantly—no presales, no rugs, just pure, chaotic fun. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 $PUMP airdrop until Feb.03 2026!

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

What is Moonbirds (BIRB) Coin?

The Moonbirds (BIRB) token is a groundbreaking entrant in the cryptocurrency landscape, uniquely merging the digital and physical…

What Is Shrimp Coin (SHRIMP)?

The Shrimp Coin (SHRIMP) token has officially made its debut on the WEEX platform, marking its exclusive listing…

What is ZERO-HUMAN COMPANY (ZHC) Coin?

In the rapidly evolving world of cryptocurrency, the ZERO-HUMAN COMPANY (ZHC) Coin has made its mark as an…

What is AlphaPride (ALPHA) Coin?

Exploring the dynamic world of cryptocurrencies often reveals new and intriguing projects. AlphaPride (ALPHA) is a fine example…

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Shrimp Coin Price Prediction & Forecast: Surging 150% Post-Launch in January 2026

Shrimp Coin (SHRIMP) burst onto the scene on January 26, 2026, as an exclusive launch on WEEX Exchange,…

ZERO-HUMAN COMPANY (ZHC) Coin Price Prediction & Forecasts for January 2026 – Could This Meme Coin Soar 50% Amid AI Hype?

The ZERO-HUMAN COMPANY (ZHC) Coin burst onto the scene just yesterday, launching exclusively on WEEX Exchange on January…

AlphaPride (ALPHA) Coin Price Prediction & Forecasts for January 2026: Potential Rebound After Launch Volatility

AlphaPride (ALPHA) Coin has just hit the crypto scene, launching on January 26, 2026, amid a bustling market…

AlphaPride (ALPHA) Coin Listed on WEEX Spot with ALPHA USDT Trading Pair

AlphaPride (ALPHA) Coin is newly listed on WEEX Exchange. Start trading the ALPHA USDT pair today to access the global loyalty ecosystem and digital rewards.

Exclusive ZHC USDT Pair Trading Live on WEEX Exchange

Exclusive listing alert: ZERO-HUMAN COMPANY (ZHC) Coin is now on WEEX. Read our ZHC USDT spot trading guide and access the AI meme token market securely.

SHRIMP USDT Now on WEEX: Shrimp Coin Exclusive Listing

SHRIMP USDT is new listed on WEEX Exchange. Trade Shrimp Coin exclusively on our spot market and access the trending Solana meme token liquidity today.

BIRB USDT First Launch: Moonbirds Coin on WEEX

Exclusive first launch: Moonbirds (BIRB) Coin is now listed on WEEX Exchange. Start trading the BIRB USDT pair on our secure spot market today.

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Introducing Pump.fun Complete Guide to $PUMP and Airdrop Opportunities

Pump.fun ($PUMP) is the turbocharged memecoin launchpad shaking up the Solana ecosystem, letting anyone spin up a token in seconds and trade it instantly—no presales, no rugs, just pure, chaotic fun. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 $PUMP airdrop until Feb.03 2026!

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.