Your 2025 Guide to Digital Currency, Stablecoins & Global Payments

Sending money across borders has always been slow and expensive. But by 2025, a powerful combination of digital currencies, stablecoins, and new blockchain technology is completely reshaping global finance. The core idea is simple: making money move as fast and easily as an email.

This guide provides a comprehensive analysis of the key players, pioneering projects, and critical trends defining the landscape.

The Infrastructure & Technology Backbone

These are the companies building the fundamental rails for the new global financial system.

- Ripple (XRP): A technical benchmark in cross-border payments. Ripple's On-Demand Liquidity (ODL) solution uses the XRP token for real-time settlement, cutting transaction costs by over 80% compared to the traditional SWIFT system. Following the (hypothetical) dismissal of the SEC's lawsuit in March 2025, XRP's market cap has exceeded $50 billion, making it a key asset for institutional investors. The launch of its RLUSD stablecoin has further enhanced its ecosystem, with over 20 banking partners, including HSBC and Standard Chartered.

- Tech Edge: Its distributed ledger technology (DLT) supports 1,500 transactions per second (TPS) with confirmation in under 4 seconds. It is also certified under the ISO 20022 standard, ensuring compatibility with over 90% of the world's banking systems.

- Stellar (XLM): Focused on financial inclusion in emerging markets. The XLM token serves as a low-cost bridge asset for remittances, with transaction costs at a mere 0.00001 XLM (about $0.000001). It holds over 35% market share in regions like Latin America and Africa. A partnership with Mastercard on its Crypto Credential service allows users to send money internationally using just an email address, connecting major wallets like Coins.ph in the Philippines and Mercado Bitcoin in Brazil.

- Policy Tailwinds: The United Nations Development Programme (UNDP) has selected the Stellar network to distribute financial aid, with a 2025 pilot covering 12 countries and an expected annual transaction volume of $2 billion.

Stablecoin Issuance and Compliance

Stablecoins are the critical bridge to the traditional economy. These companies lead in issuance and regulatory adherence.

- Circle (USDC): The issuer of USDC, the world's second-largest stablecoin, commanding 24.2% of the market (approx. $61.8 billion). Its reserves are 100% backed by cash and short-term U.S. treasuries, with real-time audits by Ernst & Young. A 2025 partnership with PayPal to launch the PYUSD stablecoin, featuring zero-fee conversion on Coinbase, has pushed daily trading volume over $1 billion.

- Policy Advantage: Circle was among the first to receive a license under Hong Kong's new Stablecoin Ordinance, permitting pilot programs in the Greater Bay Area.

- Ripple (RLUSD): Launched in December 2024, the RLUSD stablecoin is approved by the New York Department of Financial Services (NYDFS) and creates a "dual-token synergy" with XRP. Within the mBridge project, RLUSD is used as a settlement tool for international trade, helping businesses reduce foreign exchange hedging costs by 40%.

Pioneers in Cross-Border Payment Applications

Technology is only useful when applied. These companies are bringing digital currency payments to the real world.

- Coinbase: The world's largest crypto exchange launched a PYUSD stablecoin payment gateway in 2025, allowing e-commerce giants like Shopify and Amazon to accept it. This drops payment processing fees to as low as 0.5% (compared to 1.5%-3% for Visa). Coinbase has also invested in the Canadian stablecoin QCAD to solve local pain points of $45 wire fees and 45-minute settlement times.

- Tech Ecosystem: Its partnership with Chainalysis for AML monitoring ensures compliance with the FATF "Travel Rule" across 60 countries.

- HSBC: A primary participant in the mBridge project, using digital currencies of China, Hong Kong, Thailand, and the UAE to settle corporate payments in under 7 seconds, reducing costs by 50% compared to the traditional correspondent banking model. In 2025, HSBC also released results from its e-HKD+ test, experimenting with issuance on public blockchains like Arbitrum and Ethereum to explore hybrid payments.

Traditional Finance & Global Giants Enter the Fray

The old guard isn't standing still; they are building their own powerful solutions.

- JPMorgan: Its enterprise-grade JPM Coin is already used by over 200 multinational corporations for supply chain finance, processing over $150 billion in transactions in 2025. Its Onyx platform offers innovative Delivery vs. Payment (DVP) and Payment vs. Payment (PVP) functions, helping clients reduce liquidity management costs by 30%.

- SWIFT: In 2025, SWIFT launched its own CBDC interlinking platform pilot. In collaboration with over 30 institutions, including HSBC and Deutsche Bank, it is testing multi-currency real-time settlement. The goal is to slash cross-border payment costs from 0.8% to 0.3% and support hybrid payments between digital assets and traditional currencies.

Risks & Strategic Recommendations

- Policy Risk: New regulations like Hong Kong's Stablecoin Ordinance, which mandates 1:1 reserves and monthly audits, could force smaller projects out of the market (e.g., Paxos's BUSD market cap has already shrunk by 35%).

- Technological Disruption: Competition from high-speed blockchains like Solana and Polygon, which boast TPS in the tens of thousands, could erode the market share of networks like XRP and XLM.

Investment Strategy:

- Short-Term: Focus on direct participants in government-backed projects like mBridge (e.g., HSBC, Bank of China) to benefit from policy tailwinds.

- Mid-Term: Invest in stablecoin ecosystem leaders like Circle and Ripple. With the stablecoin market projected to surpass $300 billion in 2025, the top players are expected to hold over 80% market share.

- Long-Term: Watch pioneers in emerging markets like Stellar and Coinbase, where user growth potential is significantly higher than in mature markets.

Industry Trends & Value Realignment

- The "Trinity" Model: A fusion of digital currency, stablecoins, and payment applications is becoming the standard. Ripple's XRP (currency) + RLUSD (stablecoin) + ODL (network) is a prime example of this all-in-one approach.

- A Global Regulatory Framework: Major economies are accelerating the creation of stablecoin regulations. Asia-Pacific hubs like Hong Kong and Singapore have established a model based on licensing, reserve requirements, and strict AML rules. This requires companies to build a dual moat of both technology and compliance.

- From Innovation to Ecosystems: The industry is shifting from "single-point innovation" to "ecosystem collaboration." Deep technical integrations, like JPMorgan with Chainlink and HSBC with ConsenSys, are becoming the new competitive frontier.

In summary, 2025 is a pivotal year where digital finance moves from promise to reality. The core opportunities are concentrated in infrastructure, compliant stablecoins, and real-world payment applications. Success will belong to the enterprises with deep technological moats, strong regulatory standing, and powerful ecosystem synergies.

You may also like

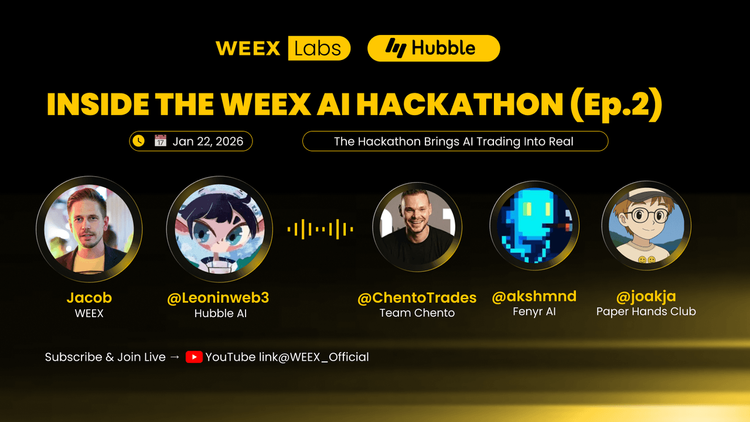

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Introducing Pump.fun Complete Guide to $PUMP and Airdrop Opportunities

Pump.fun ($PUMP) is the turbocharged memecoin launchpad shaking up the Solana ecosystem, letting anyone spin up a token in seconds and trade it instantly—no presales, no rugs, just pure, chaotic fun. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 $PUMP airdrop until Feb.03 2026!

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

What is Moonbirds (BIRB) Coin?

The Moonbirds (BIRB) token is a groundbreaking entrant in the cryptocurrency landscape, uniquely merging the digital and physical…

What Is Shrimp Coin (SHRIMP)?

The Shrimp Coin (SHRIMP) token has officially made its debut on the WEEX platform, marking its exclusive listing…

What is ZERO-HUMAN COMPANY (ZHC) Coin?

In the rapidly evolving world of cryptocurrency, the ZERO-HUMAN COMPANY (ZHC) Coin has made its mark as an…

What is AlphaPride (ALPHA) Coin?

Exploring the dynamic world of cryptocurrencies often reveals new and intriguing projects. AlphaPride (ALPHA) is a fine example…

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Shrimp Coin Price Prediction & Forecast: Surging 150% Post-Launch in January 2026

Shrimp Coin (SHRIMP) burst onto the scene on January 26, 2026, as an exclusive launch on WEEX Exchange,…

ZERO-HUMAN COMPANY (ZHC) Coin Price Prediction & Forecasts for January 2026 – Could This Meme Coin Soar 50% Amid AI Hype?

The ZERO-HUMAN COMPANY (ZHC) Coin burst onto the scene just yesterday, launching exclusively on WEEX Exchange on January…

AlphaPride (ALPHA) Coin Price Prediction & Forecasts for January 2026: Potential Rebound After Launch Volatility

AlphaPride (ALPHA) Coin has just hit the crypto scene, launching on January 26, 2026, amid a bustling market…

AlphaPride (ALPHA) Coin Listed on WEEX Spot with ALPHA USDT Trading Pair

AlphaPride (ALPHA) Coin is newly listed on WEEX Exchange. Start trading the ALPHA USDT pair today to access the global loyalty ecosystem and digital rewards.

Exclusive ZHC USDT Pair Trading Live on WEEX Exchange

Exclusive listing alert: ZERO-HUMAN COMPANY (ZHC) Coin is now on WEEX. Read our ZHC USDT spot trading guide and access the AI meme token market securely.

SHRIMP USDT Now on WEEX: Shrimp Coin Exclusive Listing

SHRIMP USDT is new listed on WEEX Exchange. Trade Shrimp Coin exclusively on our spot market and access the trending Solana meme token liquidity today.

BIRB USDT First Launch: Moonbirds Coin on WEEX

Exclusive first launch: Moonbirds (BIRB) Coin is now listed on WEEX Exchange. Start trading the BIRB USDT pair on our secure spot market today.

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Introducing Pump.fun Complete Guide to $PUMP and Airdrop Opportunities

Pump.fun ($PUMP) is the turbocharged memecoin launchpad shaking up the Solana ecosystem, letting anyone spin up a token in seconds and trade it instantly—no presales, no rugs, just pure, chaotic fun. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 $PUMP airdrop until Feb.03 2026!

What is USOR Crypto? Everything You Need to Know

USOR (United States Oil Reserve) is a cryptocurrency built on the high-speed Solana blockchain. It aims to provide a transparent, blockchain-native representation of themes tied to U.S. oil reserves. It's crucial to understand that USOR is a narrative-driven digital asset, not a direct claim on physical oil barrels.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.