Why Is Bitcoin Capped at 21 Million? Unpacking Satoshi Nakamoto's Brilliant Mathematical Design

The total supply of Bitcoin is fixed at 21 million coins—a number that was far from randomly chosen. Its creator, Satoshi Nakamoto, implemented a rigorous mathematical framework to ensure both scarcity and stable operation. To truly understand this design, we must first look at Bitcoin's issuance mechanism.

The Core Principle: How Mining and Halvings Create the 21 Million Cap

Bitcoin is generated through a process called "mining." Miners use computational power to validate transactions and secure the network, and in return for successfully adding a new block to the blockchain, they receive a reward in Bitcoin.

However, this reward is not constant. It is programmed to decrease by 50% every 210,000 blocks—an event known as the "halving."

- When Bitcoin launched in 2009, the block reward was 50 BTC.

- In 2012, the first halving cut it to 25 BTC.

- In 2016, it was halved again to 12.5 BTC.

- In 2020, it became 6.25 BTC.

By design, a new block is mined approximately every 10 minutes. At this rate, 210,000 blocks take roughly four years to mine. Following this mathematical progression, by approximately the year 2140, the total number of bitcoins will approach 21 million, at which point the creation of new coins will cease entirely. The initial reward of 50 BTC, halved roughly 32 times, results in a total sum that mathematically converges on 21 million. This elegant design ensures that Bitcoin's issuance rate gradually slows down before stopping completely.

‘Digital Gold’: Bitcoin's Built-in Deflationary Nature

This finite supply gives Bitcoin its powerful deflationary characteristic. Unlike fiat currencies, which central banks can print indefinitely, Bitcoin's total amount is unchangeably fixed. This contrast became starkly evident after the COVID-19 pandemic began in 2020. Many central banks engaged in massive quantitative easing; the U.S. Federal Reserve's balance sheet, for example, swelled from $4 trillion to $9 trillion, sparking widespread inflation fears.

During this same period, Bitcoin underwent its third halving. Its price subsequently soared from around $5,000 to a peak of $69,000. Scarcity became a primary driver of Bitcoin's value.

This scarcity has earned Bitcoin the label of "digital gold." Like physical gold, its supply is limited. However, Bitcoin offers superior divisibility and portability. While 21 million may not sound like much, each bitcoin can be divided into 100 million smaller units called "satoshis," ensuring it can accommodate a global volume of transactions. In 2021, when El Salvador adopted Bitcoin as legal tender, President Nayib Bukele explicitly cited its fixed supply on Twitter, using scarcity as a core justification for the law.

A Brilliant Incentive Structure: From Block Rewards to Transaction Fees

Another stroke of genius in Satoshi's design is its incentive mechanism.

- Early Stages: High block rewards attracted early miners, providing the necessary computational power to secure and launch the network.

- Maturity: As the network grows and block rewards diminish, transaction fees paid by users become the primary source of income for miners.

This transition is designed to unfold over decades, giving the ecosystem ample time to adapt. In 2017, when the Bitcoin network experienced severe congestion, transaction fees briefly spiked above $50. However, with technological optimizations and changing user habits, fees have since returned to more reasonable levels, demonstrating the system's flexibility.

The Store of Value Debate: Criticisms of a Fixed Supply

Of course, this limited-supply model is not without its critics. Nobel laureate in economics Paul Krugman has repeatedly criticized Bitcoin's deflationary nature, arguing that it encourages hoarding rather than circulation, which is detrimental to a currency.

On-chain data appears to support this observation. According to analytics firm Glassnode, over 60% of all Bitcoin has not moved in at least a year. However, proponents counter that serving as a store of value is one of Bitcoin's most important functions, much like physical gold, which is also rarely used for daily purchases.

Can the 21 Million Limit Be Changed? The Role of Consensus

Bitcoin's code is open-source, meaning it is theoretically possible to alter the 21 million cap. In practice, this is virtually impossible. Any change to Bitcoin's core rules requires overwhelming consensus from the global community of users and miners.

The 2017 network split, which created Bitcoin Cash (BCH) over a disagreement on block size, serves as a powerful example. Even in this contentious fork, neither side dared to propose altering the total supply limit, as doing so would destroy the very foundation of its value. As NYU Stern School of Business professor Nouriel Roubini bluntly put it: "Change the cap? You might as well just invent a new coin."

Conclusion: A Monetary Experiment in Code

To understand the volatile swings of the Bitcoin market, one must first grasp its fundamental logic. Price movements are a result of complex interactions between supply and demand, market sentiment, and macroeconomic factors.

In 2024, Bitcoin experienced its fourth halving, cutting the block reward from 6.25 to 3.125 BTC. Historical data suggests that a bull market often follows in the 12-18 months after a halving. However, past performance is not indicative of future results, and whether this pattern repeats will depend on the prevailing market conditions.

Satoshi's design showcases a masterful fusion of economics and cryptography. It uses mathematical rules to enforce scarcity and replaces the need for trust with immutable code, elegantly solving the double-spending problem for digital assets. The invention of Bitcoin is more than a technological breakthrough; it is a grand monetary experiment. While its final outcome remains to be seen, it has proven one thing: a sound monetary policy doesn't necessarily require a central bank—a well-designed algorithm can also do the job.

You may also like

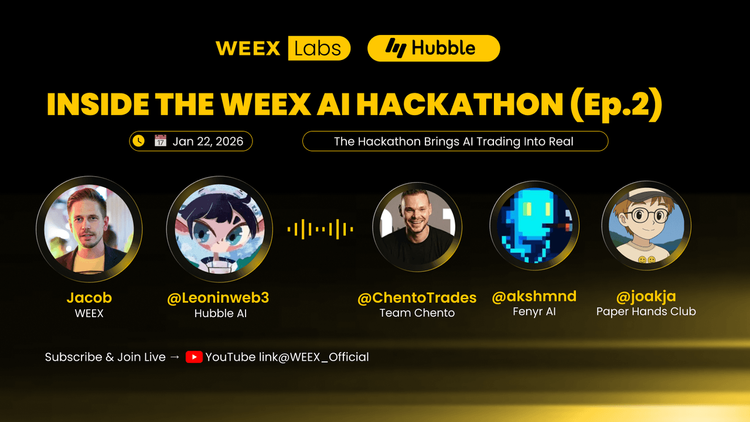

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Shrimp Coin Price Prediction & Forecast: Surging 150% Post-Launch in January 2026

Shrimp Coin (SHRIMP) burst onto the scene on January 26, 2026, as an exclusive launch on WEEX Exchange,…

AlphaPride (ALPHA) Coin Price Prediction & Forecasts for January 2026: Potential Rebound After Launch Volatility

AlphaPride (ALPHA) Coin has just hit the crypto scene, launching on January 26, 2026, amid a bustling market…

抖音热搜第四的狼格林 (格林) Coin Price Prediction & Forecasts for January 2026: Could It Surge on Launch Day?

The meme coin scene is heating up with the arrival of 抖音热搜第四的狼格林 (格林) Coin, which has already climbed…

clawdbot (CLAWD) Coin Price Prediction & Forecasts for January 2026: Could It Surge Post-Launch?

clawdbot (CLAWD) Coin is making waves as a fresh entrant in the meme coin space on Solana, launching…

EDOM Coin Price Prediction & Forecasts for January 2026: Surging 54% – Can It Hit $0.50 by Year-End?

EDOM Coin has been turning heads in the crypto space this January 2026, with a remarkable 54.30% surge…

bǐngwǔ (丙午) Coin Price Prediction & Forecasts for January 2026 – Could It Surge Amid Meme Coin Hype?

The bǐngwǔ (丙午) Coin, a fresh meme token inspired by the Chinese zodiac’s fire horse year, just hit…

Space Coin Explained: In-Depth Analysis & How to Buy on WEEX in 2026

Spacecoin is pioneering a new era in the space economy by making it more accessible and participatory. As the inaugural decentralized physical infrastructure network (DePIN) utilizing a proprietary constellation of low-Earth orbit (LEO) satellites, Spacecoin leverages blockchain-integrated nanosatellites to deliver global, decentralized, and permissionless internet connectivity.

Trade AAPL, NVDA, COIN & MSTR USDT Futures on WEEX

WEEX Exchange lists Apple (AAPL), Coinbase (COIN), NVIDIA (NVDA) and MicroStrategy (MSTR) USDT futures. Trade US stock perpetuals with competitive rates.

SPACE USDT Perpetual Contract Listings on WEEX Futures

WEEX Exchange launches MicroVisionChain (SPACE) perpetuals. Trade SPACE USDT with high leverage. Secure your position on the new SPACE Coin listing today.

How Much Will AAPL Be Worth in 2030? Expert Predictions for Apple Tokenized Stock

As we move through 2026, the tokenized version of Apple Inc. stock, known as AAPL, continues to draw…

Does Apple Have a Crypto Coin? Unpacking AAPL Tokenized Stock in the Crypto World

As of January 25, 2026, Apple Inc. hasn’t launched its own native cryptocurrency, but the rise of tokenized…

Which Is the Best AI for Trading? Expert Picks and Insights for Crypto Beginners in 2026

As we move through 2026, artificial intelligence continues to reshape the trading landscape, especially in the volatile world…

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…