Uptober Effect 2025: The Bitcoin Rally You Need to Watch

Bitcoin has had an impressive start to October 2025. Since the beginning of the month, Bitcoin’s price has surged by 8.5% at the time of writing, breaking through key resistance levels and reaching new highs. The month of October has become synonymous with Bitcoin rallies over the years, earning it the nickname "Uptober." The term was first coined by traders on platforms like Reddit and Twitter between 2013 and 2017, combining "Up" and "October" to reflect Bitcoin’s consistent bullish performance in this month. This trend has made "Uptober" more than just a meme; it’s now an expected seasonal pattern that traders and institutional investors watch closely.

October Bitcoin Surge: ETF Inflows, Exchange Balance Drop, Stablecoin Growth

Several key market indicators consistently highlight Bitcoin's price movements during October, offering valuable insights for crypto traders and investors. ETF inflows are one of the most important factors driving the current surge. According to SoSoValue, Bitcoin ETFs have seen 5 consecutive days of net inflows since September 29, with daily total net inflows ranging from $429M to $985M (on October 3, the latest data on SoSoValue), which is in line with Bitcoin's price movement. These inflows reflect institutional investors' growing interest in Bitcoin. Notably, this week’s inflow number is the largest weekly inflow on record for Spot Bitcoin ETFs this year.

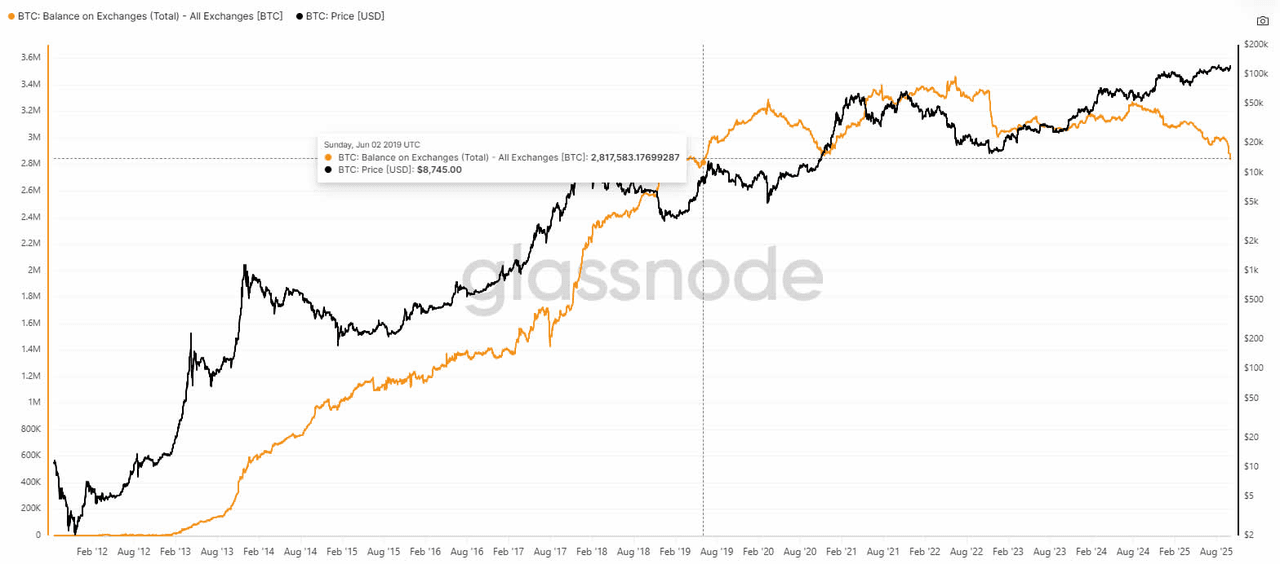

Another critical indicator is Bitcoin's decreasing exchange balances. As is shown by Glassnode, the total Bitcoin balance on centralized exchanges fell to a six-year low of 2.83 million BTC on October 4, signaling that many large holders are moving their BTC off exchanges in anticipation of price increases. This creates a supply crunch that drives prices higher.

In addition to spot ETF inflows and exchange balance decrease, onchain indicators show that whales are aggressively buying BTC and ETH. According to on-chain analytics tracker Lookonchain, from September 29 to October 5, stablecoin supply increased by $5.48B, while institutions like Bitmine and Metaplanet continued heavy accumulation of BTC and ETH, driving their prices towards higher highs.

Why October? Key Macro and Market Drivers Behind "Uptober"

October’s price surge is no accident, it’s the result of multiple macroeconomic, structural, and cyclical drivers. A major factor is the quarterly asset rebalancing done by global institutional investors. After a slow September, institutions typically begin re-evaluating their portfolios and re-enter the market at the start of October. This period of reallocation is often called "Q4 Rebalancing," and it frequently benefits high-volatility assets like Bitcoin and Ethereum. In addition to this, October coincides with several major crypto events including TOKEN2049, creating an environment of heightened market activity.

Alongside these structural factors, there’s also a psychological element at play. The "Uptober" phenomenon has become so ingrained in the minds of traders and institutional investors that many start positioning for October months in advance. The psychological anticipation of Bitcoin’s historic October rally adds an element of self-fulfilling prophecy, with more funds pouring into the market as traders prepare for price movements. Finally, October marks a critical point in Bitcoin’s price cycles. In many bull markets, October has been the month when Bitcoin breaks through key resistance levels, fueling the next phase of its rally.

Macro Trends in 2025: What Makes This October So Special for Bitcoin

Looking at the broader picture, 2025’s October surge is underpinned by macroeconomic trends and institutional behaviors that align perfectly with Bitcoin’s price movements. One major factor is the ongoing shift in global monetary policies. As the Federal Reserve released signals to lower interest rates, riskier assets like Bitcoin become more attractive, and institutions are increasingly using Bitcoin ETFs to gain exposure to the digital asset class.

Political uncertainty, particularly surrounding the U.S. government shutdown and other geopolitical risks, also drives funds away from traditional assets like the dollar and bonds, pushing investors toward decentralized assets like Bitcoin. This shift from fiat to crypto is creating a favorable environment for Bitcoin to thrive. With Bitcoin’s price now sitting at a key technical level, it has triggered massive demand for Bitcoin from both passive investment strategies and trend-following traders. The combination of all these factors has created a perfect storm for Bitcoin’s bullish October.

What Does “Uptober” Mean for WEEX Users?

For WEEX users, October presents a unique period shaped by notable macroeconomic and market dynamics. With the “Uptober” effect historically aligning with strong Bitcoin performance, the market may continue to experience heightened activity throughout the month. By paying attention to ETF inflows, whale movements, and broader macroeconomic developments, users can stay informed about evolving market conditions. Institutional participation through Bitcoin ETFs and potential regulatory developments may also play a significant role in shaping sentiment and volatility. The combination of technical indicators and macro factors provides a noteworthy backdrop for observing potential market trends. Staying updated and responsive to new information is key during this dynamic period for the crypto market.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, financial advice, trading advice, or any other form of recommendation. WEEX does not provide investment advice. Users should conduct their own research and consult with professional advisors before making any investment decisions.

You may also like

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Shrimp Coin Price Prediction & Forecast: Surging 150% Post-Launch in January 2026

Shrimp Coin (SHRIMP) burst onto the scene on January 26, 2026, as an exclusive launch on WEEX Exchange,…

AlphaPride (ALPHA) Coin Price Prediction & Forecasts for January 2026: Potential Rebound After Launch Volatility

AlphaPride (ALPHA) Coin has just hit the crypto scene, launching on January 26, 2026, amid a bustling market…

抖音热搜第四的狼格林 (格林) Coin Price Prediction & Forecasts for January 2026: Could It Surge on Launch Day?

The meme coin scene is heating up with the arrival of 抖音热搜第四的狼格林 (格林) Coin, which has already climbed…

clawdbot (CLAWD) Coin Price Prediction & Forecasts for January 2026: Could It Surge Post-Launch?

clawdbot (CLAWD) Coin is making waves as a fresh entrant in the meme coin space on Solana, launching…

EDOM Coin Price Prediction & Forecasts for January 2026: Surging 54% – Can It Hit $0.50 by Year-End?

EDOM Coin has been turning heads in the crypto space this January 2026, with a remarkable 54.30% surge…

bǐngwǔ (丙午) Coin Price Prediction & Forecasts for January 2026 – Could It Surge Amid Meme Coin Hype?

The bǐngwǔ (丙午) Coin, a fresh meme token inspired by the Chinese zodiac’s fire horse year, just hit…

Space Coin Explained: In-Depth Analysis & How to Buy on WEEX in 2026

Spacecoin is pioneering a new era in the space economy by making it more accessible and participatory. As the inaugural decentralized physical infrastructure network (DePIN) utilizing a proprietary constellation of low-Earth orbit (LEO) satellites, Spacecoin leverages blockchain-integrated nanosatellites to deliver global, decentralized, and permissionless internet connectivity.

Trade AAPL, NVDA, COIN & MSTR USDT Futures on WEEX

WEEX Exchange lists Apple (AAPL), Coinbase (COIN), NVIDIA (NVDA) and MicroStrategy (MSTR) USDT futures. Trade US stock perpetuals with competitive rates.

SPACE USDT Perpetual Contract Listings on WEEX Futures

WEEX Exchange launches MicroVisionChain (SPACE) perpetuals. Trade SPACE USDT with high leverage. Secure your position on the new SPACE Coin listing today.

How Much Will AAPL Be Worth in 2030? Expert Predictions for Apple Tokenized Stock

As we move through 2026, the tokenized version of Apple Inc. stock, known as AAPL, continues to draw…

Does Apple Have a Crypto Coin? Unpacking AAPL Tokenized Stock in the Crypto World

As of January 25, 2026, Apple Inc. hasn’t launched its own native cryptocurrency, but the rise of tokenized…

Which Is the Best AI for Trading? Expert Picks and Insights for Crypto Beginners in 2026

As we move through 2026, artificial intelligence continues to reshape the trading landscape, especially in the volatile world…

Do AI Trading Bots Really Work? Unpacking Their Role in Crypto Markets

As we head into 2026, AI trading bots are making waves in the crypto space, with recent reports…

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Shrimp Coin Price Prediction & Forecast: Surging 150% Post-Launch in January 2026

Shrimp Coin (SHRIMP) burst onto the scene on January 26, 2026, as an exclusive launch on WEEX Exchange,…