PAXG Crypto for Traders: PAX Gold Market Cap, Circulating Supply & Is It a Good Investment?

In late 2025, gold has once again captured global attention. After the U.S. dollar weakened against major currencies, gold prices climbed, breaking past $4,500 per ounce, and safe-haven demand surged amid geopolitical tensions and banking stress. On-chain, this macro momentum translated directly into growth for PAXG crypto — the tokenized representation of physical gold that many traders now treat as gold 2.0.

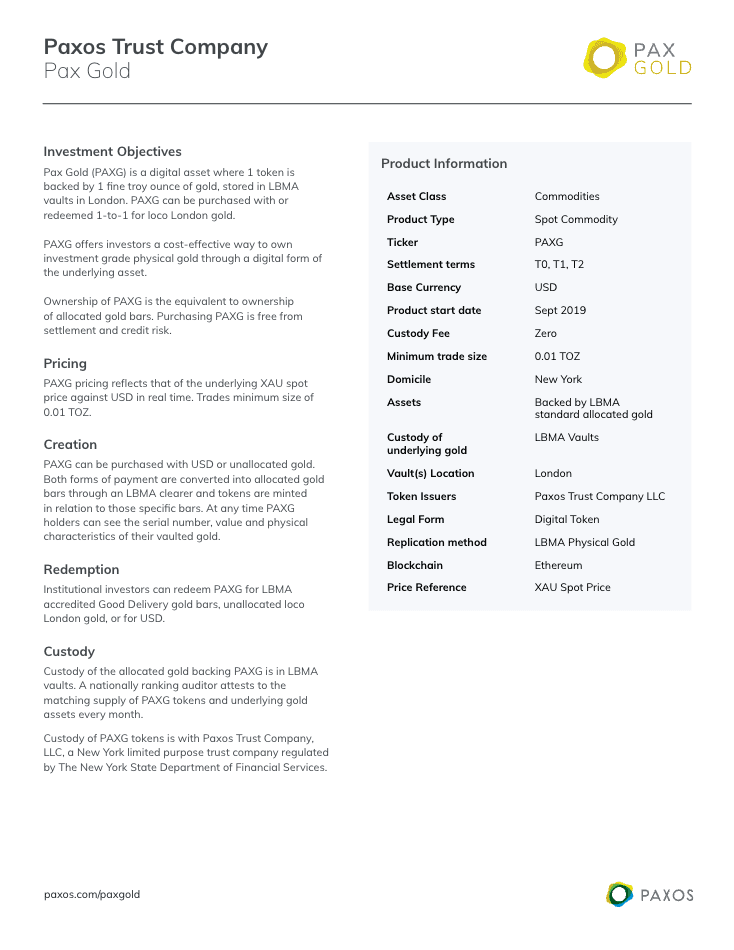

While traditional gold ETFs and bullion require custodial logistics and settlement delays, PAXG tokenized gold combines real bullion with blockchain settlement. Conversations around the PAXG issuer, PAXG market cap December 2025, and the question “is Pax Gold a good investment?” have become increasingly common among retail and institutional participants alike.

What Is PAX Gold (PAXG)? Understanding PAXG Tokenized Gold

At its core, PAX Gold (PAXG) is a tokenized gold asset where each token represents one fine troy ounce of physical gold stored in regulated vaults in London. This means when you hold PAXG, you hold a digital claim on allocated gold, not a synthetic derivative.

Unlike unallocated gold or paper-based exposure, PAXG crypto’s structure ensures that each token corresponds to a specific gold bar with a unique serial number. This configuration enhances transparency and auditability, distinguishing it from many other gold-linked instruments. PAXG is built as an ERC-20 Ethereum token, which enables 24/7 trading, instant settlement, and seamless integration with wallets, exchanges, and DeFi platforms.

Because PAXG is modelled as digital gold, it serves both as a store of value and a liquidity instrument that trades continuously — a key reason many traders consider PAXG tokenized gold over physical bullion in dynamic markets.

PAXG Issuer and Regulatory Positioning: Why the PAXG Issuer Matters

One of the core reasons the market treats PAXG crypto differently from other gold tokens is the PAXG issuer behind it. The token is issued by Paxos Trust Company, a U.S.-based financial institution regulated by the New York Department of Financial Services (NYDFS) and now also under the U.S. Office of the Comptroller of the Currency (OCC).

This regulatory structure means the gold backing PAXG is audited regularly, attested by independent firms, and held segregated in custodian vaults. In insolvency scenarios, assets remain protected from creditor claims. This level of oversight creates a foundation of trust that appeals to institutional participants who must balance compliance with performance — a dynamic often missing in less regulated parts of the crypto space.

Because of these credentials, the PAXG issuer and its regulatory alignment are top reasons PAXG has attracted interest from asset managers, hedge funds, and regulated entities looking for on-chain exposure to gold.

PAXG Market Cap December 2025 and PAXG Circulating Supply 2025

As of December 2025, PAXG market cap reflects the full value of its underlying gold reserves.

Key metrics include:

- PAXG price: $4,348.13

- Market cap: $1,594,886,602

- Fully diluted valuation: $1,594,886,602

- PAXG circulating supply 2025: 367,324

- Total supply: 367,324

- Max supply: Unlimited (minted only against new gold deposits)

- 24-hour trading volume: $260,045,292

- Total value locked (TVL): $1,587,618,080

The PAXG circulating supply 2025 only increases when new physical gold is deposited with the PAXG issuer, ensuring supply growth corresponds to real bullion inflows, not artificial inflation. This transparency in PAXG’s tokenomics reinforces confidence in its status as a digital gold instrument.

Industry trackers also show that the broader tokenized gold market cap — led primarily by PAXG and its main competitor — topped over $4 billion in late 2025 as demand for on-chain commodities expanded.

Is PAX Gold a Good Investment? A Trader’s Perspective

When traders ask “is PAX Gold a good investment?” they are usually considering more than price performance. For many, PAXG isn’t about winding up rich quickly — it’s about managing risk with a digital asset that mirrors gold’s safe-haven properties.

PAXG is engineered to track the gold price with minimal deviation, which means the PAXG coin vs gold price relationship historically stays tight. Any premiums or discounts tend to be short-term and exchange-specific rather than structural. This predictability is a core appeal for traders focused on hedging and risk balance.

From a trader’s lens, PAXG crypto serves three primary functions:

- Portfolio hedging: During equity drawdowns or macro stress, migrating risk exposure into PAXG can protect capital without leaving crypto markets.

- Capital parking: Traders use PAXG as a stable anchor in periods where fiat stablecoins may underperform due to inflation or currency devaluation.

- Tactical trading: While less volatile than most crypto assets, PAXG still responds to macro catalysts (inflation data, geopolitical events) in ways that are actionable with 24/7 liquidity.

Thus, for traders emphasizing stability and capital efficiency, PAXG often ranks as a practical element of risk management. For those chasing outsized crypto-like gains, it is not positioned for that role.

PAXG Crypto vs XAUt: Why Institutions Prefer PAX Gold

Both PAXG crypto and XAUT (Tether Gold) represent tokenized gold, but institutional behavior reveals a differentiation in preference. Many regulated protocols and institutions lean towards PAXG tokenized gold because of its regulatory clarity and audit framework.

Protocols with compliance frameworks — such as MakerDAO and Aave — have evaluated or integrated PAXG due to these attributes. This institutional endorsement strengthens network effects and deepens liquidity, making PAXG a practical choice for entities that must meet regulatory requirements while accessing gold exposure on-chain.

Why Crypto Experts Are Betting Big on PAX Gold (PAXG)

Market analysts and industry experts highlight several reasons for sustained interest in PAXG crypto:

- Macro alignment: Gold’s price strength during inflationary periods naturally supports PAXG’s narrative.

- Institutional flows: Net inflows into PAXG have been notable in 2025, reflecting demand from larger players.

- Regulatory milestones: Recent oversight by the OCC and integration into major spot listings enhances confidence.

These dynamics fuel the ongoing discussion around is PAX Gold a good investment, especially among sophisticated market participants who weigh regulatory safety along with macro constructs.

PAX Gold Price and Performance Relative to Physical Gold

A defining characteristic of PAXG tokenized gold is its tight tracking of the spot gold price. Arbitrage opportunities across centralized and decentralized exchanges help align the PAX Gold price with bullion benchmarks, contributing to its reputation as a reliable digital representation of gold.

Even in volatile conditions, deviations between PAXG crypto and spot physical gold are usually temporary and corrected quickly as traders exploit pricing inefficiencies.

Trading PAXG Crypto on WEEX

For traders who want streamlined access to PAXG crypto, WEEX provides a reliable execution environment with institutional-grade liquidity. WEEX PAXG markets are designed to support traders looking for efficient entry and exit points, risk control tools, and deep order book depth — especially during high-volatility windows.

Whether hedging macro risk or adding a stable, inflation-aligned asset to a diversified crypto portfolio, WEEX’s PAXG trading infrastructure helps traders implement strategies without compromising on execution quality or speed.

Final Thoughts on PAXG Tokenized Gold

By late 2025, PAXG crypto has solidified its position not just as a novelty but as a core tool for traders and institutions seeking regulated gold exposure on-chain. With a trusted PAXG issuer, transparent audits, and expanding adoption reflected in its PAXG market cap December 2025 and PAXG circulating supply 2025, PAXG tokenized gold stands out in the evolving landscape of digital assets.

For traders evaluating whether PAX Gold is a good investment, the answer is increasingly about purpose: if your aim is stability, hedging, and seamless integration of real-world assets with blockchain liquidity, PAXG crypto delivers a compelling blend of characteristics that bridge traditional gold markets with modern financial infrastructure.

You may also like

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

What Is Shrimp Coin (SHRIMP)?

The Shrimp Coin (SHRIMP) token has officially made its debut on the WEEX platform, marking its exclusive listing…

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Shrimp Coin Price Prediction & Forecast: Surging 150% Post-Launch in January 2026

Shrimp Coin (SHRIMP) burst onto the scene on January 26, 2026, as an exclusive launch on WEEX Exchange,…

ZERO-HUMAN COMPANY (ZHC) Coin Price Prediction & Forecasts for January 2026 – Could This Meme Coin Soar 50% Amid AI Hype?

The ZERO-HUMAN COMPANY (ZHC) Coin burst onto the scene just yesterday, launching exclusively on WEEX Exchange on January…

AlphaPride (ALPHA) Coin Price Prediction & Forecasts for January 2026: Potential Rebound After Launch Volatility

AlphaPride (ALPHA) Coin has just hit the crypto scene, launching on January 26, 2026, amid a bustling market…

What is Dale (DALE) Coin?

The intriguing realm of cryptocurrency is ever-evolving, and a fascinating new entrant has just hit the scene: Dale…

抖音热搜第四的狼格林 (格林) Coin Price Prediction & Forecasts for January 2026: Could It Surge on Launch Day?

The meme coin scene is heating up with the arrival of 抖音热搜第四的狼格林 (格林) Coin, which has already climbed…

What is EDOM (EDOM) Coin?

The crypto landscape is ever-evolving, offering novel opportunities for traders and investors alike. Recently, EDOM (EDOM) coin was…

What is Aura Farming Eagle (Eagle) Coin?

Aura Farming Eagle (Eagle) Coin has recently captured the attention of the crypto community with its unique position…

EDOM Coin Price Prediction & Forecasts for January 2026: Surging 54% – Can It Hit $0.50 by Year-End?

EDOM Coin has been turning heads in the crypto space this January 2026, with a remarkable 54.30% surge…

What Is Ripple USD (RLUSD)? Is Ripple USD (RLUSD) a Good Investment?

Ripple USD (RLUSD) is more than just another stablecoin. It is a strategically launched asset designed to bring the speed and efficiency of blockchain to institutional finance while operating within a clear regulatory perimeter. For enterprises, it offers a compliant tool for global payments. For investors and DeFi users, it provides a new, transparently backed stable asset option.

Trump Family Crypto Project Exlpained: How Much Has the Trump Family Earned from Crypto?

WLFI stands for "Wrapped Liquid Finance Index." In the crypto industry, WLFI is a token designed to track the value of a curated set of financial assets by packaging or "wrapping" them into a single blockchain-based digital asset. This allows users to gain diversified exposure to a range of DeFi (Decentralized Finance) protocols and products through one unified token, streamlining portfolio management for both newcomers and experienced investors.

SPACE USDT Perpetual Contract Listings on WEEX Futures

WEEX Exchange launches MicroVisionChain (SPACE) perpetuals. Trade SPACE USDT with high leverage. Secure your position on the new SPACE Coin listing today.

GWEI USDT Perpetual Contract Launches on WEEX Futures

Trade the new Gwei (GWEI) coin on WEEX. The GWEI USDT perpetual contract is now live with flexible leverage. Join WEEX Exchange for seamless crypto futures.

How Much Will AAPL Be Worth in 2030? Expert Predictions for Apple Tokenized Stock

As we move through 2026, the tokenized version of Apple Inc. stock, known as AAPL, continues to draw…

Does Apple Have a Crypto Coin? Unpacking AAPL Tokenized Stock in the Crypto World

As of January 25, 2026, Apple Inc. hasn’t launched its own native cryptocurrency, but the rise of tokenized…

Which Is the Best AI for Trading? Expert Picks and Insights for Crypto Beginners in 2026

As we move through 2026, artificial intelligence continues to reshape the trading landscape, especially in the volatile world…

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

What Is Shrimp Coin (SHRIMP)?

The Shrimp Coin (SHRIMP) token has officially made its debut on the WEEX platform, marking its exclusive listing…

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Shrimp Coin Price Prediction & Forecast: Surging 150% Post-Launch in January 2026

Shrimp Coin (SHRIMP) burst onto the scene on January 26, 2026, as an exclusive launch on WEEX Exchange,…

ZERO-HUMAN COMPANY (ZHC) Coin Price Prediction & Forecasts for January 2026 – Could This Meme Coin Soar 50% Amid AI Hype?

The ZERO-HUMAN COMPANY (ZHC) Coin burst onto the scene just yesterday, launching exclusively on WEEX Exchange on January…

AlphaPride (ALPHA) Coin Price Prediction & Forecasts for January 2026: Potential Rebound After Launch Volatility

AlphaPride (ALPHA) Coin has just hit the crypto scene, launching on January 26, 2026, amid a bustling market…